Source: https://www.wsj.com/personal-finance/americas-60-year-olds-are-staring-at-financial-peril-62599a76

Archive: https://archive.is/T1Tk5

July 22, 2024 9:00 pm ET

Shauna Sharpes doesn’t travel and grows much of her own food at her home in western Washington state. The payroll manager for a local Native American tribal authority has meager savings and expects she will have to keep working for at least the next decade.

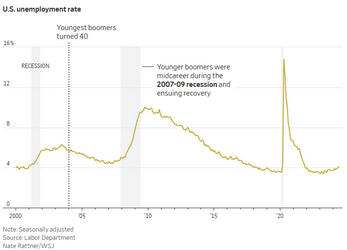

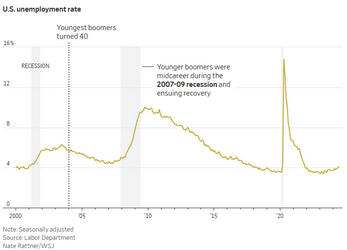

Part of her challenge: She turned 60 in January, putting her at the tail end of a baby boom generation that is hurtling toward retirement age in uncertainty. Born in a midcentury, postwar America brimming with promise, many of the youngest boomers are still sporting financial bruises from the 2007-09 recession and the nation’s steady shift away from guaranteed pensions.

“The most important things for me right now are a place to live indoors, water and food,” said Sharpes, who has about $3,000 in her retirement accounts. “And thinking about how I’m going to provide that for myself from now until I drop dead.”

By the end of this year, the youngest baby boomers will all turn 60. The birth dates of those in this generation—around 70 million strong, or one in five Americans—cover a 19-year span stretching from the aftermath of World War II to 1964, the year the Beatles made their debut on the Ed Sullivan Show.

Older Americans—including young boomers with retirement accounts powered by a booming stock market—remain a major force in the economy. Those 55 and up control nearly 70% of U.S. household wealth, Federal Reserve data show.

But that age group also includes older adults with little if any retirement funds socked away, or only Social Security to lean on, who are facing golden years laden with risk. For millions of younger boomers, who could live at least two more decades, a lost job or expensive medical problem could upend their stability while ramping up pressure on younger generations.

The baby-boom generation’s long span means the youngest boomers hit major life events at different times than their elders. Their midcareer years, when earnings typically start to peak, got upended by the 2007-09 financial shock, according to retirement experts. Younger boomers without traditional pensions had to shoulder more investment risk while saving for retirement. There is also a greater share of nonwhite young boomers who are more likely to lack retirement accounts.

About a third of younger boomer households lacked retirement benefits beyond Social Security in 2022, the most recent year available, according to a closely watched Federal Reserve tool called the Survey of Consumer Finances. When the older boomers were roughly the same age, a smaller amount—one quarter—were missing these retirement benefits.

Many others have only meager savings or are worried that soaring health costs will quickly drain their reserves.

More of these young boomers “are going to enter into retirement without the resources they need,” said David John, who studies retirement savings issues at the AARP Public Policy Institute.

For many, making ends meet will likely mean having to work well into old age, if they are able. But they may also have to rely on younger family members as caregivers and for financial support. A large number of seniors in poverty could also increase reliance on Medicaid, the health program for the poor, which foots bills for long-term care including nursing homes.

Sharpes, who has four adult daughters and lives in Oakville, Wash., lost roughly half the $20,000 in her 401(k) during the financial shock of 2007-09, she said. She applied the remainder to a home mortgage despite the steep penalty for early withdrawal.

Several years after the financial crisis, she said, she lost her job as controller of a small lumber yard when the company closed. Her marriage also ended.

Last year, she bought a rundown two-bedroom home on nearly 2 acres that she is rehabbing with her fiancé. She hopes to at least cut back on work by age 70. To do that, she said, she will need to pay down $260,000 in home-related debt while belatedly building a retirement nest egg. Her target: $100,000.

“It’s not going to be a lot, I already know this,” she said.

A recent study looking at the roughly 30 million young boomers who will turn 65 between this year and 2030 determined that just over half have no more than $250,000 in financial assets. This makes it likely these people will have to rely on Social Security after burning through savings as a primary source of income in retirement, according to the study, commissioned by the Washington, D.C.-based nonprofit Alliance for Lifetime Income, which advocates for retirement annuities and includes insurers and financial-services companies.

“Social Security was never intended to be the sole source of income later in life,” said Ramsey Alwin, chief executive at the National Council on Aging, which advocates for older peoples’ financial security.

Researchers at Boston College’s Center for Retirement Research, who have studied financial weaknesses among young boomers, said that there are several contributing factors.

One is that younger boomers are more diverse, due especially to growth in the Hispanic population. Recent census estimates show Hispanic people represent about 15% of the youngest boomers compared with 8% of the oldest.

Research has shown Hispanic people and Black people are far less likely to have access to retirement plans at their jobs, compared with the non-Hispanic white population. Low pay also discourages saving, financial experts say. Many Hispanic immigrants also send savings to family members in their native country.

There is also a growing disconnect between working and accumulating wealth, the Boston College researchers found. Younger boomers were caught in the transition away from pensions, which guaranteed retirement income, in a time when 401(k) plans put the onus on users to make proactive and savvy investment decisions, said John, from the AARP’s Public Policy Institute.

Some experts and some data sources don’t see a firm divide among the boomer cohorts. Also, surging markets have aided young boomers who do have investment accounts, said Lowell Ricketts, a data scientist at the St. Louis Fed.

The Fed survey showed young boomers with 401(k) and individual retirement account plans in 2022 had more assets in them than older boomers did when they were the same age. The median for young boomers was $189,000, while the median for older boomers, nine years earlier, and adjusted for inflation, was just under $143,000. The survey doesn’t take into account the value of pensions and Social Security.

But the many young boomers without such accounts face gloomier prospects, Ricketts said, adding, “That can translate to just a diminished standard of living later in life.”

Barbara Tarallo, 62, lost her job with a software company during the 2007-09 recession. She was able to find other work, with a job she still has now doing marketing work for another software company, but at roughly half her prior salary. She still makes about $45,000 a year today while working from her Pelham, N.H., home.

She said she hasn’t been able to contribute to her retirement since then due to another major life event: a traumatic brain injury her husband, Tom Tarallo, suffered about a year after she switched to the lower-paying job.

The couple lost his higher salary and had to move homes to accommodate his wheelchair. Barbara Tarallo pays their mortgage and other household expenses from her salary and modest disability benefits related to Tom’s accident, while also caring for him. She has also dipped into their retirement savings—they have about $250,000 to $300,000—to help cover costs.

Today, living in a 55-and-up community filled with older retirees, she finds it hard to envision leaving work herself.

“I think I’ve just resigned myself to the fact that I can do this as long as I can do it and when I can’t do it anymore, I’ll cross that bridge when I get there,” Tarallo said.

That can come sooner than boomers hope. A recent study by the nonpartisan Employee Benefit Research Institute suggested people are overly optimistic about how long they can remain on the job. Issues like personal medical problems, partners’ health needs and layoffs are all potential hazards, said Craig Copeland, EBRI’s director of wealth benefits research.

Social Security can provide a financial backstop for many older Americans who otherwise might face destitution, said economist John Sabelhaus, a visiting fellow at the Urban-Brookings Tax Policy Center. Benefits are calculated progressively, meaning the share of preretirement earnings that the benefits replace is proportionally higher for those with lower career earnings.

Someone retiring this year at full retirement age with average annual earnings of about $28,550 would get yearly benefits equal to 57%, while someone who made just over $100,000 would see 35%, according to the Social Security Administration.

Keith Seawell, 60, has no retirement savings accounts and rents the apartment near Baltimore he shares with his girlfriend and teenage daughter. He has been pulling in about $2,500 a month from a temporary administrative job and Social Security disability payments stemming from a back injury he sustained working construction and other manual-labor jobs. Disability payments eventually convert to regular Social Security benefits.

Like other young boomers, Seawell says he has no intention to retire, because he never wants his four children to have to support him financially.

“I always felt I was the one that would have to be the provider, never looked at years down the road where they would have to do for me,” he said.

Worsening back problems recently sidelined Seawell, requiring surgery. He said he hopes to rejoin the workforce after he recovers.

Archive: https://archive.is/T1Tk5

America’s 60-Year-Olds Are Staring at Financial Peril

A bruising recession and the disappearance of pensions have left many young boomers financially exposed

By Jon Kamp, Scott Calvert and Paul OverbergJuly 22, 2024 9:00 pm ET

Shauna Sharpes doesn’t travel and grows much of her own food at her home in western Washington state. The payroll manager for a local Native American tribal authority has meager savings and expects she will have to keep working for at least the next decade.

Part of her challenge: She turned 60 in January, putting her at the tail end of a baby boom generation that is hurtling toward retirement age in uncertainty. Born in a midcentury, postwar America brimming with promise, many of the youngest boomers are still sporting financial bruises from the 2007-09 recession and the nation’s steady shift away from guaranteed pensions.

“The most important things for me right now are a place to live indoors, water and food,” said Sharpes, who has about $3,000 in her retirement accounts. “And thinking about how I’m going to provide that for myself from now until I drop dead.”

By the end of this year, the youngest baby boomers will all turn 60. The birth dates of those in this generation—around 70 million strong, or one in five Americans—cover a 19-year span stretching from the aftermath of World War II to 1964, the year the Beatles made their debut on the Ed Sullivan Show.

Older Americans—including young boomers with retirement accounts powered by a booming stock market—remain a major force in the economy. Those 55 and up control nearly 70% of U.S. household wealth, Federal Reserve data show.

But that age group also includes older adults with little if any retirement funds socked away, or only Social Security to lean on, who are facing golden years laden with risk. For millions of younger boomers, who could live at least two more decades, a lost job or expensive medical problem could upend their stability while ramping up pressure on younger generations.

The baby-boom generation’s long span means the youngest boomers hit major life events at different times than their elders. Their midcareer years, when earnings typically start to peak, got upended by the 2007-09 financial shock, according to retirement experts. Younger boomers without traditional pensions had to shoulder more investment risk while saving for retirement. There is also a greater share of nonwhite young boomers who are more likely to lack retirement accounts.

About a third of younger boomer households lacked retirement benefits beyond Social Security in 2022, the most recent year available, according to a closely watched Federal Reserve tool called the Survey of Consumer Finances. When the older boomers were roughly the same age, a smaller amount—one quarter—were missing these retirement benefits.

Many others have only meager savings or are worried that soaring health costs will quickly drain their reserves.

More of these young boomers “are going to enter into retirement without the resources they need,” said David John, who studies retirement savings issues at the AARP Public Policy Institute.

For many, making ends meet will likely mean having to work well into old age, if they are able. But they may also have to rely on younger family members as caregivers and for financial support. A large number of seniors in poverty could also increase reliance on Medicaid, the health program for the poor, which foots bills for long-term care including nursing homes.

Sharpes, who has four adult daughters and lives in Oakville, Wash., lost roughly half the $20,000 in her 401(k) during the financial shock of 2007-09, she said. She applied the remainder to a home mortgage despite the steep penalty for early withdrawal.

Several years after the financial crisis, she said, she lost her job as controller of a small lumber yard when the company closed. Her marriage also ended.

Last year, she bought a rundown two-bedroom home on nearly 2 acres that she is rehabbing with her fiancé. She hopes to at least cut back on work by age 70. To do that, she said, she will need to pay down $260,000 in home-related debt while belatedly building a retirement nest egg. Her target: $100,000.

“It’s not going to be a lot, I already know this,” she said.

A recent study looking at the roughly 30 million young boomers who will turn 65 between this year and 2030 determined that just over half have no more than $250,000 in financial assets. This makes it likely these people will have to rely on Social Security after burning through savings as a primary source of income in retirement, according to the study, commissioned by the Washington, D.C.-based nonprofit Alliance for Lifetime Income, which advocates for retirement annuities and includes insurers and financial-services companies.

“Social Security was never intended to be the sole source of income later in life,” said Ramsey Alwin, chief executive at the National Council on Aging, which advocates for older peoples’ financial security.

Researchers at Boston College’s Center for Retirement Research, who have studied financial weaknesses among young boomers, said that there are several contributing factors.

One is that younger boomers are more diverse, due especially to growth in the Hispanic population. Recent census estimates show Hispanic people represent about 15% of the youngest boomers compared with 8% of the oldest.

Research has shown Hispanic people and Black people are far less likely to have access to retirement plans at their jobs, compared with the non-Hispanic white population. Low pay also discourages saving, financial experts say. Many Hispanic immigrants also send savings to family members in their native country.

There is also a growing disconnect between working and accumulating wealth, the Boston College researchers found. Younger boomers were caught in the transition away from pensions, which guaranteed retirement income, in a time when 401(k) plans put the onus on users to make proactive and savvy investment decisions, said John, from the AARP’s Public Policy Institute.

Some experts and some data sources don’t see a firm divide among the boomer cohorts. Also, surging markets have aided young boomers who do have investment accounts, said Lowell Ricketts, a data scientist at the St. Louis Fed.

The Fed survey showed young boomers with 401(k) and individual retirement account plans in 2022 had more assets in them than older boomers did when they were the same age. The median for young boomers was $189,000, while the median for older boomers, nine years earlier, and adjusted for inflation, was just under $143,000. The survey doesn’t take into account the value of pensions and Social Security.

But the many young boomers without such accounts face gloomier prospects, Ricketts said, adding, “That can translate to just a diminished standard of living later in life.”

Barbara Tarallo, 62, lost her job with a software company during the 2007-09 recession. She was able to find other work, with a job she still has now doing marketing work for another software company, but at roughly half her prior salary. She still makes about $45,000 a year today while working from her Pelham, N.H., home.

She said she hasn’t been able to contribute to her retirement since then due to another major life event: a traumatic brain injury her husband, Tom Tarallo, suffered about a year after she switched to the lower-paying job.

The couple lost his higher salary and had to move homes to accommodate his wheelchair. Barbara Tarallo pays their mortgage and other household expenses from her salary and modest disability benefits related to Tom’s accident, while also caring for him. She has also dipped into their retirement savings—they have about $250,000 to $300,000—to help cover costs.

Today, living in a 55-and-up community filled with older retirees, she finds it hard to envision leaving work herself.

“I think I’ve just resigned myself to the fact that I can do this as long as I can do it and when I can’t do it anymore, I’ll cross that bridge when I get there,” Tarallo said.

That can come sooner than boomers hope. A recent study by the nonpartisan Employee Benefit Research Institute suggested people are overly optimistic about how long they can remain on the job. Issues like personal medical problems, partners’ health needs and layoffs are all potential hazards, said Craig Copeland, EBRI’s director of wealth benefits research.

Social Security can provide a financial backstop for many older Americans who otherwise might face destitution, said economist John Sabelhaus, a visiting fellow at the Urban-Brookings Tax Policy Center. Benefits are calculated progressively, meaning the share of preretirement earnings that the benefits replace is proportionally higher for those with lower career earnings.

Someone retiring this year at full retirement age with average annual earnings of about $28,550 would get yearly benefits equal to 57%, while someone who made just over $100,000 would see 35%, according to the Social Security Administration.

Keith Seawell, 60, has no retirement savings accounts and rents the apartment near Baltimore he shares with his girlfriend and teenage daughter. He has been pulling in about $2,500 a month from a temporary administrative job and Social Security disability payments stemming from a back injury he sustained working construction and other manual-labor jobs. Disability payments eventually convert to regular Social Security benefits.

Like other young boomers, Seawell says he has no intention to retire, because he never wants his four children to have to support him financially.

“I always felt I was the one that would have to be the provider, never looked at years down the road where they would have to do for me,” he said.

Worsening back problems recently sidelined Seawell, requiring surgery. He said he hopes to rejoin the workforce after he recovers.