Alexandra Citrin-Safadi/WSJ

By Rebecca Feng and Jason Douglas

May 4, 2025 9:00 pm ET

Not long ago, anyone could comb through a wide range of official data from China. Then it started to disappear.

Land sales measures, foreign investment data and unemployment indicators have gone dark in recent years. Data on cremations and a business confidence index have been cut off. Even official soy sauce production reports are gone.

In all, Chinese officials have stopped publishing hundreds of data points once used by researchers and investors, according to a Wall Street Journal analysis.

In most cases, Chinese authorities haven’t given any reason for ending or withholding data. But the missing numbers have come as the world’s second biggest economy has stumbled under the weight of excessive debt, a crumbling real-estate market and other troubles—spurring heavy-handed efforts by authorities to control the narrative.

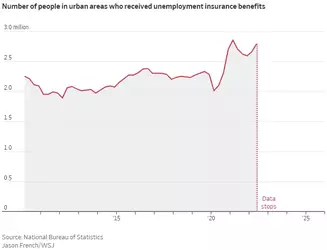

China’s National Bureau of Statistics stopped publishing some numbers related to unemployment in urban areas in recent years. After an anonymous user on the bureau’s website asked why one of those data points had disappeared, the bureau said only that the ministry that provided it stopped sharing the data.

The disappearing data have made it harder for people to know what’s going on in China at a pivotal time, with the trade war between Washington and Beijing expected to hit China hard and weaken global growth. Plunging trade with the U.S. has already led to production shutdowns and job cuts.

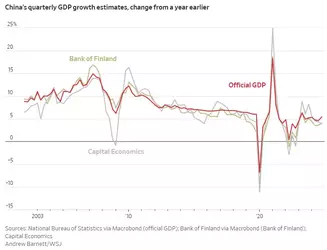

Getting a true read on China’s growth has always been tricky. Many economists have long questioned the reliability of China’s headline gross domestic product data, and concerns have intensified recently. Official figures put GDP growth at 5% last year and 5.2% in 2023, but some have estimated that Beijing overstated its numbers by as much as 2 to 3 percentage points.

To get what they consider to be more realistic assessments of China’s growth, economists have turned to alternative sources such as movie box office revenues, satellite data on the intensity of nighttime lights, the operating rates of cement factories and electricity generation by major power companies. Some parse location data from mapping services run by private companies such as Chinese tech giant Baidu to gauge business activity.

One economist said he has been assessing the health of China’s services sector by counting news stories about owners of gyms and beauty salons who abruptly close up and skip town with users’ membership fees.

State of the economy

Questions over China’s GDP figures go back years. Former Chinese premier Li Keqiang famously told the U.S. ambassador in 2007 that GDP data for a Chinese province he governed at the time were “man-made” and therefore unreliable, according to a leaked U.S. diplomatic cable. Instead, he said he kept track of electricity consumption, rail-freight volumes and new bank loans.Official GDP figures were “for reference only,” he confided to the ambassador, according to the cable. Li died in October 2023.

China’s official GDP growth of 5% in 2024 exactly matched the target the government had set the previous year. Economists privately dismissed the figure, with one telling the Journal it would have been more credible if authorities had released something lower. Retail sales, construction activity and other data painted a considerably weaker picture, they noted.

Bank of Finland and Capital Economics have generally found bigger swings in GDP than what China reports—and its estimates are lower than official figures in recent quarters.

In December, a prominent Chinese economist at state-owned SDIC Securities, Gao Shanwen, said at a conference in Washington that China’s economic growth “might be around 2%” the past few years, adding, “we do not know the true number of China’s real growth figure.”

China’s leader Xi Jinping ordered that Gao be disciplined and he has been banned from speaking publicly for an unspecified period. The Securities Association of China warned brokerages in late December to ensure their economists “play a positive role” in boosting investor confidence.

China’s statistics bureau has defended its data practices, saying that data quality has improved over the years and that it has taken steps to ensure accuracy and investigate any misconduct during collection.

In February, Goldman Sachs came up with an alternative way of measuring China’s economic growth by crunching figures such as import data, which can be read as proxies for domestic spending. The thinking was that trade data get published frequently and is hard to fudge, since China’s trading partners also report those numbers.

That approach implied that China’s growth in 2024 averaged 3.7%. Using a different method, Rhodium Group, a New York-based research outfit, said growth was closer to 2.4% in 2024.

Vanishing act

Presenting an image of stability is paramount for China’s Communist Party, especially now, with many middle-class Chinese worried about the future and the country entering uncharted territory in its competition with the U.S.Often, the data that goes missing involves areas of high sensitivity or headaches for Beijing, such as the property market, whose collapse in recent years wiped out billions of dollars of household wealth and triggered protests by frustrated home buyers.

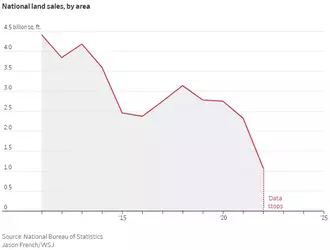

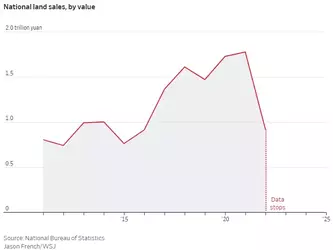

During the boom years, China’s developers furiously bought up land from local governments at sky-high prices. The transactions poured money into local governments’ coffers and signaled future development plans, a key driver of the economy.

The downturn began in 2021, after Beijing tightened credit on the sector. With home sales falling and real-estate developers going bankrupt, a Chinese think tank called Beike Research Institute released a report in 2022 that found the average housing vacancy rate among 28 Chinese cities was higher than the average in the U.S. and other places—a sign of oversupply.

The report drew attention because China doesn’t release an official vacancy rate, and property analysts were trying to figure out how badly developers had overbuilt. A few days later, Beike retracted the report and apologized, saying that some of the data had errors. Analysts said they believed the group pulled the data under government pressure.

Official data went away, too.

Figures show the value of land sales plummeted 48% in 2022—a big problem for heavily indebted local governments, which suddenly lacked funds to pay salaries or carry on with infrastructure projects. That data disappeared at the start of 2023.

In this case, there are still private data providers that gather individual land transactions at the local level from public records.

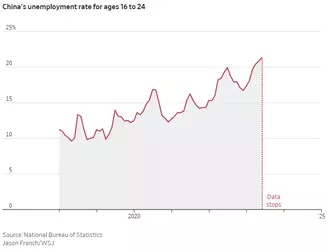

By mid-2023, much of the talk locally revolved around the dismal job market for young people. Many of the students finishing college didn’t have job offers, and viral social-media posts showed them dressed in caps and gowns splayed out motionless on the ground, interpreted by many as a form of silent protest.

Around that time, the official youth unemployment rate hit a record 21.3%. Zhang Dandan, a Peking University economist, made headlines saying she thought China’s true youth unemployment rate might be as high as 46.5%.

In August 2023, authorities announced they would stop releasing the youth unemployment rate, saying they needed to revisit how they calculated the figures.

Five months later, Beijing began releasing a new data series. The real youth jobless rate, it said, was 14.9%.

Officials said the new data series excluded nearly 62 million people who were studying full-time in universities, and so shouldn’t be counted as jobless. But that didn’t make sense to economists. Statistics typically count anyone actively looking for a job as unemployed, including full-time students.

Investor flight

In April 2024, China’s stock market was teetering as economic worries deepened. Foreign investors dumped more than $2 billion of Chinese stocks over a two-week span, spooking domestic individual investors.China’s two major exchanges in Shanghai and Shenzhen abruptly announced that they would stop publishing real-time data on inflows and outflows of foreign investors. The Shanghai Stock Exchange said in a statement that it was aligning its practices with other international markets, which don’t disclose real-time trading data of specific groups of investors.

After authorities stopped publishing the real-time data in mid-May, the CSI 300 benchmark index continued its decline for four consecutive months, until authorities announced a blitz of measures to support the country’s weakening economy in September.

Some data are still publicly available but harder to get. Beijing passed a law in 2021 that caused data providers to make certain information—such as corporate registry data and satellite images—accessible only in mainland China.

Chinese data provider Wind Information started to limit international users’ access to certain data sets, such as online retail shopping figures and land-auction records, in early 2023. That led one economist at a foreign bank in Hong Kong to start making regular weekend trips to the neighboring mainland city of Shenzhen to download data, the economist told the Journal.

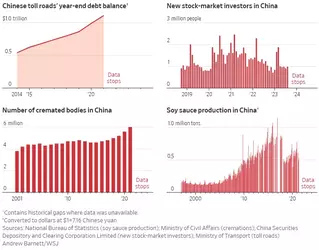

Also gone in recent years: official figures on Chinese toll road operators’ year-end debt balances and the number of new stock-market investors.

China stopped publishing national cremation data after it ended its controversial zero-Covid policy to contain the virus in late 2022—a move some analysts had estimated could lead to between 1.3 million and 2.1 million deaths. The government also censored discussions about the impact of the virus on social media.

The country’s low fertility rate has become a major economic liability—and some data pointing to it is gone, too. In the mid-2000s, an economist named Yi Fuxian questioned the accuracy of China’s population data and argued that tuberculosis vaccinations were a better measure of population growth because every newborn in China is required to be vaccinated.

In 2020, 5.4 million such vaccines were administered, according to data compiled by the private Chinese think tank Forward Business and Intelligence. Chinese authorities said the country recorded 12.1 million births that year.

A year later, the National Institutes for Food and Drug Control discontinued the weekly data release of tuberculosis vaccines administered, along with other vaccine data.

Some information that has disappeared defies explanation. Data providing estimates of the size of elementary school toilets stopped being released in 2022, then resumed publication in February. Official soy sauce production data stopped appearing in May 2021, and hasn’t returned.

Source (Archive)