Last edited:

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

US US Politics General - Discussion of President Biden and other politicians

- Thread starter SeniorFuckFace

- Start date

- Joined

- Apr 22, 2019

Inflation rose 9.1% in June, even more than expected, as price pressures intensify

Shoppers paid sharply higher prices for a variety of goods in June as inflation kept its hold on a slowing U.S. economy, the Bureau of Labor Statistics reported Wednesday.

The consumer price index, a broad measure of everyday goods and services, soared 9.1% from a year ago, above the 8.8% Dow Jones estimate. That marked another month of the fastest pace for inflation going back to December 1981.

Excluding volatile food and energy prices, so-called core CPI increased 5.9%, compared to the 5.7% estimate.

On a monthly basis, headline CPI rose 1.3% and core CPI was up 0.7%, compared to respective estimates of 1.1% and 0.5%.

Taken together, the numbers seemed to counter the narrative that inflation may be peaking, as the gains were based across a variety of categories.

Energy prices surged 7.5% on the month and were up 41.6% on a 12-month basis. The food index increased 1%, while shelter costs, which make up about one-third of the CPI rose 0.6% for the month and were up 5.6% annually. This was the sixth straight month that food at home rose at least 1%.

Rental costs 0.8% in June, the largest monthly increase since April 1986, according to the BLS.

Stock market futures slumped following the data while government bond yields surged.

Much of inflation rise came from gasoline prices, which increased 11.2% on the month and just shy of 60% for the 12-month period. Electricity costs rose 1.7% and 13.7%, respectively. New and used vehicle prices posted respective gains of 0.7% and 1.6%.

The consumer price index, a broad measure of everyday goods and services, soared 9.1% from a year ago, above the 8.8% Dow Jones estimate. That marked another month of the fastest pace for inflation going back to December 1981.

Excluding volatile food and energy prices, so-called core CPI increased 5.9%, compared to the 5.7% estimate.

On a monthly basis, headline CPI rose 1.3% and core CPI was up 0.7%, compared to respective estimates of 1.1% and 0.5%.

Taken together, the numbers seemed to counter the narrative that inflation may be peaking, as the gains were based across a variety of categories.

Energy prices surged 7.5% on the month and were up 41.6% on a 12-month basis. The food index increased 1%, while shelter costs, which make up about one-third of the CPI rose 0.6% for the month and were up 5.6% annually. This was the sixth straight month that food at home rose at least 1%.

Rental costs 0.8% in June, the largest monthly increase since April 1986, according to the BLS.

Stock market futures slumped following the data while government bond yields surged.

Much of inflation rise came from gasoline prices, which increased 11.2% on the month and just shy of 60% for the 12-month period. Electricity costs rose 1.7% and 13.7%, respectively. New and used vehicle prices posted respective gains of 0.7% and 1.6%.

- Joined

- Apr 21, 2013

Biden's economy ladies and gents. Highest inflation since Reagan.

Last edited:

- Joined

- Apr 22, 2019

- Joined

- May 18, 2014

Weimar 2.0 by November. We already have the troons and child rape might as well go all out.Inflation rose 9.1% in June, even more than expected, as price pressures intensify

Shoppers paid sharply higher prices for a variety of goods in June as inflation kept its hold on a slowing U.S. economy, the Bureau of Labor Statistics reported Wednesday.

The consumer price index, a broad measure of everyday goods and services, soared 9.1% from a year ago, above the 8.8% Dow Jones estimate. That marked another month of the fastest pace for inflation going back to December 1981.

Excluding volatile food and energy prices, so-called core CPI increased 5.9%, compared to the 5.7% estimate.

On a monthly basis, headline CPI rose 1.3% and core CPI was up 0.7%, compared to respective estimates of 1.1% and 0.5%.

Taken together, the numbers seemed to counter the narrative that inflation may be peaking, as the gains were based across a variety of categories.

Energy prices surged 7.5% on the month and were up 41.6% on a 12-month basis. The food index increased 1%, while shelter costs, which make up about one-third of the CPI rose 0.6% for the month and were up 5.6% annually. This was the sixth straight month that food at home rose at least 1%.

Rental costs 0.8% in June, the largest monthly increase since April 1986, according to the BLS.

Stock market futures slumped following the data while government bond yields surged.

Much of inflation rise came from gasoline prices, which increased 11.2% on the month and just shy of 60% for the 12-month period. Electricity costs rose 1.7% and 13.7%, respectively. New and used vehicle prices posted respective gains of 0.7% and 1.6%.

- Joined

- Sep 19, 2018

This shit is after they massaged the numbers. This is the best they could make it look.Inflation rose 9.1% in June, even more than expected, as price pressures intensify

Shoppers paid sharply higher prices for a variety of goods in June as inflation kept its hold on a slowing U.S. economy, the Bureau of Labor Statistics reported Wednesday.

The consumer price index, a broad measure of everyday goods and services, soared 9.1% from a year ago, above the 8.8% Dow Jones estimate. That marked another month of the fastest pace for inflation going back to December 1981.

Excluding volatile food and energy prices, so-called core CPI increased 5.9%, compared to the 5.7% estimate.

On a monthly basis, headline CPI rose 1.3% and core CPI was up 0.7%, compared to respective estimates of 1.1% and 0.5%.

Taken together, the numbers seemed to counter the narrative that inflation may be peaking, as the gains were based across a variety of categories.

Energy prices surged 7.5% on the month and were up 41.6% on a 12-month basis. The food index increased 1%, while shelter costs, which make up about one-third of the CPI rose 0.6% for the month and were up 5.6% annually. This was the sixth straight month that food at home rose at least 1%.

Rental costs 0.8% in June, the largest monthly increase since April 1986, according to the BLS.

Stock market futures slumped following the data while government bond yields surged.

Much of inflation rise came from gasoline prices, which increased 11.2% on the month and just shy of 60% for the 12-month period. Electricity costs rose 1.7% and 13.7%, respectively. New and used vehicle prices posted respective gains of 0.7% and 1.6%.

We're unofficially in the teens when it comes to inflation, and that is lowballing it.

- Joined

- Nov 29, 2020

Inflation rose 9.1% in June, even more than expected, as price pressures intensify

Shoppers paid sharply higher prices for a variety of goods in June as inflation kept its hold on a slowing U.S. economy, the Bureau of Labor Statistics reported Wednesday.

The consumer price index, a broad measure of everyday goods and services, soared 9.1% from a year ago, above the 8.8% Dow Jones estimate. That marked another month of the fastest pace for inflation going back to December 1981.

Excluding volatile food and energy prices, so-called core CPI increased 5.9%, compared to the 5.7% estimate.

On a monthly basis, headline CPI rose 1.3% and core CPI was up 0.7%, compared to respective estimates of 1.1% and 0.5%.

Taken together, the numbers seemed to counter the narrative that inflation may be peaking, as the gains were based across a variety of categories.

Energy prices surged 7.5% on the month and were up 41.6% on a 12-month basis. The food index increased 1%, while shelter costs, which make up about one-third of the CPI rose 0.6% for the month and were up 5.6% annually. This was the sixth straight month that food at home rose at least 1%.

Rental costs 0.8% in June, the largest monthly increase since April 1986, according to the BLS.

Stock market futures slumped following the data while government bond yields surged.

Much of inflation rise came from gasoline prices, which increased 11.2% on the month and just shy of 60% for the 12-month period. Electricity costs rose 1.7% and 13.7%, respectively. New and used vehicle prices posted respective gains of 0.7% and 1.6%.

Weimar 2.0 by November. We already have the troons and child rape might as well go all out.

No fucking wonder the Brandon admin was scrambling hard to justify it yesterday. This is shits for the birds. Also:This shit is after they massaged the numbers. This is the best they could make it look.

We're unofficially in the teens when it comes to inflation, and that is lowballing it.

"Seemed to counter". Not even in the face of hard evidence can they ever outright admit they were wrong. Fuck journo-scum.Taken together, the numbers seemed to counter the narrative that inflation may be peaking, as the gains were based across a variety of categories.

- Joined

- Apr 21, 2013

It doesn't matter if the fed keeps bumping up basis points, its not going to stem the bleeding.

To quote @the fall of man

The global economy is gonna get fucked raw with no lube and there's nothing anyone can do.the fed's ability to hike out of trouble gets weaker every time and leads to more outsized distortions in the tech market.i suppose what you *could* say is that as we develop more highly leveraged ways to buy effectively *nothing*, the fed funds rate is more efficient at destroying money

- Joined

- Jul 30, 2016

AGreatDipAtAFairPrice

kiwifarms.net

- Joined

- Jun 18, 2019

It is the highest inflation ever without game playing. Long term 20+ percent this year, its plain as day.Biden's economy ladies and gents. Highest inflation since Reagan.

Standardized Profile

kiwifarms.net

- Joined

- Oct 5, 2018

Inflation has replaced unemployment as the new "unexpectedly."Inflation rose 9.1% in June, even more than expected, as price pressures intensify

Shoppers paid sharply higher prices for a variety of goods in June as inflation kept its hold on a slowing U.S. economy, the Bureau of Labor Statistics reported Wednesday.

The consumer price index, a broad measure of everyday goods and services, soared 9.1% from a year ago, above the 8.8% Dow Jones estimate. That marked another month of the fastest pace for inflation going back to December 1981.

Excluding volatile food and energy prices, so-called core CPI increased 5.9%, compared to the 5.7% estimate.

On a monthly basis, headline CPI rose 1.3% and core CPI was up 0.7%, compared to respective estimates of 1.1% and 0.5%.

Taken together, the numbers seemed to counter the narrative that inflation may be peaking, as the gains were based across a variety of categories.

Energy prices surged 7.5% on the month and were up 41.6% on a 12-month basis. The food index increased 1%, while shelter costs, which make up about one-third of the CPI rose 0.6% for the month and were up 5.6% annually. This was the sixth straight month that food at home rose at least 1%.

Rental costs 0.8% in June, the largest monthly increase since April 1986, according to the BLS.

Stock market futures slumped following the data while government bond yields surged.

Much of inflation rise came from gasoline prices, which increased 11.2% on the month and just shy of 60% for the 12-month period. Electricity costs rose 1.7% and 13.7%, respectively. New and used vehicle prices posted respective gains of 0.7% and 1.6%.

It's a good thing I got so fat during COVID, now I can subsist on those calories until food becomes affordable again.

mandatorylurk

kiwifarms.net

- Joined

- Dec 16, 2019

Bonus of Joepedo trying to "look here fat" Steve Doocey when asked why no one wants him to run again.

I've noticed when Joepedo gets hit with something that he's not prepared for but he tries to bullshit on, his eyes get big and his nose dips, and he looks a lot like Neil Breen while trying to lie his way through.

- Joined

- Jul 3, 2019

Well someone made this campaign commercial lol.

I showed my significant other the clip and it took them a minute. Because their first reaction was what the fuck is it breakfast taco? Do they mean a breakfast burrito?How amazing is it watching DOCTOR Jill, she's DEFINITELY a DOCTOR, get sent to speak on Mush-Brained Joe's behalf, since he can't be trusted to read properly from a teleprompter, only to have her very own "basket of deplorables" moment with the important group of voters that has turned very hostile, very fast on DNC interests during Joe's admin.

Karma bitch-slaps the Biden administration yet again, just as it deserves. We've been waiting for Joe to drop the gamer word, but his supposedly coherent wife just went to a Hispanic conference, went on stage, and called them the arguable equivalent of 'beaners'.

Who thought that was a good idea? Would they send the DOCTOR to a Muslim event and have her tell them they are "unique like kebabs"? Even ignoring the racial implication, telling people they are "unique like breakfast tacos" is pure uncut cringe.

IMO, this is way more intriguing than a Joe gamer word, because Joe is already a well-known racist and the black community isn't voting for Dems because they like the people in charge. They're voting in direct quid pro quo for handouts. Meaning that Joe gamer wording them would be funny, but would also have little effect on the black vote. The Hispanic community is at a political crossroads, and DOCTOR Jill just openly shit on them while trying to pander to them, like the dumbfuck elitist-racist cunt that she is.

Nice work, Jill Antoinette.

- Joined

- Jan 31, 2021

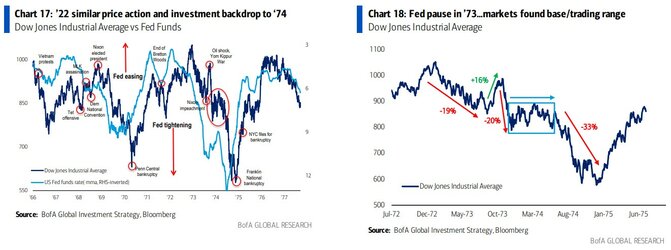

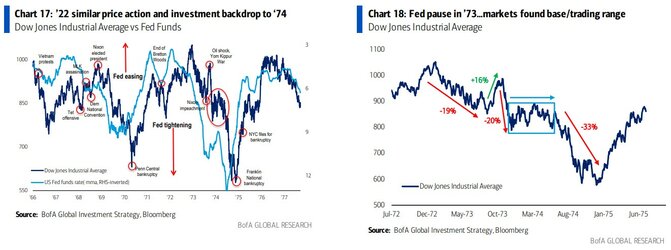

We're basically following the 70s all over again except now with $30 trillion+ debt, which is hilarious because it shows boomers never learn anything. The one positive is every major government is in debt, however the Fed is significantly behind the curve. The problem is the more the Fed changes their mind, the more it spooks the markets. If they telegraph 75 bps but then change it to 100 bps, whoops we don't know what we're doing.

Charts from BoA - Fed raised rates in the early 70s to catch up to inflation, leading to a downturn in the equities markets. There was a pause in 73' that allowed the markets to trade flat and it was only when the Fed started cutting rates that the markets started to rebound.

Charts from BoA - Fed raised rates in the early 70s to catch up to inflation, leading to a downturn in the equities markets. There was a pause in 73' that allowed the markets to trade flat and it was only when the Fed started cutting rates that the markets started to rebound.

- Joined

- Apr 21, 2013

- Joined

- Apr 21, 2013

- Joined

- Apr 11, 2016

- Became a US Senator with no political experienceIt could not be understated how much America despised Hillary:

- She thought having a vagina meant special privileges (most white women feel this way now but in the 1980s and 1990s it wasn’t as bad)

- Promoted and became the face of single payer health care in the 90s, which failed; she also fervently supported everything people generally despised outside of deep blue pockets of the country

- Became a US Senator with no political experience

- Thought it was her turn in 2008 and could not accept that she lost

- Became a senior official in the Obama administration, who used her office to curry political favors to enrich her and her husband and when things blew up around her, blamed everyone else and ran

- Lots of little stories of obvious lies she said that just got America’s teeth to grit

She is a truly and uniquely unlikeable cunt. It’s how a guy with no political experience was able to beat her in 2016. To act like there was a conspiracy to keep her from the presidency is truly laughable.

In a state she neither lived in nor was born. I hazily remember the reasoning she was allowed to run in NY was because she owned a vacation property there.

- Joined

- Jan 14, 2020

Gas has gone down about a dollar per gallon in my neck of the woods but it is still retarded expensive. Joe "pedo pete" Biden can diaf

- Joined

- Apr 21, 2013

Thats pretty much the same thing with Mittens. I think he was born in Mexico and was the gov or Massachusetts but doesnt really live in SLC.- Became a US Senator with no political experience

In a state she neither lived in nor was born. I hazily remember the reasoning she was allowed to run in NY was because she owned a vacation property there.

- Joined

- Sep 19, 2018

Yup, they're crashing this shit with no survivors.

- Joined

- Aug 11, 2020

- Status

- Not open for further replies.