- Joined

- Nov 12, 2019

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bank Run Watch 2023 after Silicon Valley Bank shutdown - Over 97% of SVB's assets were not FDIC insured

- Thread starter chiobu

- Start date

- Joined

- Dec 17, 2019

Not poggers

not a single peep on the other side in norway with exeptions of economic newspaper or two

- Joined

- Jan 15, 2019

The only reason I have a 401(k) at all anymore is because of employer matching contributions. This shit right here is why.So boomer, Gen X and Millennial 401(k)s take the hit, I guess. Not "the taxpayers" per se, but people who make enough money to pay meaningful income tax and have some left over to invest.

I'm beginning to realize that it still isn't keeping up with inflation either. I'd be more tempted to just liquidate it and eat the 10% early withdrawal penalty if I thought my money would be any safer anywhere else...

- Joined

- Aug 29, 2019

You can get 4.5 and 5.0% 13 month CD's anywhere now.The only reason I have a 401(k) at all anymore is because of employer matching contributions. This shit right here is why.

I'm beginning to realize that it still isn't keeping up with inflation either. I'd be more tempted to just liquidate it and eat the 10% early withdrawal penalty if I thought my money would be any safer anywhere else...

If your going to sit on the sidelines you might as well sit with that.

- Joined

- Jan 15, 2019

Inflation is 8%+. And those "anywhere" CDs are available from all those "too big to fail" banks that are currently failing right before our eyes. So my options are basically "you might lose less or you might lose it all"?You can get 4.5 and 5.0% 13 month CD's anywhere now.

If your going to sit on the sidelines you might as well sit with that.

I should just stock up on ammo while civilians can still buy it...

- Joined

- Jul 18, 2017

Fed is going to raise interest rates, guarantee it. I'm convinced they've decided they can control the meltdown, but only if they have CONTROL, and that means the banking industry needs to get centralized in a hurry under the "too big to fails". Easier to control if all the accounts are in one place. At least according to the logic of the people running the show.

So, raise rates again, wipe out the small fry and then sell their assets in a forced government fire sale to the big boys at pennies on the dollar, while FDIC insured liabilities get covered by the money printer. Biden then does a speech thanking JP Morgan for doing their civic duty by buying up the failed regional banks using government provided funds

What they are doing is creating a single point of failure. It's rather fascinating to watch the ever more extreme measures they are resorting too in order to prevent the reactor from exploding.

They can't stop it though. It's amusing to see the flailing, but ultimately the banking system is completely fucked. It's too strung out, has too many liabilities and its entire business model is failed because the plebes can't afford to save any money in their checking accounts and the Patricians have no economic incentive to do it either, having become used to putting all their money in Bonds, Investments and Money Market accounts and paying for their day to day with credit cards.

It's over. All that's left now is the screaming.

So, raise rates again, wipe out the small fry and then sell their assets in a forced government fire sale to the big boys at pennies on the dollar, while FDIC insured liabilities get covered by the money printer. Biden then does a speech thanking JP Morgan for doing their civic duty by buying up the failed regional banks using government provided funds

What they are doing is creating a single point of failure. It's rather fascinating to watch the ever more extreme measures they are resorting too in order to prevent the reactor from exploding.

They can't stop it though. It's amusing to see the flailing, but ultimately the banking system is completely fucked. It's too strung out, has too many liabilities and its entire business model is failed because the plebes can't afford to save any money in their checking accounts and the Patricians have no economic incentive to do it either, having become used to putting all their money in Bonds, Investments and Money Market accounts and paying for their day to day with credit cards.

It's over. All that's left now is the screaming.

- Joined

- Jul 15, 2016

Member in the 1980s when interest rates were in the double digits.

Raise the rates powell

Raise the rates powell

- Joined

- Dec 15, 2022

I heard there was another bank that collapsed.

You know what this means?

You know what this means?

- Joined

- Nov 12, 2019

Yep, you heard JPowell

.............

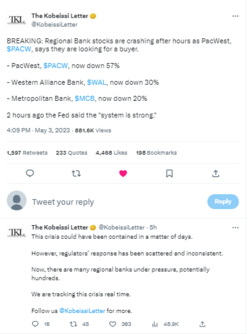

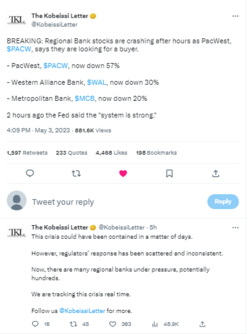

end of day news:

....

The final Day plan :

news.yahoo.com

news.yahoo.com

www.businessinsider.com

www.businessinsider.com

archive.ph

archive.ph

.............

end of day news:

....

The final Day plan :

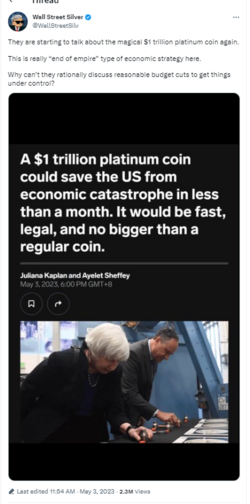

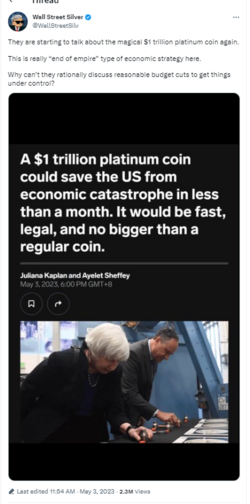

A $1 trillion platinum coin could save the US from economic catastrophe in less than a month. It would be fast, legal, and no bigger than a regular coin.

The US is rapidly hurtling toward a catastrophic debt ceiling default. A trillion-dollar coin the size of a quarter could stop it.

A $1 trillion platinum coin could save the US from economic catastrophe in less than a month. It would be fast, legal, and no bigger than a regular coin.

The US is rapidly hurtling toward a catastrophic debt ceiling default. A trillion-dollar coin the size of a quarter could stop it.

Debt Ceiling Solution: $1 Trillion Platinum Coin Could Stop Crisis

archived 3 May 2023 12:34:02 UTC

The government could run out of money to pay its debts as soon as June 1, and Congress hasn't acted.

One potential solution: Minting a trillion dollar platinum coin to pay off debts and avert disaster.

The coin is unlikely to fly, but Biden aides are looking at other legal workarounds.

The US is hurtling towards an entirely preventable economic crisis, and a trillion-dollar coin could solve all of its problems — if the Biden administration decides to take it seriously.

Treasury Secretary Janet Yellen said that the government could run out of money to pay its debts as soon as June 1, triggering a never-before-seen debt-ceiling crisis. Even a short default could cost the country almost a million jobs and trigger a recession.

But Republicans and Democrats are still waiting for the other to blink. The House GOP narrowly passed a bill last week that would tie massive budget cuts to a one-year increase, which Senate Democrats have proclaimed dead on arrival. President Joe Biden said he would veto that legislation, and continues to insist upon a clean raise.

Some economists say that means it's time for a break-the-glass option: a trillion-dollar coin.

The coin — which wouldn't need to be bigger than an average coin, and can be made quickly — is part of a potential debt-ceiling loophole. The Treasury Department can mint platinum coins of any denomination. That's led to a school of thought that says Yellen should simply mint a trillion-dollar platinum coin and deposit it to pay off the debts until a more permanent solution can be found.

"At this point, if any of the other solutions, the so-called more serious solutions would work, then they would've been used by now. But they keep not actually being strong enough. The coin's the only one that's strong enough," Rohan Grey, an assistant professor at Willamette University College of Law, told Insider.

To be sure, Biden's administration has not been so accepting of using a $1 trillion platinum coin to avoid an economically catastrophic default. Yellen, for example, dismissed the idea back in January, saying that it "is not by any means to be taken as a given that the Fed would do it, and I think especially with something that's a gimmick."

"The Fed is not required to accept it, there's no requirement on the part of the Fed," she added. "It's up to them what to do."

Brian Riedl, a senior fellow and economist at the conservative-leaning Manhattan Institute, told Insider that "the first problem with the trillion-dollar coin is they would have to get past their own Treasury Secretary."

"There is a large chance the courts would shoot it down," Riedl said. "There's a large chance the Treasury Secretary would not be on board. The Federal Reserve may not be willing to accept the trillion-dollar coin."

Grey said that the coin is a type of "messaging symbol." At the end of the day, he argued, it helps break through the noise, and show that a simple solution can be the best one. Yes, a trillion-dollar coin is silly, but would Biden "rather not look silly and hurt seniors and hurt Medicare than the other way around?"

A constitutional workaround could also solve the problem

Calls for the coin come as Biden aides look into whether the debt limit itself is constitutional, according to The New York Times.

Even if the coin isn't on the table, there could be yet another way to avoid a default while avoiding congressional drama. The Times reported on Tuesday that, according to people familiar with the discussions, officials in the White House, Treasury, and Justice Departments have floated invoking a clause in the 14th Amendment that could take care of the debt ceiling without lawmakers' approval.

The clause states that "the validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned." Some experts suggest that this could mean a default — and thus the debt ceiling — would be unconstitutional.

"Of course, the Biden administration is not only going to look into these constitutional options, but more importantly they're gonna signify to Republicans that they're looking at these extralegal and constitutional options as a threat to undercut the legitimacy of the Republican position," Riedl said.

Yellen has been critical of that route as well, telling ABC's "This Week" in 2021 that she believes it is Congress' job to raise the debt ceiling.

"It's Congress's responsibility to show that they have the determination to pay the bills that the government amasses," she said. "We shouldn't be in a position where we need to consider whether or not the 14th Amendment applies. That's a disastrous situation that the country shouldn't be in."

And yet, here we are. Biden is meeting with McCarthy, House Minority Leader Hakeem Jeffries, Senate Majority Leader Chuck Schumer, and Senate Minority Leader Mitch McConnell on May 9 to discuss raising the debt ceiling. A White House official told Insider in a statement that Biden "will stress that Congress must take action to avoid default without conditions."

With just 12 legislative days left in the House before June 1, the clock is ticking.

"I think in this instance there probably will be a deal," Riedl said. "It will probably come from a few scraps of the House-passed plan and no one will come away happy, but everyone will come away thinking they got something that they can sell back home."

- Joined

- May 17, 2019

When did we go back to pretending we aren't in a recession? Did the word get redefined again?Even a short default could cost the country almost a million jobs and trigger a recession.

- Joined

- Dec 13, 2022

They will keep redefining the word until Janet Yellen herself has to assure citizens that even though bread is unaffordable the economy is perfectly healthy and that the dollar's world reserve status will never change. Hell, given the economic atrosities committed by the fed changing definitions is as innocent as they get.When did we go back to pretending we aren't in a recession? Did the word get redefined again?

- Joined

- Jan 9, 2023

Lol the bailouts aren't working now, we're fucked!

- Joined

- Dec 15, 2022

We are nowhere near Weimar levels of inflation. We are probably another decade or so away from people needing a wheelbarrow of money to buy a loaf of stale bread. But things aren't good. But they haven't been good for a 20+ years now. The US economy has been running on fumes for the last 20 years. We are in late stage capitalism. This is what happens when you let capitalism and rich people run amok. You get problems like this.They will keep redefining the word until Janet Yellen herself has to assure citizens that even though bread is unaffordable the economy is perfectly healthy and that the dollar's world reserve status will never change. Hell, given the economic atrosities committed by the fed changing definitions is as innocent as they get.

They will just do what they always do and keep lying about the state of the economy. It comes down to do you believe what you see or do you believe their lies. People aren't buying the lies anymore.

- Joined

- Nov 6, 2014

But will the 1 trillion dollarino have CWC's face on it?

We at the farms need to ask the important questions.

We at the farms need to ask the important questions.

- Joined

- Dec 17, 2019

American gold broke 2000 dollar celling in april and went down a bit now is firmly above the 2000 dollars and going hockey stick in terms of pricing. Literally 2008/2009/2010/2011 bundled in one on steroids

I checked both on nok and euro literally stonks go up line . Jesus fuck inflation is going the get fucked

I checked both on nok and euro literally stonks go up line . Jesus fuck inflation is going the get fucked

- Joined

- Jan 9, 2023

The money needed to turn the dollar into a Weimar mark is already printed up 20 times over with the dollar being the world reserve currency being the reason it hasn't inflated yet. If de-dollarization continues and countrues keep dropping the dollar inflation can run outta control very quickly.We are nowhere near Weimar levels of inflation. We are probably another decade or so away from people needing a wheelbarrow of money to buy a loaf of stale bread. But things aren't good. But they haven't been good for a 20+ years now. The US economy has been running on fumes for the last 20 years. We are in late stage capitalism. This is what happens when you let capitalism and rich people run amok. You get problems like this.

They will just do what they always do and keep lying about the state of the economy. It comes down to do you believe what you see or do you believe their lies. People aren't buying the lies anymore.

khaine

kiwifarms.net

- Joined

- Jan 31, 2021

‘It’s spooky’: Half of America’s banks are already insolvent

There’s $13.5 trillion uninsured deposits in the US banking system. Such deposits can vanish in an afternoon in the cyber age.

“It’s spooky. Thousands of banks are underwater,” said Professor Amit Seru, a banking expert at Stanford University. “Let’s not pretend that this is just about Silicon Valley Bank and First Republic. A lot of the US banking system is potentially insolvent.”

The full shock of monetary tightening by the Fed has yet to hit. A great edifice of debt faces a refinancing cliff-edge over the next six quarters. Only then will we learn whether the US financial system can safely deflate the excess leverage induced by extreme monetary stimulus during the pandemic.

A Hoover Institution report by Professor Seru and a group of banking experts calculates that more than 2315 US banks are currently sitting on assets worth less than their liabilities. The market value of their loan portfolios is $US2 trillion lower than the stated book value.

These lenders include big beasts. One of the 10 most vulnerable banks is a globally systemic entity with assets of over $US1 trillion. Three others are large banks. “It is not just a problem for banks under $US250 billion that didn’t have to pass stress tests,” he said.

Shit's fucked yo

Rei is Shit.

kiwifarms.net

- Joined

- Dec 12, 2022

Pulling almost every dumb geopolitical move possible to help accelerate dedollerization while also having a completely fucked domestic banking sector is some real daring shit. Either retards are manning the titanic or they are gonna kill the dollar to have their cbdc.

- Joined

- Nov 15, 2021

Hyperinflation isn't just a simple function of the money supply expanding. It kicks in when there's pretty much anything people would rather have than money, or fixed assets denominated in money. It's when your man on the street takes his paycheck, and immediate goes to a store to buy the smallest, most expensive, imperishable goods he can-jewelry, trading cards, appliances, whatever he can carry-because he knows he'll lose less money holding onto them and pawning them when he needs paper money than by letting the money sit in his account. At that point, the currency enters freefall. The government is pretty desperate to make sure people don't lose faith in the dollar, which is why they are constantly trying to convince us this is just a temporary problem.The money needed to turn the dollar into a Weimar mark is already printed up 20 times over with the dollar being the world reserve currency being the reason it hasn't inflated yet. If de-dollarization continues and countrues keep dropping the dollar inflation can run outta control very quickly.