- Joined

- Jul 23, 2022

Predictit is a company founded in 2014, A New Zealand-based online prediction market and a research aggregator that offers exchanges on political and financial events such as tax rates, legislation, political party primaries, elections, and international elections. PredictIt is owned and operated by Victoria University of Wellington with support from Aristotle, Inc. The company's office is located in Washington, D.C.

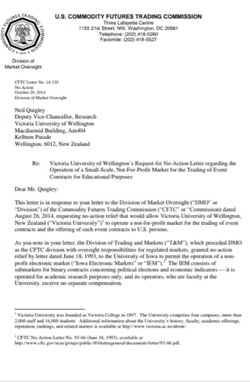

PredictIt is also a project of Victoria University of Wellington, New Zealand, a not-for-profit university, for educational purposes. The site is supported by Aristotle International, Inc., a U.S. provider of data processing and verification services. They operate under the terms of a No Action letter granted by the Commodity Futures Trading Commission (CFTC) in October, 2014. It is an experimental project operated for academic purposes. Despite there being a prohibition of online betting in the U.S.A., PredictIt secured a no-action letter from the Division of Market Oversight of the Commodity Futures Trading protecting them against action from the FTC (Federal Trading Commission)

Note:

Even though many states have legalized online gambling or betting prediction markets, it is still federally illegal.

www.ftc.gov

www.ftc.gov

August 2022

The Commodity Futures Trading Commission, without clear explanation, revoked PredictIt’s permission to operate, ordering that it shut down by mid-February.

In response, Predictit has decided to post their original agreement on the front page of their website. You can download and read the full 6 page statement/PDF file here by the Commodity Futures Trading Commission of the no action letter granted to Predictit in 2014.

September 2022

Predictit remains confident they did not violate any terms of the no action protection letter. You can read their damage assessment, response to the community, And response on a plan going forward Here (This is subject to updates at any time)

The lawsuit

Predictit has launched a lawsuit against the Commodity Futures Trading Commission to block the shutdown order and more specifically to give a reason as to which term they violated.

The lawsuit was filed on Sept. 9 in U.S. Federal District Court for the Western District of Texas.

You can read/download the full copy of the lawsuit here in PDF format.

Relevant articles specifically relating to the lawsuit

Yahoo finance (they basically repost coindesks article but note they reached out for comment from the CFTC with no response)

(A)

Coindesk

(A)

Other relevant articles specifically to the decision of CFTC to drop Predictits no action letter

The Atlantic

(A)

Bloomberg

(A)

The New York Times

(A)

Washington Post

(A)

Gaming Today

(A)

Gambling News

(A)

Quartz

(A)

Slate

(A)

(Out of the articles that reached out for comment from Commodity Futures Trading Commission or CFTC, none have received any.)

edit: this is the CFTC's statement https://www.cftc.gov/PressRoom/PressReleases/8567-22

(A)

I've also decided to include the archives of Predictit's boa in New Zealand and their partner Aristotle.

10yr old Aristotle archive

archive.ph

archive.ph

Current https://archive.ph/ETA3O

PredictIt is also a project of Victoria University of Wellington, New Zealand, a not-for-profit university, for educational purposes. The site is supported by Aristotle International, Inc., a U.S. provider of data processing and verification services. They operate under the terms of a No Action letter granted by the Commodity Futures Trading Commission (CFTC) in October, 2014. It is an experimental project operated for academic purposes. Despite there being a prohibition of online betting in the U.S.A., PredictIt secured a no-action letter from the Division of Market Oversight of the Commodity Futures Trading protecting them against action from the FTC (Federal Trading Commission)

Note:

Even though many states have legalized online gambling or betting prediction markets, it is still federally illegal.

Unlawful Internet Gambling Enforcement Act

This Act prohibits any person engaged in the business of betting, as defined, from knowingly accepting credit, electronic fund transfers, checks, or any other payment involving a financial institut

August 2022

The Commodity Futures Trading Commission, without clear explanation, revoked PredictIt’s permission to operate, ordering that it shut down by mid-February.

In response, Predictit has decided to post their original agreement on the front page of their website. You can download and read the full 6 page statement/PDF file here by the Commodity Futures Trading Commission of the no action letter granted to Predictit in 2014.

September 2022

Predictit remains confident they did not violate any terms of the no action protection letter. You can read their damage assessment, response to the community, And response on a plan going forward Here (This is subject to updates at any time)

The lawsuit

Predictit has launched a lawsuit against the Commodity Futures Trading Commission to block the shutdown order and more specifically to give a reason as to which term they violated.

The lawsuit was filed on Sept. 9 in U.S. Federal District Court for the Western District of Texas.

You can read/download the full copy of the lawsuit here in PDF format.

Relevant articles specifically relating to the lawsuit

Yahoo finance (they basically repost coindesks article but note they reached out for comment from the CFTC with no response)

(A)

Coindesk

(A)

Other relevant articles specifically to the decision of CFTC to drop Predictits no action letter

The Atlantic

(A)

Bloomberg

(A)

The New York Times

(A)

Washington Post

(A)

Gaming Today

(A)

Gambling News

(A)

Quartz

(A)

Slate

(A)

(Out of the articles that reached out for comment from Commodity Futures Trading Commission or CFTC, none have received any.)

edit: this is the CFTC's statement https://www.cftc.gov/PressRoom/PressReleases/8567-22

(A)

I've also decided to include the archives of Predictit's boa in New Zealand and their partner Aristotle.

10yr old Aristotle archive

Political technology, software, data and micro-targeting for campaign…

archived 20 Jul 2012 01:29:21 UTC

Current https://archive.ph/ETA3O

Last edited: