Link (Archive)

Backed by its Chinese parent, the discount marketplace has been on a shopping spree for ad space, driving up digital advertising costs by outbidding rivals that range from decades-old bricks-and-mortar shops to specialty e-commerce platforms.

That is good news for Meta Platforms and Google, which are seeing revenue growth from ad juggernauts Temu and its Singapore-based fast-fashion rival Shein. It is a wrecking ball for some U.S. retailers, threatening online marketplace Etsy and dollar stores by driving up ad prices and luring away shoppers. Lately, Temu has been building enough consumer momentum to gain ground on behemoths such as Amazon.com.

Temu’s marketing bill reached $1.7 billion in 2023 and the figure will grow to nearly $3 billion in 2024, JPMorgan analysts estimate. Last year, Temu’s marketing spending contributed to an average loss of $7 an order, according to Goldman Sachs estimates.

A Temu spokesperson said the idea it sells at a loss to gain market share isn’t accurate, declining to give details.

Temu was the fifth-largest advertiser in the U.S. by digital-ad spending in the fourth quarter of 2023, a significant leap from placing 67th during the same period in 2022, according to research firm Sensor Tower. Shein also jumped the ranks, coming in 17th in the fourth quarter. Amazon, the world’s largest e-commerce company, was the top spender.

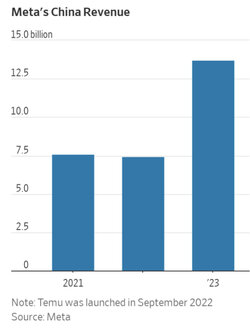

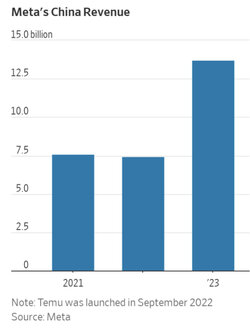

In late September, the price of an advertisement to reach every 1,000 people on one webpage on Meta increased 24% from a year earlier, according to Gupta Media, an online advertising price tracker. Meta said earlier this month that China-based advertisers contributed to 10% of its 2023 sales, or about $13.7 billion, almost doubling its 2022 revenue from China. It didn’t specify the advertisers.

“I think every major retailer will be spending more to acquire the same shoppers this year,” said Juozas Kaziukėnas, founder and chief executive of Marketplace Pulse, a business-intelligence firm.

Etsy, the Brooklyn-based online marketplace operator, said in December it would cut 11% of its workforce as part of a cost-saving restructuring. Chief Executive Josh Silverman said late last year that Temu and Shein were “almost single-handedly having an impact on the cost of advertising.”

Analysts say Temu is disrupting U.S. e-commerce with tried-and-true competition tactics used by Chinese companies, which involve earning razor-thin profits or losing money in exchange for market share.

The costly battle over ad space is “such as a game of chicken,” said Michael Morton, an analyst at MoffettNathanson.

Many Chinese companies are also savvy about using digital-advertisement placement strategy to their advantage, said Luke Fan, former chief investment director at Cheetah Mobile, one of the first Chinese mobile internet companies to expand overseas. “When I bid the top ad space, you’d have to pay more for the same spot. This is how you kill your rivals.”

Temu, which launched in September 2022, has deep pockets thanks to parent PDD Holdings PDD 0.65%increase; green up pointing triangle. Its growth strategy is reminiscent of the one PDD used in China to rival Alibaba—luring shoppers with rock-bottom prices and extraordinary subsidies.

After carving out its market share, PDD turned profitable as it scaled back on customer acquisition, generated more advertisement fees from merchants and moved into higher-margin categories.

Some analysts are skeptical. If Temu can’t find a way to generate recurring revenue, the substantial subsidies could hurt PDD’s profitability, said Ivy Yang, founder of Wavelet Strategy, a China tech consulting firm.

Temu also faces geopolitical tensions and regulatory risks. Changes in U.S. tariffs and tax policy on imports may hinder its prospects. The sheer volume of low-cost goods it sells overseas could trigger antidumping investigations in the U.S. and the European Union, Yang added.

The Temu spokesperson said the company “competes fairly” in a free market and complies with laws in markets where it operates.

Six months after entering the U.S. market, Temu’s aggressive advertising spending propelled its active monthly users to exceed Shein’s, which took years to build.

Temu is now the second-most popular shopping app in the U.S. as measured by monthly users, behind Amazon. Its U.S. mobile app monthly active users jumped 950% year-over-year in the last three months of 2023, when its digital ad expenses increased more than three times, according to Sensor Tower.

There are signs that Temu’s voracious ad buying is taking shoppers from other retailers. A study of more than a half million Dollar General shoppers found that their spending at Temu rose to 10% of their total spending in December, up from 1% a year ago, according to market-research firm Earnest Analytics. During the same period, shares of their spending at Dollar General and Dollar Tree both declined, the study showed.

Temu’s Chinese sister platform Pinduoduo spent more on marketing than the sales it brought in after launching in 2015 to take on legacy e-commerce giants Alibaba and JD.com.

It first attracted buyers with low-cost toilet rolls and unbranded socks and now sells big-ticket items including iPhones and home appliances.

It took Amazon nine years after its founding to get into the black. For PDD, it took six years.

“Temu’s really playing a long game here,” said Insider Intelligence analyst Sky Canaves.

Temu’s contribution to PDD’s operating profit will swing from a $3 billion loss in 2023 to $3.5 billion in income by 2027, analysts from JPMorgan have estimated. PDD doesn’t break out financials for Temu.

Amazon remains out front with American shoppers with its sheer breadth of product offerings and speedy delivery made possible by Prime membership, analysts say.

In December, Amazon said it would reduce fees it charges sellers for apparel items under $20, a move some analysts read as its response to the rise of Shein and Temu. An Amazon spokeswoman said the company reduced the fees to help offer a wider selection of goods with competitive prices for consumers. She said healthy competition is good for consumers and businesses.

Temu recently announced plans to open its marketplace to U.S. and European sellers. Analysts say Temu’s first target could be Amazon’s Chinese sellers with inventory in the U.S., though attracting major U.S. brands might be challenging.

Temu hasn’t yet made a dent on Amazon, analysts say. But as it grows, “it is a threat Amazon needs to watch,” said Neil Saunders, a retail analyst at research firm GlobalData.

The Spend, Spend, Spend Strategy Behind Temu’s Rapid Ascent in America

Temu’s rise as one of America’s most popular places to shop is powered by its ultracheap goods and billions of dollars of advertising, including in this Sunday’s Super Bowl.Backed by its Chinese parent, the discount marketplace has been on a shopping spree for ad space, driving up digital advertising costs by outbidding rivals that range from decades-old bricks-and-mortar shops to specialty e-commerce platforms.

That is good news for Meta Platforms and Google, which are seeing revenue growth from ad juggernauts Temu and its Singapore-based fast-fashion rival Shein. It is a wrecking ball for some U.S. retailers, threatening online marketplace Etsy and dollar stores by driving up ad prices and luring away shoppers. Lately, Temu has been building enough consumer momentum to gain ground on behemoths such as Amazon.com.

Temu’s marketing bill reached $1.7 billion in 2023 and the figure will grow to nearly $3 billion in 2024, JPMorgan analysts estimate. Last year, Temu’s marketing spending contributed to an average loss of $7 an order, according to Goldman Sachs estimates.

A Temu spokesperson said the idea it sells at a loss to gain market share isn’t accurate, declining to give details.

Temu was the fifth-largest advertiser in the U.S. by digital-ad spending in the fourth quarter of 2023, a significant leap from placing 67th during the same period in 2022, according to research firm Sensor Tower. Shein also jumped the ranks, coming in 17th in the fourth quarter. Amazon, the world’s largest e-commerce company, was the top spender.

In late September, the price of an advertisement to reach every 1,000 people on one webpage on Meta increased 24% from a year earlier, according to Gupta Media, an online advertising price tracker. Meta said earlier this month that China-based advertisers contributed to 10% of its 2023 sales, or about $13.7 billion, almost doubling its 2022 revenue from China. It didn’t specify the advertisers.

“I think every major retailer will be spending more to acquire the same shoppers this year,” said Juozas Kaziukėnas, founder and chief executive of Marketplace Pulse, a business-intelligence firm.

Etsy, the Brooklyn-based online marketplace operator, said in December it would cut 11% of its workforce as part of a cost-saving restructuring. Chief Executive Josh Silverman said late last year that Temu and Shein were “almost single-handedly having an impact on the cost of advertising.”

Analysts say Temu is disrupting U.S. e-commerce with tried-and-true competition tactics used by Chinese companies, which involve earning razor-thin profits or losing money in exchange for market share.

The costly battle over ad space is “such as a game of chicken,” said Michael Morton, an analyst at MoffettNathanson.

Many Chinese companies are also savvy about using digital-advertisement placement strategy to their advantage, said Luke Fan, former chief investment director at Cheetah Mobile, one of the first Chinese mobile internet companies to expand overseas. “When I bid the top ad space, you’d have to pay more for the same spot. This is how you kill your rivals.”

Temu, which launched in September 2022, has deep pockets thanks to parent PDD Holdings PDD 0.65%increase; green up pointing triangle. Its growth strategy is reminiscent of the one PDD used in China to rival Alibaba—luring shoppers with rock-bottom prices and extraordinary subsidies.

After carving out its market share, PDD turned profitable as it scaled back on customer acquisition, generated more advertisement fees from merchants and moved into higher-margin categories.

Some analysts are skeptical. If Temu can’t find a way to generate recurring revenue, the substantial subsidies could hurt PDD’s profitability, said Ivy Yang, founder of Wavelet Strategy, a China tech consulting firm.

Temu also faces geopolitical tensions and regulatory risks. Changes in U.S. tariffs and tax policy on imports may hinder its prospects. The sheer volume of low-cost goods it sells overseas could trigger antidumping investigations in the U.S. and the European Union, Yang added.

The Temu spokesperson said the company “competes fairly” in a free market and complies with laws in markets where it operates.

Six months after entering the U.S. market, Temu’s aggressive advertising spending propelled its active monthly users to exceed Shein’s, which took years to build.

Temu is now the second-most popular shopping app in the U.S. as measured by monthly users, behind Amazon. Its U.S. mobile app monthly active users jumped 950% year-over-year in the last three months of 2023, when its digital ad expenses increased more than three times, according to Sensor Tower.

There are signs that Temu’s voracious ad buying is taking shoppers from other retailers. A study of more than a half million Dollar General shoppers found that their spending at Temu rose to 10% of their total spending in December, up from 1% a year ago, according to market-research firm Earnest Analytics. During the same period, shares of their spending at Dollar General and Dollar Tree both declined, the study showed.

Temu’s Chinese sister platform Pinduoduo spent more on marketing than the sales it brought in after launching in 2015 to take on legacy e-commerce giants Alibaba and JD.com.

It first attracted buyers with low-cost toilet rolls and unbranded socks and now sells big-ticket items including iPhones and home appliances.

It took Amazon nine years after its founding to get into the black. For PDD, it took six years.

“Temu’s really playing a long game here,” said Insider Intelligence analyst Sky Canaves.

Temu’s contribution to PDD’s operating profit will swing from a $3 billion loss in 2023 to $3.5 billion in income by 2027, analysts from JPMorgan have estimated. PDD doesn’t break out financials for Temu.

Amazon remains out front with American shoppers with its sheer breadth of product offerings and speedy delivery made possible by Prime membership, analysts say.

In December, Amazon said it would reduce fees it charges sellers for apparel items under $20, a move some analysts read as its response to the rise of Shein and Temu. An Amazon spokeswoman said the company reduced the fees to help offer a wider selection of goods with competitive prices for consumers. She said healthy competition is good for consumers and businesses.

Temu recently announced plans to open its marketplace to U.S. and European sellers. Analysts say Temu’s first target could be Amazon’s Chinese sellers with inventory in the U.S., though attracting major U.S. brands might be challenging.

Temu hasn’t yet made a dent on Amazon, analysts say. But as it grows, “it is a threat Amazon needs to watch,” said Neil Saunders, a retail analyst at research firm GlobalData.