For those who are wondering, here is the will of Nick Rekieta's wealthy maternal grandfather Louis Walter Owen (Lou Owen), a codicil to the will, and an affidavit by the executor of his estate, Ty Beard, in PDF and image format.

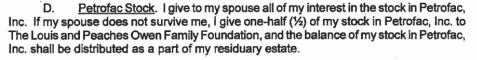

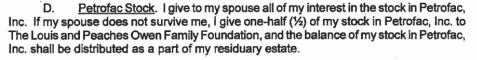

Fun tidbit: the will of Louis Walter Owen has an apparent oversight on page 3 of the document, which is dated March 1 2010.

One problem: the parent company of the Petrofac group of companies, following a 2002 restructuring, is Petrofac Limited, a company based in the island of Jersey, in the Channel Islands.

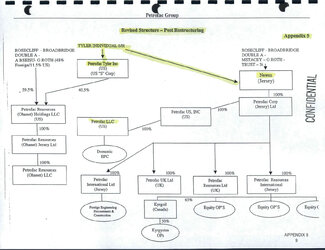

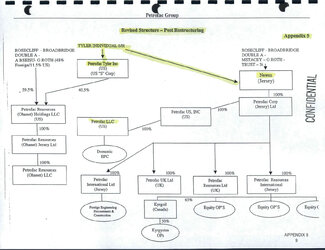

The below internal document from before the restructuring, revealed through a court case in Texas, shows the planned restructuring of the company. The planned new entity listed as "Newco" became Petrofac Limited and went public on the London Stock Exchange in 2005.

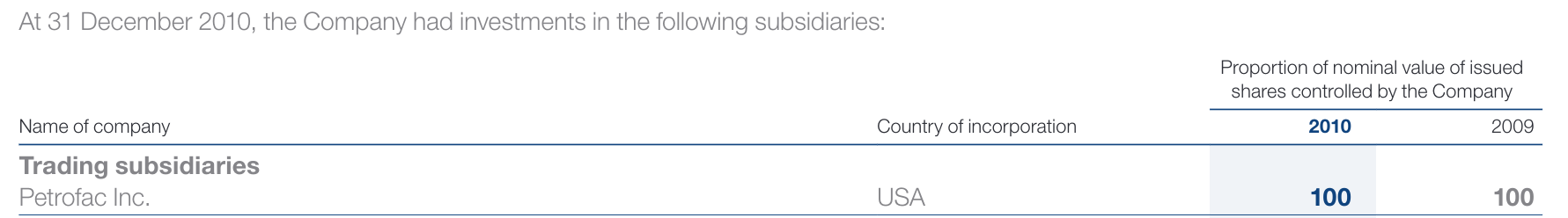

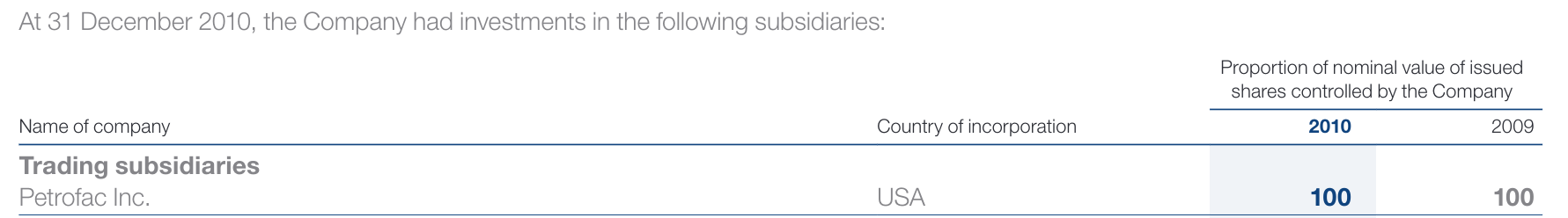

According to Petrofac's 2010 annual report, Petrofac Limited in Jersey controlled 100% of issued shares in Petrofac Inc. as of both 2009 and 2010.

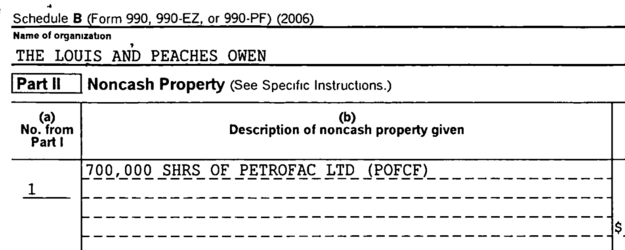

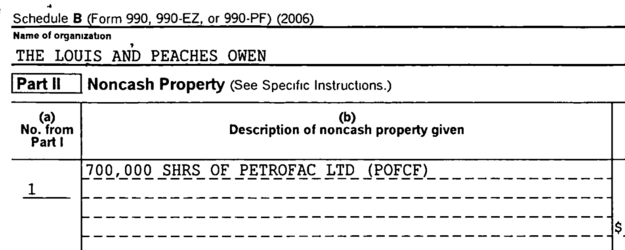

Form 990 returns from the Louis and Peaches Owen Foundation correctly identify Petrofac Limited as the stock being donated to the foundation by the Owens. The ticker symbol (POFCF) represents the listing on US OTC markets for Petrofac Limited, which trades on the London Stock Exchange under the ticker symbol PFC.

Since this is being brought up, I wanted to give a greater breakdown of old Lou and Peaches Owen.

You may find Lou's obituary here. They seemed like remarkable people and reading their legacy spelled out by people who knew them just demonstrates how much of an unworthy inheritor Nick Rekieta truly is to their lineage.

It is not being brought up randomly. A very detailed post on the background is forthcoming.

It wasn't something I had thought about looking into in detail until Rekieta's "Dear John" rant where he relished and delighted in the fact that other people didn't have the vastly wealthy family background he does. Before then, I had just looked over the company's Wikipedia page and said "interesting".

Recently I did have the time to look into the situation in great detail and find all the documents I needed.

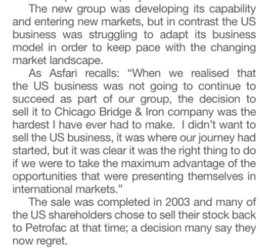

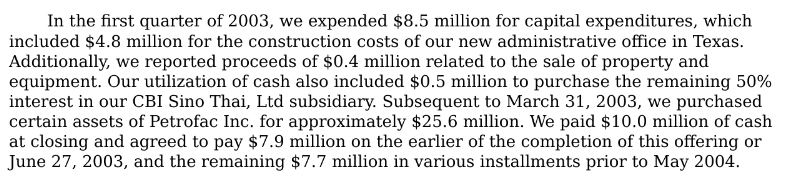

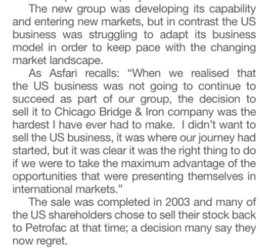

One piece of context to this is that the US business based in Tyler was sold to Chicago Bridge & Iron Company in 2003 for $25.6 million, a tiny fraction of what the remaining company was valued at when it went public two years later.

(From a Petrofac internal magazine,

Petrofacts)

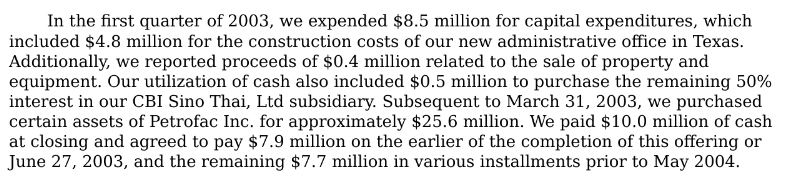

EDIT: Source for purchase price: