By Melanie Evans

May 9, 2024 5:30 am ET

ILLUSTRATION: JOHNNY SIMON/WSJ, ISTOCK

Heather Miconi has seven weeks to come up with $2,000 to pay for surgery her daughter needs to breathe more easily.

Merritt Island Surgery Center in Merritt Island, Fla., billed Miconi in advance of the adenoid and tonsil surgery. If she can’t pay for the surgery before it is scheduled to take place next month, the procedure will be put off.

Miconi, whose insurance won’t cover the cost because she has a high deductible, works three jobs and doesn’t have savings to cover the cost. She is now appealing to strangers through a GoFundMe campaign for help.

For years, hospitals and surgery centers waited to perform procedures before sending bills to patients. That often left them chasing after patients for payment, repeatedly sending invoices and enlisting debt collectors.

Heather Miconi and daughter Trista Churchwell. PHOTO: HEATHER MICONI

Now, more hospitals and surgery centers are demanding patients pay in advance.

Advance billing helps the facilities avoid hounding patients to settle up. Yet it is distressing patients who must come up with thousands of dollars while struggling with serious conditions.

Those who can’t come up with the sums have been forced to put off procedures. Some who paid up discovered later they were overcharged, then had to fight for refunds.

Among the procedures that hospitals and surgery centers are seeking prepayments for are knee replacements, CT scans and births.

Merritt Island first provided Miconi an estimate for $3,000 for treatment for her daughter, Trista Churchwell. It then lowered the estimate to $2,000 because she had already paid down some of her deductible.

When she got the first estimate, Miconi figured “there’s no way” she would be able to afford the procedure. Miconi, who lives with her daughter in Merritt Island, processes medical records, delivers food on weekends and helps cater meals to make a living.

“I can’t even provide for my daughter to get surgery for her to be able to breathe,” she recalled feeling.

The surgery would improve her daughter’s breathing by reducing obstructions such as adenoids, tonsils and bony nose structures called turbinates.

Merritt Island Surgery Center is jointly owned by physicians and SCA Health, a subsidiary of UnitedHealth’s health-services arm Optum. “Before providing care, Merritt Island Surgery Center engages each of our patients individually to ensure they understand their potential out-of-pocket costs and are aware of available no-cost financing options,” the center said.

Federal law requires hospitals to take care of people in an emergency. Hospitals say they don’t turn away patients who need medical care urgently for lack of prepayment.

Some 23% of what patients owe is collected by hospitals before treatment, according to an analysis of first-quarter data this year from 1,850 hospitals by Kodiak Solutions, a healthcare consulting and software company. For the same period in 2022, the figure was 20%.

They are seeking advance payment for nonemergencies, they say, because chasing unpaid bills is challenging and costly. Roughly half the debt hospitals wrote off last year was owed by patients with insurance, the Kodiak analysis found.

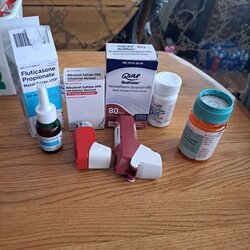

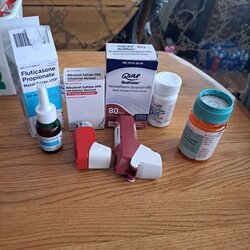

Heather Miconi’s daughter takes several medicines for asthma and obstructed breathing. PHOTO: HEATHER MICONI

“We need those patients who are able to pay to do so,” said Leslie Taylor, a spokeswoman for University of Arkansas for Medical Sciences, which owns one general hospital in Arkansas and will—after discussing with doctors—reschedule some procedures until patients can pay.

For patients, the hospitals say, knowing the cost ahead of service gives them the opportunity to comparison-shop and avoid getting walloped with a huge bill unexpectedly.

Patients often want to know in advance what their medical care will cost. Congress and regulators in recent years have ordered hospitals to be more transparent on prices, which vary widely, and limit surprise billing.

Still, finding money for treatment is a challenge for many American households. Half of adults say they can’t afford to spend more than $500 on medical care should they be suddenly sick or injured, a survey by health policy nonprofit KFF found. They would need to borrow.

In addition, determining how much a patient will owe can be tricky. How much each patient pays depends on their health plan, its deductible or other out-of-pocket costs and the prices the plan negotiated with a hospital to pay.

Blake Young was overcharged roughly $2,500 by CHI Memorial Hospital in Chattanooga, Tenn., ahead of a heart screening late last November.

The hospital initially said he owed about $3,600 and asked for payment. He paid upfront, using funds stocked away in his health-savings account. When he arrived for the testing, the hospital gave him a new bill, saying he owed less.

Young, 59 years old, an industrial-machinery salesman who lives in Chattanooga, said he didn’t get a refund check that the hospital said it mailed in late December. The next month, Young filed a complaint with the Better Business Bureau.

In February, CHI Memorial agreed to reissue the check. In April, the hospital wrote in a letter to Young that it had failed to reissue the check because of a communication error. The hospital also apologized to Young for the delay.

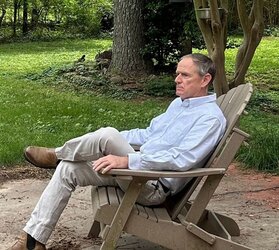

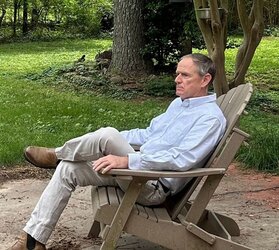

Blake Young of Chattanooga, Tenn., paid upfront for a heart screening. PHOTO: BLAKE YOUNG

“CHI Memorial is committed to helping patients understand and afford the cost of their health care,” a spokeswoman said. The hospital overbilled Young because of an administrative error and issued a refund, she said.

CHI Memorial, which is owned by one of the nation’s largest Catholic health systems, CommonSpirit Health, will go ahead with procedures without advance payment, a spokeswoman said.

Young got the hospital’s $2,546 refund check Tuesday. He wanted the money back for future medical bills. “It’s not unlimited funds,” he said. “They do run out.”

Source (Archive)

May 9, 2024 5:30 am ET

ILLUSTRATION: JOHNNY SIMON/WSJ, ISTOCK

Heather Miconi has seven weeks to come up with $2,000 to pay for surgery her daughter needs to breathe more easily.

Merritt Island Surgery Center in Merritt Island, Fla., billed Miconi in advance of the adenoid and tonsil surgery. If she can’t pay for the surgery before it is scheduled to take place next month, the procedure will be put off.

Miconi, whose insurance won’t cover the cost because she has a high deductible, works three jobs and doesn’t have savings to cover the cost. She is now appealing to strangers through a GoFundMe campaign for help.

For years, hospitals and surgery centers waited to perform procedures before sending bills to patients. That often left them chasing after patients for payment, repeatedly sending invoices and enlisting debt collectors.

Heather Miconi and daughter Trista Churchwell. PHOTO: HEATHER MICONI

Now, more hospitals and surgery centers are demanding patients pay in advance.

Advance billing helps the facilities avoid hounding patients to settle up. Yet it is distressing patients who must come up with thousands of dollars while struggling with serious conditions.

Those who can’t come up with the sums have been forced to put off procedures. Some who paid up discovered later they were overcharged, then had to fight for refunds.

Among the procedures that hospitals and surgery centers are seeking prepayments for are knee replacements, CT scans and births.

Merritt Island first provided Miconi an estimate for $3,000 for treatment for her daughter, Trista Churchwell. It then lowered the estimate to $2,000 because she had already paid down some of her deductible.

When she got the first estimate, Miconi figured “there’s no way” she would be able to afford the procedure. Miconi, who lives with her daughter in Merritt Island, processes medical records, delivers food on weekends and helps cater meals to make a living.

“I can’t even provide for my daughter to get surgery for her to be able to breathe,” she recalled feeling.

The surgery would improve her daughter’s breathing by reducing obstructions such as adenoids, tonsils and bony nose structures called turbinates.

Merritt Island Surgery Center is jointly owned by physicians and SCA Health, a subsidiary of UnitedHealth’s health-services arm Optum. “Before providing care, Merritt Island Surgery Center engages each of our patients individually to ensure they understand their potential out-of-pocket costs and are aware of available no-cost financing options,” the center said.

Federal law requires hospitals to take care of people in an emergency. Hospitals say they don’t turn away patients who need medical care urgently for lack of prepayment.

Some 23% of what patients owe is collected by hospitals before treatment, according to an analysis of first-quarter data this year from 1,850 hospitals by Kodiak Solutions, a healthcare consulting and software company. For the same period in 2022, the figure was 20%.

They are seeking advance payment for nonemergencies, they say, because chasing unpaid bills is challenging and costly. Roughly half the debt hospitals wrote off last year was owed by patients with insurance, the Kodiak analysis found.

Heather Miconi’s daughter takes several medicines for asthma and obstructed breathing. PHOTO: HEATHER MICONI

“We need those patients who are able to pay to do so,” said Leslie Taylor, a spokeswoman for University of Arkansas for Medical Sciences, which owns one general hospital in Arkansas and will—after discussing with doctors—reschedule some procedures until patients can pay.

For patients, the hospitals say, knowing the cost ahead of service gives them the opportunity to comparison-shop and avoid getting walloped with a huge bill unexpectedly.

Patients often want to know in advance what their medical care will cost. Congress and regulators in recent years have ordered hospitals to be more transparent on prices, which vary widely, and limit surprise billing.

HOW TO TALK ABOUT THE BILL

Medical bills are often large and unexpected. Hospitals and doctors might ask for money before your appointment. Before you pay:

- Don’t assume because they ask for money that you’re required to pay immediately. Hospitals might not initially offer an option to pay later. Ask about your options.

- If you can’t afford the amount, let them know. Ask about no-interest payment plans, discounts and financial aid.

- Financial-aid programs, also known as charity care, can be complicated, but there are resources, such as the nonprofit Dollar For, to help with applications.

Still, finding money for treatment is a challenge for many American households. Half of adults say they can’t afford to spend more than $500 on medical care should they be suddenly sick or injured, a survey by health policy nonprofit KFF found. They would need to borrow.

In addition, determining how much a patient will owe can be tricky. How much each patient pays depends on their health plan, its deductible or other out-of-pocket costs and the prices the plan negotiated with a hospital to pay.

Blake Young was overcharged roughly $2,500 by CHI Memorial Hospital in Chattanooga, Tenn., ahead of a heart screening late last November.

The hospital initially said he owed about $3,600 and asked for payment. He paid upfront, using funds stocked away in his health-savings account. When he arrived for the testing, the hospital gave him a new bill, saying he owed less.

Young, 59 years old, an industrial-machinery salesman who lives in Chattanooga, said he didn’t get a refund check that the hospital said it mailed in late December. The next month, Young filed a complaint with the Better Business Bureau.

In February, CHI Memorial agreed to reissue the check. In April, the hospital wrote in a letter to Young that it had failed to reissue the check because of a communication error. The hospital also apologized to Young for the delay.

Blake Young of Chattanooga, Tenn., paid upfront for a heart screening. PHOTO: BLAKE YOUNG

“CHI Memorial is committed to helping patients understand and afford the cost of their health care,” a spokeswoman said. The hospital overbilled Young because of an administrative error and issued a refund, she said.

CHI Memorial, which is owned by one of the nation’s largest Catholic health systems, CommonSpirit Health, will go ahead with procedures without advance payment, a spokeswoman said.

Young got the hospital’s $2,546 refund check Tuesday. He wanted the money back for future medical bills. “It’s not unlimited funds,” he said. “They do run out.”

Source (Archive)