Here Are the Wildest Parts of the New FTX Bankruptcy Filing - Bloombe…

archived 17 Nov 2022 14:01:07 UTC

Lawyers for the bankrupt crypto exchange FTX filed today in Delaware, asking a federal judge to transfer a competing bankruptcy case filed in New York by Bahamian liquidators to the state.

The filing, led by new CEO and chief restructuring officer for FTX, John Ray, is quite something.

Here, for instance, is Ray blasting former FTX CEO Sam Bankman-Fried (our emphasis throughout):

FTX, once the world’s second biggest crypto-exchange, filed for Chapter 11 bankruptcy protection last week following a stunningly swift collapse that has sparked the unwinding of Bankman-Fried’s erstwhile crypto empire and an ongoing series of revelations about how it was run.I have over 40 years of legal and restructuring experience. I have been the Chief Restructuring Officer or Chief Executive Officer in several of the largest corporate failures in history. I have supervised situations involving allegations of criminal activity and malfeasance (Enron). I have supervised situations involving novel financial structures (Enron and Residential Capital) and cross-border asset recovery and maximization (Nortel and Overseas Shipholding). Nearly every situation in which I have been involved has been characterized by defects of some sort in internal controls, regulatory compliance, human resources and systems integrity. Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.

The first day bankruptcy filing paints a picture of a chaotically-run web of intertwined companies, including potentially serious lack of controls around spending both corporate and client money.

Here, for instance is a footnote which reveals a tangled web of lending at Alameda Research, including potentially to Bankman-Fried himself:

And here’s some color regarding spending controls within the crypto exchange FTX:

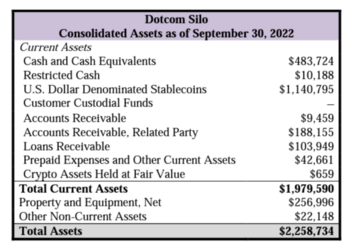

The crypto tokens held by FTX.com are being valued at just $659,000, compared to the billions Bankman-Fried was valuing them at according to a term sheet leaked last week. The filing splits FTX’s businesses into two major units, the Dotcom Silo (which includes FTX.com) and the Ventures Silo which includes various companies managing investments.The Debtors did not have the type of disbursement controls that I believe are appropriate for a business enterprise. For example, employees of the FTX Group submitted payment requests through an online ‘chat’ platform where a disparate group of supervisors approved disbursements by responding with personalized emojis. In the Bahamas, I understand that corporate funds of the FTX Group were used to purchase homes and other personal items for employees and advisors. I understand that t here does not appear to be documentation for certain of these transactions as loans, and that certain real estate was recorded in the personal name of these employees and advisors on the records of the Bahamas.

It seems FTX.com wasn’t including customer liabilities in its financial statements:

Cash management also seems to have left something to be desired:To my knowledge, the Dotcom Silo Debtors do not have any long-term or funded debt. The Dotcom Silo Debtors may have significant liabilities to customers through the FTX.com platform. However, such liabilities are not reflected in the financial statements prepared by these companies while they were under the control of Mr. Bankman-Fried. The chart below summarizes certain information regarding the Dotcom Silo’s consolidated liabilities as reflected in the September 30, 2022 balance sheet:

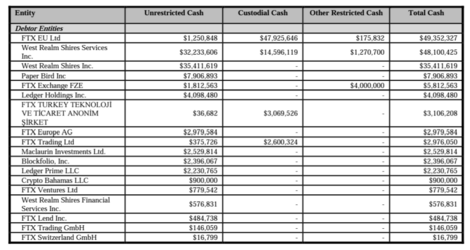

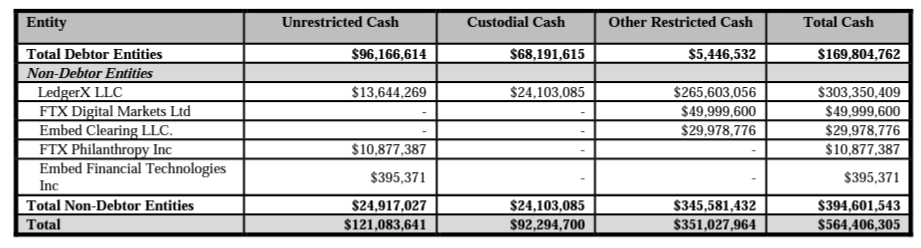

The FTX Group did not maintain centralized control of its cash. Cash management procedural failures included the absence of an accurate list of bank accounts and account signatories, as well as insufficient attention to the creditworthiness of banking partners around the world. Under my direction, the Debtors are establishing a centralized cash management system with proper controls and reporting mechanisms … Because of historical cash management failures, the Debtors do not yet know the exact amount of cash that the FTX Group held as of the Petition Date. The Debtors are working with Alvarez & Marsal to verify all cash positions. To date, it has been possible to approximate the following balances as of the Petition Date based on available books and records:

Regarding FTX’s auditors, Armanino LLP and Prager Metis:

Even putting together a list of FTX’s employees seems difficult:The FTX Group received audit opinions on consolidated financial statements for two of the Silos – the WRS Silo and the Dotcom Silo – for the period ended December 31, 2021. The audit firm for the WRS Silo, Armanino LLP, was a firm with which I am professionally familiar. The audit firm for the Dotcom Silo was Prager Metis, a firm with which I am not familiar and whose website indicates that they are the “first-ever CPA firm to officially open its Metaverse headquarters in the metaverse platform Decentraland. I have substantial concerns as to the information presented in these audited financial statements, especially with respect to the Dotcom Silo. As a practical matter, I do not believe it appropriate for stakeholders or the Court to rely on the audited financial statements as a reliable indication of the financial circumstances of these Silos.

The filing also seems to confirm some sort of backdoor relationship between Alameda and FTX:The FTX Group’s approach to human resources combined employees of various entities and outside contractors, with unclear records and lines of responsibility. At this time, the Debtors have been unable to prepare a complete list of who worked for the FTX Group as of the Petition Date, or the terms of their employment. Repeated attempts to locate certain presumed employees to confirm their status have been unsuccessful to date.

And here’s a bit about unauthorized minting of FTX’s native token, FTT, after the bankruptcy petition:The FTX Group did not keep appropriate books and records, or security controls, with respect to its digital assets. Mr. BankmanFried and Mr. Wang controlled access to digital assets of the main businesses in the FTX Group (with the exception of LedgerX, regulated by the CFTC, and certain other regulated and/or licensed subsidiaries). Unacceptable management practices included the use of an unsecured group email account as the root user to access confidential private keys and critically sensitive data for the FTX Group companies around the world, the absence of daily reconciliation of positions on the blockchain, the use of software to conceal the misuse of customer funds, the secret exemption of Alameda from certain aspects of FTX.com’s auto-liquidation protocol, and the absence of independent governance as between Alameda (owned 90% by Mr. Bankman Silo (in which third parties had invested)

FTX says that Bankman-Fried was using auto-deleting messages to communicate major decisions:The Debtors have located and secured only a fraction of the digital assets of the FTX Group that they hope to recover in these Chapter 11 Cases. The Debtors have secured in new cold wallets approximately $740 million of cryptocurrency that the Debtors believe is attributable to either the WRS, Alameda and/or Dotcom Silos. The Debtors have not yet been able to determine how much of this cryptocurrency is allocable to each Silo, or even if such an allocation can be determined. These balances exclude cryptocurrency not currently under the Debtors’ control as a result of (a) at least $372 million of unauthorized transfers initiated on the Petition Date, during which time the Debtors immediately began moving cryptocurrency in to cold storage to mitigate the risk to the remaining cryptocurrency that was accessible at the time, (b) the dilutive ‘minting’ of approximately $300 million in FTT tokens by an unauthorized source after the Petition Date and (c) the failure of the cofounders and potentially others to identify additional wallets believed to contain Debtor assets.

And here are the new FTX CEO’s thoughts on the old FTX CEO’s recent tweeting:One of the most pervasive failures of the FTX.com business in particular is the absence of lasting records of decision 4892--making. Mr. Bankman--Fried often communicated by using applications that were set to employees to do the same.

Still to come, according to the liquidators’, are balance sheets and other financial statements for the Alameda Silo.Finally, and critically, the Debtors have made clear to employees and the public that Mr. Bankman-Fried is not employed by the Debtors and does not speak for them. Mr. Bankman-Fried, currently in the Bahamas, continues to make erratic and misleading public statements. Mr. Bankman-Fried, whose connections and financial holdings in the Bahamas remain unclear to me, recently stated to a reporter on Twitter: “F*** regulators they make everything worse” and suggested the next step for him was to “win a jurisdictional battle vs. Delaware”.

But in the meantime, you can read the whole filing over here.

And look who this oxygen thief schmoozes with: