attractive_pneumonia

kiwifarms.net

- Joined

- Jun 27, 2019

This isn't the 1950s where you have to bring a suitcase of literal currency around, its just digits on a computer that are handled on the FOREX markets by the literal billions a day. The European markets were just a basket of currency until the Euro and they got along mostly fine, its only when they kept trying to peg the currency to each other that shit shows started occurring like the 1990s British Pound fuckery in the ERM that Soros got rich off of. The US Dollar is only the reserve currency because of inertia and convenience, however the convenience has become a threat and no major player will want to subject themselves to the arbitrary decisions of the US oligarchs. Nearly every important nation and important global institution like OPEC has become exceptionally frosty to the US since Biden got into office and I don't see this trend changing.People have been predicting the collapse of the US dollar at year X for decades now. What is never even asked (let alone answered) is what exactly is going to replace the dollar as the global reserve currency. A lack of a global reserve currency is going to severely complicate global finance and trade, and states like Russia, China, India, and Latin America have money that is even less valuable or stable than the US dollar. The US dollar is beloved by global financial institutions because of its convenience to hold, as opposed to the often (even more) obscurantist financial bullshit done by Russia, China, India, or Latin America. The destruction of the US dollar would require an entirely new global economic and financial system, such as how it replaced the UK pound sterling because of World War II and the subsequent economic restructuring of the world, and that simply hasn't happened yet.

I'll believe that global "de-dollarization" is happening when world banks (or big corporations) start trading primarily in yuans or rubles instead of dollars. Otherwise, America has at least a full generation to dither and "experiment" with the US dollar.

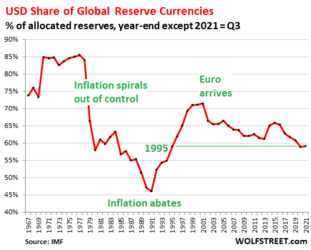

Furthermore dominance of the US Dollar as a global reserve currency has been trending downward for over a decade.

Last edited: