Ammunition supply chain crisis: Ukraine war tests Europe in race to rearm

Manufacturers struggle to replenish national weapons stockpiles and meet demand from Kyiv

Ukraine’s battle against Russia is consuming ammunition at unprecedented rates, with the country firing more than 5,000 artillery rounds every day — equal to a smaller European country’s orders in an entire year in peacetime.

The huge shift to a war footing is creating a supply chain crisis in Europe as defence manufacturers struggle to ramp up production to replenish national stockpiles as well as maintain supplies to Ukraine.

Almost a year since Russia’s invasion, the pace of demand for ammunition and explosives is turning into a test of Europe’s industrial production capacity in a race to rearm.

“It is a war about industrial capacity,” said Morten Brandtzæg, chief executive of Norway’s Nammo, which makes ammunition and shoulder-fired weapons.

He estimates Ukraine has been firing an estimated 5,000 to 6,000 artillery rounds a day, which he said is similar to the annual orders of a smaller European state before the

war.

The pressure on producers has not been helped by lingering

supply chain bottlenecks following the coronavirus pandemic, a lack of production capacity and a shortage of critical raw materials for some explosives, which is holding back efforts to increase output.

Some components are in such high demand, Brandtzæg said, that their delivery time had increased from months to years.

It has led to a rush to source materials, from chemicals for explosives to metals and plastics for fuses and artillery shell casings. Most companies have increased production shifts ahead of expected orders from national governments, and are hiring more people, another challenge since the start of the pandemic.

Yves Traissac, deputy chief executive at military explosives producer Eurenco, said the company was looking to increase production capacity to meet the higher demand from customers that include Germany’s Rheinmetall and Britain’s BAE Systems.

“We are currently managing a ramp-up to meet our customer demand. It is a challenge but we are working on that,” he said.

One particular challenge is sourcing nitric acid, which the company uses in small quantities to make explosives but which is also a key ingredient in the manufacture of fertiliser. With parts of Europe’s fertiliser production reduced because of the

high cost of energy, the supply of nitric acid “has to be secured with our suppliers”, said Traissac. Eurenco, he added, was working to “have additional sources of critical raw materials”.

Rheinmetall, Germany’s largest defence contractor, announced last month that it would build a new explosives factory in Hungary in a joint venture with the government to address the shortage.

The explosives produced in the new plant will be used for artillery, tank, and mortar ammunition, among other things. The company has also restarted decommissioned ammunition production facilities, it told the Financial Times, and has “bought in large stocks of important materials”.

Mick Ord, chief executive of Britain’s Chemring, which supplies a range of explosives and propellants to defence contractors, said some customers had asked if it was possible to “increase output [of certain materials] by 100 to 200 per cent”.

According to Ord, a “lot of the post-pandemic supply chain challenges are starting to abate”.

The “bigger challenge is that our capacity has been sized to what our customer demand was and the industry has been run very broadly on that basis, where capacity meets demand”, he added.

Increasing output significantly took time and investment in new plants, he said. “These are pretty capital-intensive projects, which take a few years to build, commission and bring online. It’s not the kind of supply chain where you can just flick a switch.”

UK-based Denroy, which makes shell casings and other components for a range of defence companies, has benefited from pre-ordering certain materials such as polymers and composites.

The challenge, said chief executive Kevin McNamee, was “not so much our capacity but the lead times of some of the materials are very long — it can be a six-month lead time on some specialised materials”.

“Companies might do a batch once or twice a year, so if you miss that batch, you have to wait.”

The crisis has prompted companies to work more closely with their suppliers and also with those further down the chain. Several industry executives said they were spending more time making sure on a daily basis that individual suppliers were able to deliver.

The huge demand for investment is also prompting calls for a change in the way procurement is handled by governments, with executives saying they need longer-term contracts.

Nammo, which is co-owned by the governments of Norway and Finland, usually receives annual contracts from state customers. The company started to invest in its facilities early last year and has been able to meet the demand from its customers. Nevertheless, Brandtzæg said the scale of the investments was such that it put a “huge strain on the financials of an otherwise healthy defence company”.

The investments for the company were “more than three times higher in 2022 than in the year before”. The defence industry needed longer, multiyear contracts, he added, “so that they can carry those massive investments”.

In the UK, BAE Systems has been in talks with the Ministry of Defence about ramping up the production of several munitions for months. The company is the main supplier for the British Armed Forces and in January began a new 15-year supply contract, but it is still waiting for a formal agreement to cover the additional output required by Ukraine.

Lee Smurthwaite, programme director for munitions at BAE, said the company had already increased the number of shifts at its plants, in addition to hiring temporary workers, both to meet the demands of the new contract as well as in anticipation of more work. The company’s three main munition plants typically run two to three shifts over 24 hours a day, five days a week.

The rush to rearm and the prospect of the war lasting for some time has prompted debate about the need to pool purchasing across the EU, despite its separate industrial bases.

Countries are also looking at collaboration further afield, with France late last month announcing that it would work with Australia to jointly produce and send several thousand 155mm artillery shells to Ukraine. The production of the shells will be led by France’s Nexter.

“You will never end up with just one propellant plant in Europe but if ever there was a time to say, we should be co-operating on munitions, it is now,” said Francis Tusa, editor of Defence Analysis, pointing to a recent speech by French president Emmanuel Macron where he revealed that the number of shells manufactured in France each year corresponded to a week of shelling sent by Russia into Ukraine.

There could be merit in an agreement on common purchasing of weapons such as ammunition or explosives, he added.

Work on this is under way. The European Defence Agency, set up in 2004, is part of an EU effort launched late last year to explore with industry how member states can co-ordinate the procurement of some critical equipment, including ammunition.

“It was clear that for a number of capacities, there was an urgent need,” said Pieter Taal, head of the EDA’s industry, strategy and European policies unit.

Progress, however, will take time, he admitted, adding that “between member states, it always takes a lot of talking back and forth”.

Trevor Taylor, of the Royal United Services Institute, said: “Scale matters in defence production and the functional case for Europeans (including the British) working together is very clear.”

But he warned: “The political hurdles to such co-operation are significant: settling who would pay for what would be challenging.”

archived 9 Feb 2023 09:20:39 UTC

archive.md

Iran’s ‘ghost fleet’ switches into Russian oil

Sanctions-busting vessels make sudden shift after introduction of oil price cap and other restrictions

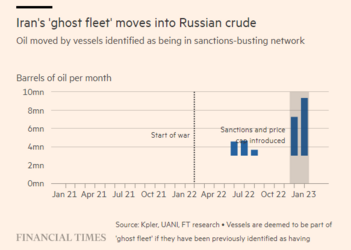

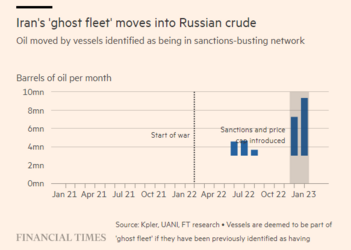

Tankers in Iran’s “ghost fleet” have switched to carrying Russian oil since western curbs on Moscow intensified in December, as the Kremlin turned to sanctions-busting techniques pioneered by Tehran.

At least 16 vessels that formed part of the “ghost” network that allowed Iran to breach US sanctions have begun to ship Russian crude

oil over the past two months, according to Financial Times research.

Before the surge, just nine vessels had switched on to the Russian route during the nine months since the start of the

war in February 2022.

Ship brokers and analysts said that Russia was enticing tanker owners and operators with premium rates, as it seeks to shield its main source of export revenues from western measures such as the G7/EU oil price cap. Estimated Russian oil export revenue is

markedly down on its prewar levels.

“We’ve seen a number of vessels involved in Russian trade that previously did Iranian barrels,” said Svetlana Lobaciova, a tanker analyst at shipbrokers EA Gibson in London.

“The premium for Russian trade is at least 50 per cent above the normal market rates and could be even more than 100 per cent in some instances, making the economics even more attractive than shipping Iranian oil.”

Iran has been able to maintain or even increase its crude exports in recent months. Tehran, which co-operates on oil policy with Moscow through the Opec+ group, has emerged as a key backer for Russian President Vladimir Putin’s invasion of Ukraine.

Competition for vessels is a possible source of tension in the relationship. However, Matthew Wright, an analyst at Kpler, a data and analytics company, said: “an increase in the number of ships in the ghost fleets owned through secretive offshore entities, which enables sanctions evasion, appears to have helped avoid much of a problem with sourcing vessels.”

The FT identified vessels involved in the Iranian ghost fleet using a list of 288 ships subject to sanctions-breaching complaints to marine registries and insurance companies by United Against Nuclear Iran, a US-based group that campaigns for tough enforcement of sanctions.

The FT checked the methods used by UANI for identifying ghost fleet members by reviewing a sample of its analyses, which are based on ship movement data and satellite photography. The FT also checked the findings on specific ships were consistent with those of other organisations. Data from Kpler was then used to monitor these vessels’ recent cargoes.

Strains in tanker markets are expected to be exacerbated in the coming weeks. EU sanctions and the G7 price cap were both extended to Russia’s exports of refined fuels like diesel and petrol on Sunday.

Russia has already had to reroute a lot of its crude to Asia after a ban on seaborne imports of Russian crude to the EU took effect on December 5. It will probably need to ship diesel and other fuels longer distances now a similar ban is in place.

Western sanctions targeting Russia are less onerous than US sanctions targeting Iran. The G7 price cap is also partly designed to limit revenues to the Kremlin while keeping enough Russian barrels in the market to avoid shortages.

Shipbrokers said terms made the Russian trade more attractive than dealing with Iran or other heavily sanctioned countries such as Venezuela. Ship owners and operators are less likely to fall foul of the measures if they can show they were told the Russian fuel was sold under the cap.

FT analysis suggests that the volumes of Russian crude being shipped on vessels identified as being part of the “ghost fleet” have surged from less than 3mn barrels in November to more than 9mn barrels in January.

One shipbroker said that while a handful of large tanker operators were still shunning Russian oil trade, such as western oil majors and US ship operators, many others were willing to take part given the rates on offer and leeway in the rules.

“Everyone is a sinner now,” the shipbroker said. “The line between the grey market and the conventional tanker market has definitely gotten blurrier in the past year.”

Some of the ships now serving the Russian route are vessels previously identified as likely to be part of Moscow’s own shadow fleet, a covertly controlled operation assembled over the past year. Shipbrokers have estimated that it consists of around 100 vessels.

Claire Jungman, chief of staff at UANI, said: “The ownership behind [ghost fleet] . . . vessels is often very opaque and disguised through numerous front companies that are constantly changing to avoid sanctions”.

Russian oil is still travelling in tankers operating with western insurance. Such insurance is only available on the condition the oil was bought for less than the price cap. The price for Russia’s main export-grade Urals has fallen to a discount of $30-$40 a barrel below benchmark international crudes such as Brent.

Russian barrels from the Baltic and Black Sea have fallen to a large discount partly to cover the cost of shipping and as refiners in India and Turkey negotiate lower prices for crude that once flowed to the EU.

Lobaciova at EA Gibson said Russian oil deliveries have proved more lucrative because they do not face significant delays, unlike Iranian cargoes that often spend more time at sea to mask their origin. Refiners in countries such as China, which has remained a big buyer of Iranian oil, have also left tankers of Iranian oil waiting to unload.

“We have at times seen Iranian tankers waiting for months — as best as we can tell that hasn’t happened to Russian tankers, which is better for operators especially when rates for Russian routes are so high,” she said.

archived 7 Feb 2023 06:13:55 UTC

archive.ph

Military briefing: what the west’s shifting red lines mean for Ukraine

Allies wary of risk of Russian escalation even as arms decisions reflect Kyiv’s changing battlefield requirements

Kyiv’s allies have repeatedly crossed their red lines on weapons deliveries. But nearly a year into the full-scale invasion of Ukraine, concerns in the US and Europe about Russian escalation have not changed substantially and still hang over the next decisions, including whether to send fighter jets.

The

US and its partners have committed many of the systems once considered off limits, most recently tanks as well as Himar guided missiles and Patriot missile defence units, among other systems.

There is growing consensus among western officials that time is now on Russia’s side and Ukraine has a narrow window to launch a

counteroffensive in the spring, prompting allies to come together quickly to send heavier kit such as tanks, infantry fighting vehicles and longer-range weapons.

Further evidence of the change in thinking came last week, when the US announced it is sending smart bombs known as Ground-Launched Small Diameter Bombs or GLSDBs, the longest-range bombs it has provided to Kyiv.

The constant crossing of self-imposed boundaries reflects Ukraine’s changing battlefield requirements rather than a shift in allies’ assessments of the escalatory threat, according to western officials and analysts.

“The course of the war has been more fundamental in determining Russia’s escalation risk,” said Samuel Charap, a senior political scientist at the Rand Corporation. “We’ve seen when concerns about escalation have been most acute, they have been at moments of extreme vulnerability for the Russians rather than a function of new weapons.”

For their part, US officials say they are constantly re-evaluating support for Ukraine. Missile strikes against critical infrastructure in recent months convinced US and allied officials that it was necessary to send more sophisticated air defence systems, for example.

“The war remains fluid and dynamic, so the nature of our support will continue to adapt as conditions evolve to give Ukraine the training, equipment and capabilities they require to be effective on the battlefield,” said Pentagon deputy press secretary Sabrina Singh.

Washington’s constant redefinition of which weapons systems would escalate the conflict serves a purpose, some analysts said.

“The administration and European allies believe this approach of incrementalism has been a really effective way to tamp down the risk of escalation and to prevent a direct US-Russia military confrontation,” said Andrea Kendall-Taylor, director of transatlantic security at Washington think-tank Center for New American Security. “In many ways it’s like the frog in a boiling pot of water.”

However, the shifting red lines do not guarantee that the next big-ticket item sought

by Ukraine, F-16 fighter jets, is within reach. US President Joe Biden, asked last week if the US would provide them, simply responded “No”.

While American officials have conceded that they may eventually send fighter jets or permit allies to do so, for now US officials say they are too expensive, not easily available and will take significant time to train Ukrainians to fly.

They could also risk drawing Nato into the conflict, with one US official saying F-16s have “the potential to be provocative because of their range and capability”.

The official added: “Russia’s narrative is that this is a war with the United States. That’s not true and we don’t want to feed into that by giving them things to point at like F-16s that could be used in Russia.”

Ukrainian officials — together with their hawkish allies in eastern Europe — say Russia’s threats, including clear references to use of nuclear weapons, are scare tactics intended to deter Kyiv’s allies from providing advanced weaponry.

But in a sign that Ukraine sees US concerns over escalation as a serious impediment to supplies of longer-range armaments,

outgoing defence minister Oleksiy Reznikov took the unusual step this week of promising not to use western-supplied weapons to hit Russian territory.

Concerns over escalation peaked in September following the collapse of Russia’s defensive lines in Kharkiv province. President Vladimir Putin ordered the mobilisation of 300,000 men and warned the west of a possible nuclear response, saying “if its territorial integrity is threatened Russia will use all the means at its disposal”.

Russia has since dialled down the threats. Putin last week appeared to hint again at the possible use of nuclear weapons in reaction to the pledge of Germany and other countries to send western tanks to Ukraine, saying “we have ways of responding, and it won’t be limited to using armoured vehicles”. But it was a less explicit reference.

Western officials and analysts have offered multiple reasons for the shift in tone, including

concern in China about Russian nuclear brinkmanship. One senior western diplomat said it was the effect of a co-ordinated US-British-French warning to Moscow that any resort to nuclear weapons would have “catastrophic consequences”.

Some experts say the Kremlin’s nuclear sabre-rattling was directed at a domestic audience, to galvanise Russians behind mobilisation. US officials did not detect any threatening change in Russia’s nuclear posture during the fiery rhetoric last year. But they still take the risk seriously and constantly monitor for any sign that Russia may move towards firing a nuclear weapon.

In a report published last month by the Rand Corporation think-tank, Charap and Miranda Priebe argued there were several reasons to think Russian nuclear use was still possible, not least because Putin regards the war to be “near-existential”.

“The Biden administration has ample reason to make the prevention of Russian use of nuclear weapons a paramount priority for the US,” they wrote.

Jack Reed, Democratic chair of the US Senate’s armed services committee, said the collapse of the Russian army, Ukrainian advances on the annexed peninsula of Crimea or attacks on Russia would all prompt heightened nuclear risks.

“If the Ukrainians . . . are entering Crimea, that’s an area where the discussion would heat up tremendously within the Kremlin.”

“Red lines are an interesting issue, but the lines are never quite that bright or obvious,” he added. “I wish it was almost like arithmetic, like add one plus one, you get two. [But] it’s not that easy.”

archived 8 Feb 2023 12:54:21 UTC

archive.ph

EU leaders cautious about Zelenskyy’s ‘wings for freedom’ plea

Ukraine’s Nato allies must avoid direct confrontation with Russia, Dutch prime minister Mark Rutte warns

EU leaders meeting Ukrainian President Volodymyr Zelenskyy at a summit in Brussels struck a cautious note on the prospect of sending the western fighter jets Kyiv says it needs to defend itself against Russian aggression.

Speaking on his way into the first in-person summit with Zelenskyy in Brussels, Dutch prime minister Mark Rutte said that Ukraine’s allies needed to ensure they are not getting themselves into a direct confrontation with Russia.

“You have to make absolutely sure you are not getting into an Article 5 direct confrontation between Nato and Russia,” he said, in a reference to the collective defence provision of the Nato treaty. Rutte said the pros and cons of such decisions should only be discussed behind closed doors, given the sensitivity of the topic.

In a speech to the European parliament earlier on Thursday, Zelenskyy said that a victory for his country in its war with Russia would guarantee the safety of Europe as a whole.

Ukraine’s president did not mention jets in his speech, but in recent days he has been stepping up his calls for allies to rapidly supply the arms his forces need to prepare for a renewed Russian offensive. During a visit to London on Wednesday, Zelenskyy called for “wings for freedom” and the UK government said afterwards it was looking at what jets it might be able to give Ukraine, but only as a “medium- to long-term” solution.

However Nato allies are striking a cautious note about the idea, which officials expect to be discussed at the EU summit.

French president Emmanuel Macron said he had not discussed fighter jets with Zelenskyy during their meeting in Paris on Wednesday evening, adding that he would not “share the Ukrainian plan” publicly.

Polish prime minister Mateusz Morawiecki stressed that his country could only act “as part of a Nato formation”. He added: “If such a decision is made, we will not be the first to transfer fighters, but we will certainly respond positively to it, provided that those who have the most of these fighters . . . transfer them to Ukraine.”

The Kremlin said discussions over supplying Ukraine with fighter jets showed western countries were drawing closer to fighting a direct war against Russia. “We see this as the UK, France and Germany’s growing involvement in the conflict between Russia and Ukraine. The line between indirect and direct involvement is gradually disappearing,” Dmitry Peskov, president Vladimir Putin’s spokesman, told reporters.

In his speech in the EU parliament, Zelenskyy praised the bloc for purging itself of the “corrupt” influence of Russian oligarchs and its “ruinous” dependence on Russian fossil fuels.

“We are defending against the most anti-European force in the modern world; we Ukrainians are on the battlefield with you,” he said.

He addressed much of his speech to European citizens, thanking them for their support for Ukraine and receiving several standing ovations. “I would like to thank all of you in Europe in hundreds of towns and villages who supported Ukraine in this historic battle,” he said.

Zelenskyy is also seeking continued support for his country’s EU membership bid. The decision to grant Ukraine candidate status had “kept us motivated to stay the course”, he said. He expressed confidence that “Ukraine is going to be a member of a European Union that is winning.”

Additional reporting by Max Seddon in Riga

archived 9 Feb 2023 12:22:09 UTC

archive.ph

SpaceX curbed Ukraine's use of Starlink internet for drones -company president

SpaceX has taken steps to prevent Ukraine's military from using the company's Starlink satellite internet service for controlling drones in the region during the country's war with Russia, SpaceX's president said Wednesday.

SpaceX's Starlink satellite internet service, which has provided Ukraine's military with broadband communications in its defense against Russia's military, was "never never meant to be weaponized," Gwynne Shotwell, SpaceX's president and chief operating officer, said during a conference in Washington, D.C.

"However, Ukrainians have leveraged it in ways that were unintentional and not part of any agreement," she said.

Speaking later with reporters, Shotwell referred to reports that the Ukrainian military had used the Starlink service to control drones.

Ukraine has made effective use of unmanned aircraft for spotting enemy positions, targeting long-range fires and dropping bombs.

"There are things that we can do to limit their ability to do that," she said, referring to Starlink's use with drones. "There are things that we can do, and have done."

Shotwell declined to say what measures SpaceX had taken.

Using Starlink with drones went beyond the scope of an agreement SpaceX has with the Ukrainian government, Shotwell said, adding the contract was intended for humanitarian purposes such as providing broadband internet to hospitals, banks and families affected by Russia's invasion.

"We know the military is using them for comms, and that's ok," she said. "But our intent was never to have them use it for offensive purposes."

SpaceX has privately shipped truckloads of Starlink terminals to Ukraine, allowing the country's military to communicate by plugging them in and connecting them with the nearly 4,000 satellites SpaceX has launched into low-Earth orbit so far.

Governments including the United States and France have paid for other shipments of Starlink terminals on top of those funded privately by SpaceX.

Russia has attempted to jam Starlink signals in the region, though SpaceX countered by hardening the service's software, Elon Musk, the company's chief executive, has said.

Asked if SpaceX had anticipated Starlink's use for offensive purposes in Ukraine when deciding to ship terminals into conflict zones, Shotwell said: "We didn't think about it. I didn't think about it. Our starlink team may have, I don't know. But we learned pretty quickly."

Starlink had suffered services outages in Ukraine late last year, for reasons SpaceX did not explain.

Asked if those outages were related to SpaceX’s efforts to curb offensive use of Starlink, Shotwell said: “I don’t want to answer it because I’m not sure I know the answer.”