- Joined

- Feb 21, 2021

Edit: they have TWO registered companies allegedly one started this year as a 501. The one they are touting as a charity currently is NOT. It is a BUSINESS. If this is truly a 501, the tax returns for the 2021 Ranch will be available for viewing next year. Despite them saying this press x to doubt because it's not registered in the state of Colorado

TENACIOUS UNICORN RANCH IS NOT A 501(c)(3) CHARITY THEY'RE A FOR PROFIT LLC. (LLC'S CANNOT BE 501(c)(3)'s IN COLORADO)

TENACIOUS UNICORN RANCH IS NOT A 501(c)(3) CHARITY THEY'RE A FOR PROFIT LLC. (LLC'S CANNOT BE 501(c)(3)'s IN COLORADO)

Proof of bullshit is as follows.

The claim so they can't backpedal:

The deep dive:

Charities are REQUIRED BY FEDERAL LAW to disclose their forms to the public and public record. Free and Legal.

BUT

They're registered as:

LLC is a for-profit business with no share holders. To refute any backpedaling the trancheros will do when they find this let me explain some autistic tax law.

IN SOME states they let LLCs also register as 501(c)(3)'s OR low income llc charity called L3C .

Neither of which is allowed in Colorado. Therefore they CANNOT be a 501(c)(3) AND an LLC/L3C. As shown on their business records since 2018 they have registered as an LLC only.

Neither of which is allowed in Colorado. Therefore they CANNOT be a 501(c)(3) AND an LLC/L3C. As shown on their business records since 2018 they have registered as an LLC only.

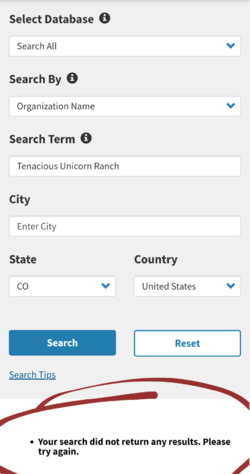

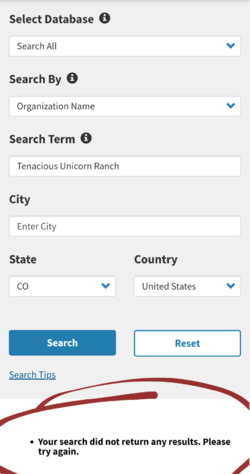

Just to make sure let's look at the IRS website and search all 501(c)(3) charities.

To be fair to them in my search I looked at:

It does not exist.

They are not a charity.

They are a FOR PROFIT BUSINESS

Tenacious Unicorn Ranch is LYING to you

Don't Believe me because I'm a farmer? Go Look on the IRS yourself. It's all Legally Obtained Public Record.

Bonnie may just be ignorant of this fact despite allegedly owning half the company and it being their business to know. Or maybe they're just lying because IF they were a charity we could all see their taxes publicly which we can't. And very that they would release them publicly

that they would release them publicly

Best Case Scenario: they're turbo retarded and don't realize their own business status

Worst Case Scenario: Lyinggggg

TENACIOUS UNICORN RANCH IS NOT A 501(c)(3) CHARITY THEY'RE A FOR PROFIT LLC. (LLC'S CANNOT BE 501(c)(3)'s IN COLORADO)

TENACIOUS UNICORN RANCH IS NOT A 501(c)(3) CHARITY THEY'RE A FOR PROFIT LLC. (LLC'S CANNOT BE 501(c)(3)'s IN COLORADO)

Proof of bullshit is as follows.

The claim so they can't backpedal:

The deep dive:

Charities are REQUIRED BY FEDERAL LAW to disclose their forms to the public and public record. Free and Legal.

BUT

They're registered as:

LLC is a for-profit business with no share holders. To refute any backpedaling the trancheros will do when they find this let me explain some autistic tax law.

IN SOME states they let LLCs also register as 501(c)(3)'s OR low income llc charity called L3C .

Just to make sure let's look at the IRS website and search all 501(c)(3) charities.

To be fair to them in my search I looked at:

- The general search (as shown)

- with just a few keywords such as "unicorn" "tenacious"

- every 501(c)(3) in Westcliffe (where TUR is said to be registered in according to official state paperwork)

- Everywhere in Colorado just in case it was registered elsewhere in the state

- everywhere in the USA

- Other sites that let you search 503(c)(3)

It does not exist.

They are not a charity.

They are a FOR PROFIT BUSINESS

Tenacious Unicorn Ranch is LYING to you

Don't Believe me because I'm a farmer? Go Look on the IRS yourself. It's all Legally Obtained Public Record.

Bonnie may just be ignorant of this fact despite allegedly owning half the company and it being their business to know. Or maybe they're just lying because IF they were a charity we could all see their taxes publicly which we can't. And very

Best Case Scenario: they're turbo retarded and don't realize their own business status

Worst Case Scenario: Lyinggggg

- Must net 10k within 4 years

- Mission statement for charity theirs would be underprivileged twans pweople (some of which who are convicted child molesters or ones who leave their 4 kids to go visit the tranch)

- Must donate at least 5% of the fair market value of their assets each year to permissible donees. The bar is Low.

- "no part of the organization’s net earnings may inure for the benefit of any private shareholder or individual". However, this does not prevent the founders or employees of the charity from receiving ""fair compensation"" for their services. I say this because Susan G Komen pays herself 500k....

Attachments

Last edited: