Prices and rents will fall under Rachel Reeves’ plans, enabling a younger generation with new ideas to enter the field

Will HuttonSun 17 Nov 2024 02.00 EST

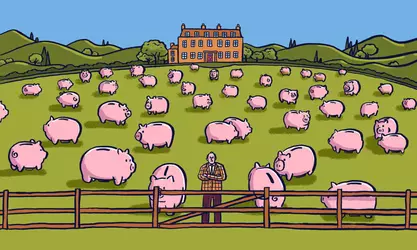

Illustration by Dominic McKenzie.

One of the baleful dimensions of our times is the way that the conversation about what constitutes the good society is framed by the rich and their interests. A conception of the common good withers; instead it is replaced by the existential importance of private wealth, private interests and private ownership to societal health. Nowhere is this more exposed than in the debate over taxation, and in particular the taxation of inherited wealth – as the debate over the past fortnight has dramatised.

Half a million people die every year. Under the reforms to inheritance tax relief on agricultural land proposed in the budget, about 500 individuals who inherit land worth more than £2m (£3m if they were married to the deceased) will join the rest of society and have inheritance tax levied on their bequest – albeit at half the rate, with an enlarged exemption and 10 years to pay it, concessions not made to the rest of us. How fortunate and privileged are they?

Yet ever since, the National Farmers Union, Historic Houses, the Tory party, the rightwing media and, inevitably, Elon Musk have behaved as if the move represents a new communist dictatorship. Edward Stanley, the 19th Earl of Derby, denizen of Merseyside’s Knowsley Hall where his family has lived since 1385, represented their united view. “Taking 20% of a business away every generation is just a shockingly awful concept for a government that wants growth,” he told the Financial Times. Positioning himself as a wealth-creating small business, he insisted it “would kill off farming and heritage businesses” like his. According to the lobby, a new age of Jacobin terror has been unleashed – production will collapse, rural Britain will be devastated, and all for a trivial amount of money. Rarely have 500 very privileged people got so hysterical – and commanded so much attention.

There is no acknowledgment of the potential wider benefits that go beyond the non-trivial contribution the tax will make to relieving the crisis in public services. The hoarding of land that has gone on since the bung was introduced by Margaret Thatcher in 1984, which has so steadily driven up land prices and farmers’ rents, will at last be checked as some of the larger estates are obliged to sell parcels of land to pay inheritance tax, as they did before 1984 without the world falling in, rather than be enabled to own it in perpetuity. Young farmers, now increasingly crowded out of the market, will get a chance to buy land: there is the prospect of a levelling off, even a fall, in farm rents. New life and ideas will be brought to the rural economy as innovative, energetic farmers enter the market – and production even increases.

A convoy of tractors in Llandudno, where the Welsh Labour party conference was being held, are used to protest the inheritance tax changes for farms. Photograph: Oli Scarff/AFP/Getty Images

As importantly, a key principle that has underpinned all human societies – that we have a right to share in the bounty of inherited assets – will be reaffirmed. Whether ancient Rome or feudal Europe, societies have taken the view that just because an individual got lucky and came out of the right womb, they are not entitled to inherit everything without paying some levy or tribute on their inherited wealth. After all, wealth is enjoyed in a societal context and society made a contribution to the existence of the wealth. Of course society should share in the transfer, if only in a minor way, and the principle should extend to everyone, with as few exceptions as possible. Far from a death tax, it is a life tax on undeserved good luck.

Part of the problem is that rural Britain has never escaped the cultural trappings of feudalism

Why so much fuss? Part of the problem is that rural Britain has never escaped the cultural trappings of feudalism. It is now largely forgotten, but in 1883 the Conservative party, to fight the rise of progressive liberalism and its emergent outrider socialism, set up the mass membership Primrose League, whose adherents formally accepted the vital role that the “landed estates of the realm” played in an idea of imperial, free-enterprise Britain. It was a direct response to William Gladstone’s creation of “succession duty” in 1881 codifying the longstanding practice of levying a duty on the transfer of landed assets – and the principle had to be fought to the last. Within a decade its members, incredibly, outnumbered trade unionists.

The Earl of Derby speaks to that Primrose League tradition, arguing that his family is less a 650-year beneficiary of the baronial carve-up of England after the Norman conquest and more an employment-generating small business. Selling a little of the estate to pay inheritance tax is off limits; instead, the assumption is that the tax will have to be paid from the business’s cashflow, to preserve the estate in perpetuity – hence the over-egged predictions of devastation. In the wider economy, the creation of perpetual monopolies would be widely criticised as not only unfairly entrenching wealth and power but stifling the process of creative churn that is at the heart of economic vitality. Britain’s landed estates are excused from the same criticism.

It is a political and cultural achievement that must be challenged today with the same energy it was challenged by Liberal leaders in the run-up to the First World War. The Lib Dem leader, Ed Davey, calling for the government to suspend the measure, forgets Gladstone’s succession duty, William Harcourt’s introduction of estates duty in 1894 and David Lloyd George’s imaginative plans to break up the monopoly of land ownership. Yet, while the non-royal dukes might no longer have automatic membership of the House of Lords, they still own as much of Britain as they did then. Davey should not cosy up to Musk and co, inflaming the hysteria, but rather back Keir Starmer and Rachel Reeves who, to their credit, are holding the line.

But Labour needs to win the argument, and to be convincing that argument must be made from first principles. Inheritance tax springs from the universally held belief that society has the right to share when wealth is transferred on death as a matter of justice. This is not confiscation, especially if the lion’s share of the bequest is left intact. It is asking for a share. The principle should apply to all estates and to everyone. It is fair. It limits the entrenchment of wealth and privilege. It breaks up monopoly, especially of land. It enlarges the tax base. It gives the next generation a chance. Any other argument is the special pleading of plutocrats – and should be seen as such.

Source (Archive)