By Kelsey Piper Nov 16, 2022, 3:20pm EST

Sam Bankman-Fried. | Lam Yik/Bloomberg via Getty Images

Last night, Sam Bankman-Fried DMed me on Twitter.

That was surprising. I’d spoken to Bankman-Fried via Zoom earlier in the summer when I was working on a profile of him, so I reached out to him via DM on November 13, after news broke that his cryptocurrency exchange had collapsed, with billions in customer deposits apparently gone. I didn’t expect him to respond — typically, people under investigation by both the Securities and Exchange Commission and the Department of Justice don’t return requests for comment.

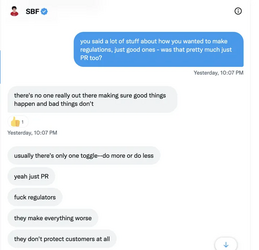

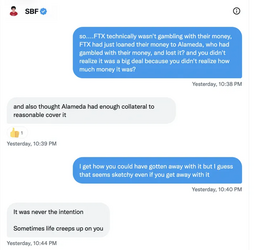

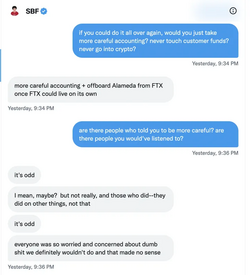

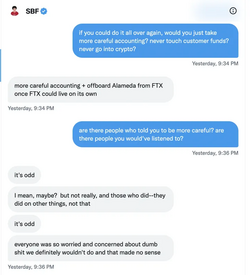

Bankman-Fried, though, apparently wanted to talk. About how FTX and his hedge fund Alameda Research had gambled with customer money without, he claims, realizing that’s what they were doing. About who gets lauded as a hero and who’s the fall guy. About regulators. (“Fuck regulators.”) About what he regrets (“Chapter 11,” the decision to declare bankruptcy) and about what he would have done differently with FTX and Alameda (“more careful accounting + offboard Alameda from FTX once FTX could live on its own”).

It was past midnight Bahamas time, where Bankman-Fried is reportedly still located, and we went back and forth on Twitter for more than an hour. He was, he said, still working to try to raise the funding needed to pay back all his depositors.

As we messaged, I was trying to make sense of what, behind the PR and the charitable donations and the lobbying, Bankman-Fried actually believes about what’s right and what’s wrong — and especially the ethics of what he did and the industry he worked in. Looming over our whole conversation was the fact that people who trusted him have lost their savings, and that he’s done incalculable damage to everything he proclaimed only a few weeks ago to care about. The grief and pain he has caused is immense, and I came away from our conversation appalled by much of what he said. But if these mistakes haunted him, he largely didn’t show it.

(Disclosure: This August, Bankman-Fried’s philanthropic family foundation, Building a Stronger Future, awarded Vox’s Future Perfect a grant for a 2023 reporting project. That project is now on pause.)

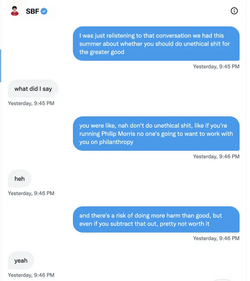

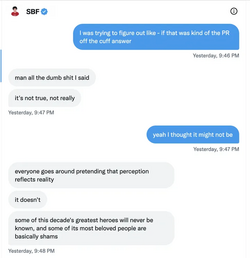

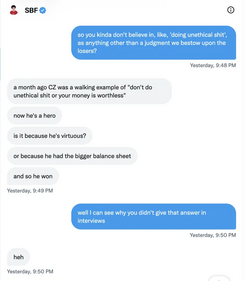

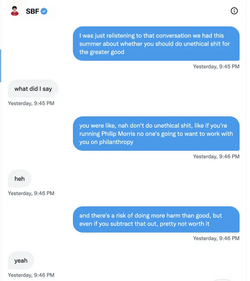

That question happens to be one I had asked him in the interview this summer, which I had just relistened to the night before our Twitter conversation. At the time, of course, I thought the ethical dilemma where Bankman-Fried had perhaps crossed a line was whether it was acceptable to run a cryptocurrency exchange in the first place — and whether the good he claimed he meant to do made it okay.

A lot of people, I said to Bankman-Fried in that earlier interview, would think of “starting a crypto company to make billions of dollars the way I would think of starting a tobacco company to make billions of dollars: deeply immoral. Presumably, there’s some line where you shouldn’t do something that bad even for good reasons. I’m curious whether you think there’s some line? And if so, where would you draw that line?”

“There is some line,” he told me then. “The answer can’t be there is no line. Or else, you know, you could end up doing massively more damage than good. And I think more generally, you could say, okay, fine, but just, like, subtract that out. But I don’t think it’s that simple, either. Because there are a lot of complicated but important second-order harms that come if your core business is bad for the world, in terms of your ability to work with partners and your ability to work with partners in your philanthropic efforts.

“You could imagine that if the Philip Morris Foundation had really good ideas about how to improve the world, they probably would still have a really hard time working with the Gates Foundation. So I do think it’s more complicated than that. And you have to seriously contend with what the impact is of your direct work.”

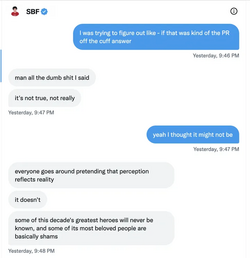

I returned to those questions in our Twitter conversation. Those well-considered ideas about balancing ethical imperatives? “It’s not true, not really,” he said now.

Why didn’t Bankman-Fried realize what was happening until it was too late? “Sometimes life creeps up on you,” he said.

Bankman-Fried argues he should instead have kept trying to raise more money, and insisted that if he’d just done that, “withdrawals would be opening up in a month with customers fully whole.” The Wall Street Journal reported earlier this week on Bankman-Fried’s efforts to find funding and found no indication any investors were committing. Even if fresh funding were obtained, the paper continued, it would require negotiations with FTX creditors and the approval of the bankruptcy court.

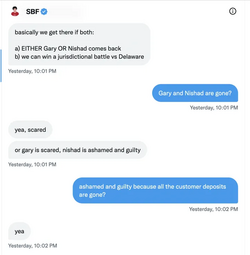

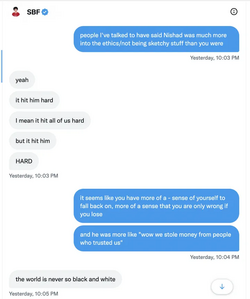

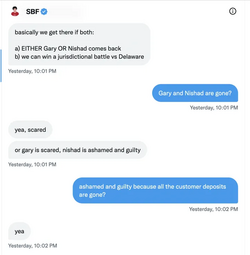

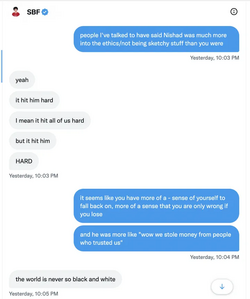

While he said that some of his colleagues — co-founder Gary Wang and director of engineering Nishad Singh — were “scared,” and, in the case of Singh, “ashamed and guilty,” Bankman-Fried seems to maintain some emotional distance from the collapse: “The world is never so black and white.”

This morning, I emailed Bankman-Fried to confirm he had access to his Twitter account and this conversation had been with him. “Still me, not hacked! We talked last night,” he answered.

His lawyers did not return a request for comment.

Source (Archive)

FTX's interim CEO has disavowed him and this interview:

Source (Archive)

Sam Bankman-Fried. | Lam Yik/Bloomberg via Getty Images

Last night, Sam Bankman-Fried DMed me on Twitter.

That was surprising. I’d spoken to Bankman-Fried via Zoom earlier in the summer when I was working on a profile of him, so I reached out to him via DM on November 13, after news broke that his cryptocurrency exchange had collapsed, with billions in customer deposits apparently gone. I didn’t expect him to respond — typically, people under investigation by both the Securities and Exchange Commission and the Department of Justice don’t return requests for comment.

Bankman-Fried, though, apparently wanted to talk. About how FTX and his hedge fund Alameda Research had gambled with customer money without, he claims, realizing that’s what they were doing. About who gets lauded as a hero and who’s the fall guy. About regulators. (“Fuck regulators.”) About what he regrets (“Chapter 11,” the decision to declare bankruptcy) and about what he would have done differently with FTX and Alameda (“more careful accounting + offboard Alameda from FTX once FTX could live on its own”).

It was past midnight Bahamas time, where Bankman-Fried is reportedly still located, and we went back and forth on Twitter for more than an hour. He was, he said, still working to try to raise the funding needed to pay back all his depositors.

As we messaged, I was trying to make sense of what, behind the PR and the charitable donations and the lobbying, Bankman-Fried actually believes about what’s right and what’s wrong — and especially the ethics of what he did and the industry he worked in. Looming over our whole conversation was the fact that people who trusted him have lost their savings, and that he’s done incalculable damage to everything he proclaimed only a few weeks ago to care about. The grief and pain he has caused is immense, and I came away from our conversation appalled by much of what he said. But if these mistakes haunted him, he largely didn’t show it.

(Disclosure: This August, Bankman-Fried’s philanthropic family foundation, Building a Stronger Future, awarded Vox’s Future Perfect a grant for a 2023 reporting project. That project is now on pause.)

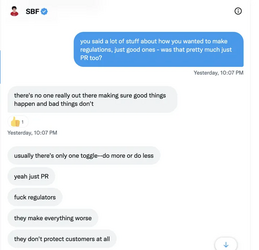

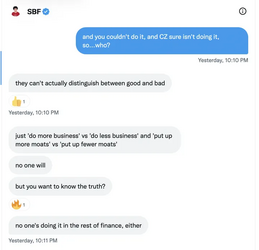

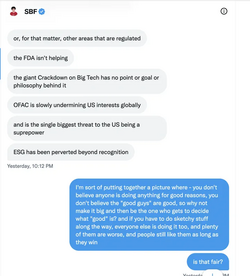

On regulators

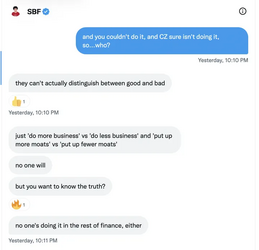

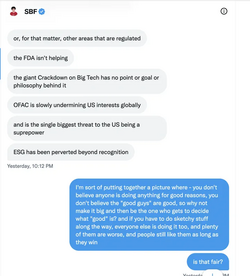

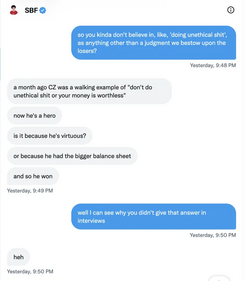

Before his empire collapsed, Bankman-Fried was actively engaged in lobbying in Washington for a regulatory framework for cryptocurrency. While many crypto CEOs — like Bankman-Fried’s nemesis Binance CEO Changpeng “CZ” Zhao — are openly skeptical of government regulation, Bankman-Fried has largely avoided criticizing regulators. But in our conversation, he dismissed their role. He characterized his past conciliatory statements — like when he said just last month that some amount of crypto regulation would be “definitively good” — as little more than “PR.” In doing so, he all but confirmed the view of critics who have argued that his overtures to Washington were much more about image than substance.

On being willing to behave unethically

One question on which I’ve seen widespread speculation is whether Bankman-Fried thought it was okay to do unethical things “for the greater good” — a position that hardcore utilitarians, which Bankman-Fried has identified as in the past, might hold.That question happens to be one I had asked him in the interview this summer, which I had just relistened to the night before our Twitter conversation. At the time, of course, I thought the ethical dilemma where Bankman-Fried had perhaps crossed a line was whether it was acceptable to run a cryptocurrency exchange in the first place — and whether the good he claimed he meant to do made it okay.

A lot of people, I said to Bankman-Fried in that earlier interview, would think of “starting a crypto company to make billions of dollars the way I would think of starting a tobacco company to make billions of dollars: deeply immoral. Presumably, there’s some line where you shouldn’t do something that bad even for good reasons. I’m curious whether you think there’s some line? And if so, where would you draw that line?”

“There is some line,” he told me then. “The answer can’t be there is no line. Or else, you know, you could end up doing massively more damage than good. And I think more generally, you could say, okay, fine, but just, like, subtract that out. But I don’t think it’s that simple, either. Because there are a lot of complicated but important second-order harms that come if your core business is bad for the world, in terms of your ability to work with partners and your ability to work with partners in your philanthropic efforts.

“You could imagine that if the Philip Morris Foundation had really good ideas about how to improve the world, they probably would still have a really hard time working with the Gates Foundation. So I do think it’s more complicated than that. And you have to seriously contend with what the impact is of your direct work.”

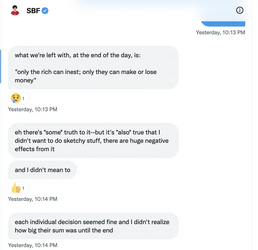

I returned to those questions in our Twitter conversation. Those well-considered ideas about balancing ethical imperatives? “It’s not true, not really,” he said now.

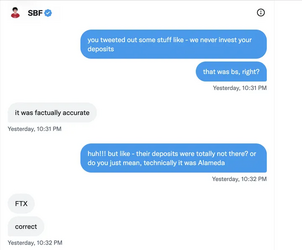

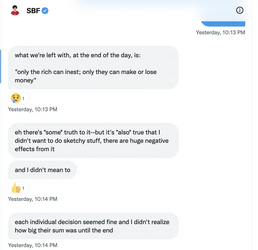

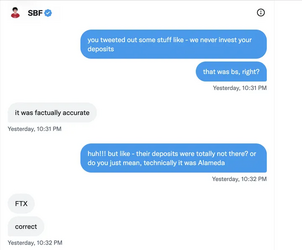

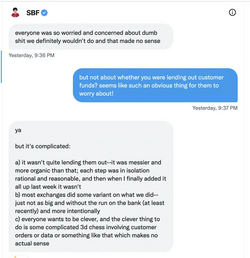

On bending the truth

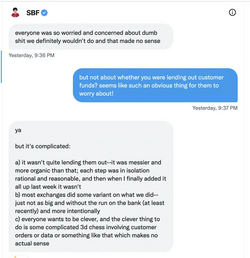

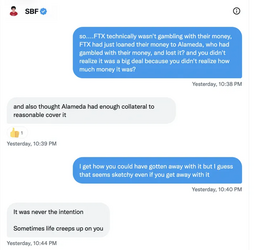

Bankman-Fried has maintained that FTX has never invested the deposits of crypto account holders on the exchange. I pressed him on that point via Twitter, and while he continued to insist that FTX did not directly use account money in this way, he said that Alameda — which he also owns — had borrowed far more money from FTX’s balance sheet for investments than he had realized, which ultimately left FTX vulnerable to the crypto equivalent of a bank run.Why didn’t Bankman-Fried realize what was happening until it was too late? “Sometimes life creeps up on you,” he said.

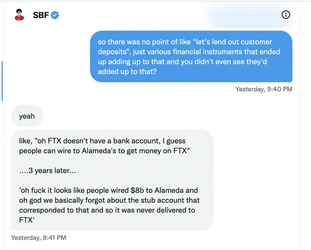

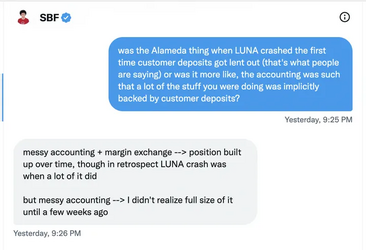

On what happened

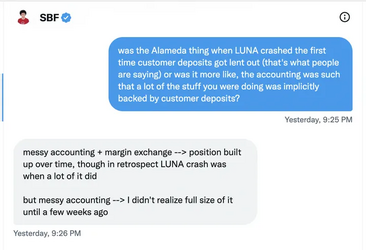

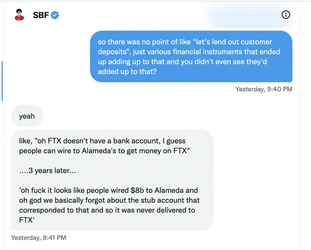

One theory is that the seeds of FTX’s downfall were sown earlier this year, when Alameda reportedly took huge losses after the crypto company Terra’s LUNA stablecoin collapsed. Bankman-Fried said he didn’t realize the extent of the problem because of “messy accounting” — albeit messy accounting to the tune of billions of dollars.

On what he regrets

Bankman-Fried acknowledged that he “fucked up. Big. Multiple times.” But he also insisted that much of the trouble could have been avoided if FTX had not declared bankruptcy, which has largely taken financial matters out of his control. (During the process, Bankman-Fried was replaced as CEO of FTX by John J. Ray III, a lawyer who helped creditors recover billions of dollars after the bankruptcy of the energy trading firm Enron.) “The people in charge of [the company] are trying to burn it all to the ground out of shame,” he told me.Bankman-Fried argues he should instead have kept trying to raise more money, and insisted that if he’d just done that, “withdrawals would be opening up in a month with customers fully whole.” The Wall Street Journal reported earlier this week on Bankman-Fried’s efforts to find funding and found no indication any investors were committing. Even if fresh funding were obtained, the paper continued, it would require negotiations with FTX creditors and the approval of the bankruptcy court.

While he said that some of his colleagues — co-founder Gary Wang and director of engineering Nishad Singh — were “scared,” and, in the case of Singh, “ashamed and guilty,” Bankman-Fried seems to maintain some emotional distance from the collapse: “The world is never so black and white.”

On the hack of FTX

Shortly after FTX filed for bankruptcy, watchers of blockchain transactions noticed someone had transferred hundreds of millions of dollars out of the company. I asked Bankman-Fried what was up.

On what’s next

Bankman-Fried says his No. 1 priority now is to try to raise $8 billion to make account holders whole. “That,” he told me, is “basically all that matters for the rest of my life.” But while he said that “a month ago I was one of the world’s greatest fundraisers,” that $8 billion dwarfs what FTX was able to raise so far, there’s no indication any investors would bite, and even if he could secure funding, it would likely require both creditors and the bankruptcy court to get on board.

This morning, I emailed Bankman-Fried to confirm he had access to his Twitter account and this conversation had been with him. “Still me, not hacked! We talked last night,” he answered.

His lawyers did not return a request for comment.

Source (Archive)

FTX's interim CEO has disavowed him and this interview:

Source (Archive)

Last edited: