The Federal Reserve on Wednesday cut its benchmark interest rate by an unusually large half-point, a dramatic shift after more than two years of high rates that helped tame inflation but also made borrowing painfully expensive for American consumers.

The rate cut, the Fed’s first in more than four years, reflects its new focus on bolstering the job market, which has shown clear signs of slowing. Coming just weeks before the presidential election, the Fed’s move also has the potential to scramble the economic landscape just as Americans prepare to vote.

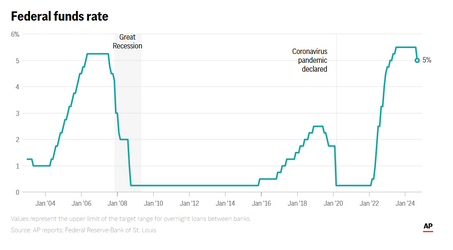

The central bank’s action lowered its key rate to roughly 4.8%, down from a two-decade high of 5.3%, where it had stood for 14 months as it struggled to curb the worst inflation streak in four decades. Inflation has tumbled from a peak of 9.1% in mid-2022 to a three-year low of 2.5% in August, not far above the Fed’s 2% target.

The Fed’s policymakers also signaled that they expect to cut their key rate by an additional half-point in their final two meetings this year, in November and December. And they envision four more rate cuts in 2025 and two in 2026.

In a statement and in a news conference with Chair Jerome Powell, the Fed came closer than it has before to declaring victory over inflation.

“We know it is time to recalibrate our (interest rate) policy to something that’s more appropriate given the progress on inflation,” Powell said. “We’re not saying, ‘mission accomplished’ ... but I have to say say, though, we’re encouraged by the progress that we have made.”

“The U.S. economy is in a good place,” he added, “and our decision today is designed to keep it there.”

Though the central bank now believes inflation is largely defeated, many Americans remain upset with still-high prices for groceries, gas, rent and other necessities. Former President Donald Trump blames the Biden-Harris administration for sparking an inflationary surge. Vice President Kamala Harris, in turn, has charged that Trump’s promise to slap tariffs on all imports would raise prices for consumers even further.

Rate cuts by the Fed should, over time, lead to lower borrowing costs for mortgages, auto loans and credit cards, boosting Americans’ finances and supporting more spending and growth. Homeowners will be able to refinance mortgages at lower rates, saving on monthly payments, and even shift credit card debt to lower-cost personal loans or home equity lines. Businesses may also borrow and invest more. Average mortgage rates have already dropped to an 18-month low of 6.2%, according to Freddie Mac, spurring a jump in demand for refinancings.

In an updated set of projections, the Fed’s policymakers collectively envision a faster drop in inflation than they did three months ago but also higher unemployment. They foresee their preferred inflation gauge falling to 2.3% by year’s end, from its current 2.5%, and to 2.1% by the end of 2025. And they now expect the unemployment rate to rise further this year, to 4.4%, from 4.2% now, and to remain there by the end of 2025. That’s above their previous forecasts of 4% for the end of this year and 4.2% for 2025.

Powell was pressed at his news conference about whether the Fed’s decision to cut its key rate by an unusually large half-point is an acknowledgement that it waited too long to begin reducing borrowing rates.

“We don’t think we’re behind,” he replied. “We think this is timely. But I think you can take this as a sign of our commitment not to get behind. We’re not seeing rising (unemployment) claims, not seeing rising layoffs, not hearing from companies that that’s something that’s going to happen.”

He added: “There is thinking that the time to support the labor market is when it’s strong and not when you begin to see the layoffs. We don’t think we need to see further loosening in labor market conditions to get inflation down to 2%.”

The Fed’s next policy meeting is Nov. 6-7 — immediately after the presidential election. By cutting rates this week, soon before the election, the Fed is risking attacks from Trump, who has argued that lowering rates now amounts to political interference. Yet Politico has reported that even some key Senate Republicans who were interviewed expressed support for a Fed rate cut this week.

Powell pushed back Wednesday against any suggestion that the Fed shouldn’t cut rates so close to an election.

“This is my fourth presidential election at the Fed,” he said. “It’s always the same. We’re always going into this meeting in particular and asking, ‘What’s the right thing to do for the people we serve?’ We do that and we make a decision as a group and we announce it. That’s always what it is. Nothing else is discussed.”

The Fed’s move Wednesday reverses the inflation-fighting effort it engineered by raising its key rate 11 times in 2022 and 2023. Wage growth has since slowed, removing a potential source of inflationary pressure. And oil and gas prices are falling, a sign that inflation should continue to cool in the months ahead. Consumers are also pushing back against high prices, forcing such companies as Target and McDonald’s to dangle deals and discounts.

The Fed’s decision drew the first dissent from a member of its governing board since 2005. Michelle Bowman, a board member who has expressed concern in the past that inflation had not been fully defeated, said she would have preferred a quarter-point rate cut.

But the Fed’s policymakers as a whole recognize that after years of strong job growth, employers have slowed hiring, and the unemployment rate has risen nearly a full percentage point from its half-century low in April 2023 to a still-low 4.2%. Once unemployment rises that much, it tends to keep climbing.

At the same time, the officials and many economists have noted that the rise in unemployment this time largely reflects an influx of people seeking jobs — notably new immigrants and recent college graduates — rather than layoffs.

“The labor market is actually in solid condition,” Powell said. “Our intention with our policy move today is to keep it there.”

Article Link

Archive