- Joined

- Aug 7, 2020

If you're out of the loop - this is the (hilarious) story of a subreddit (wall street bets) taking down a multi-billion dollar hedge fund... get your popcorn ready

the hero of our story: a user named DeepFuckingValue bought $50k of call options in Gamestop ($GME) that has turned into a $13M+ win in ~3 months.

he's a part of the subreddit r/WallStreetBets, a group of degenerate gamblers that I love.

So here's the situation.

Gamestop (GME) = a dying biz. circling the drain. Who goes to a store to buy games? It's basically a pokemon card dealership at this point. Plus with covid, malls are dead.

So some Hedge Funds are shorting the stock, betting it would go down.

One fund in particular, Melvin Capital Managment - a multi-billion dollar hedge fund...had been accruing a big short position in gamestop. Usually you don't have to disclose your shorts - but these were 'listed put options' so some clever redditors discovered the position

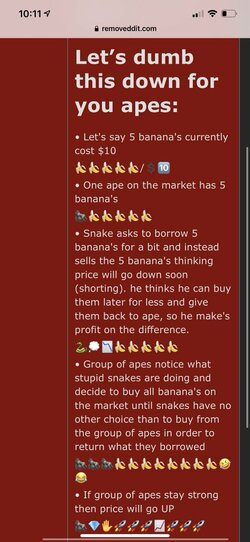

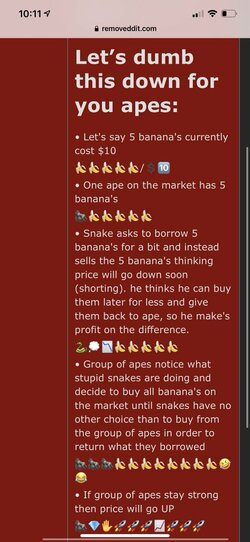

Melvin had a $55M+ short against GME.. If you're not familiar with shorting - read this simple explanation using apes and snakes and bananas from the subreddit.

Teachers, take note:

except in this case - redditors saw the overloaded short position and started buying the stock, as a "short squeeze" against melvin. Now the "borrowed" shares were due, but redditors refused to sell, demanding higher and higher prices.

to be clear. This has nothing to do with gamestop as a business. They are just a piece of rope being used in a tug of war between internet nerds and wall st suits.

the rally cry on r/wallstreet bets:

"we can remain retarded for longer than they can stay solvent!"

Melvin lost $2B+ in like 2 weeks, and just had to get bailed out by 2 other funds just to cover it's losses from the shorts.

It's not quite George Soros "Breaking the Bank of England" - but it's close.

The yolo traders of reddit just broke a multi-billion dollar hedge fund

"Why can't Melvin capital just uninstall robinhood and reinstall it to restore their save game to get their money back????" - u/dopexile

short squeezes (and day trading) are stressful and super volatile.

But... I'm here for the petty fight between internet trolls and wall st.

And in that fight, i'm going with the neckbeard cat guy rather than goldman sachs suit. $50k on $GME and $BB at market open baby

Elon musk is egging on via twitter. CNBC anchors and experts are losing shit

Other potential wild cards in the story

- SEC might intervene

- the naked short (more than 100%). no idea what might happen

- the hedgefund guys are lying via the media that they are out of the game

- reddit admins might ban the sub. autists are gonna fuck the site up in that scenario

- cryptomarket might collapse as autists change their focus to stonks

- /biz/ is salty that the younger brother reddit won the medal again

finviz.com

finviz.com

the hero of our story: a user named DeepFuckingValue bought $50k of call options in Gamestop ($GME) that has turned into a $13M+ win in ~3 months.

he's a part of the subreddit r/WallStreetBets, a group of degenerate gamblers that I love.

So here's the situation.

Gamestop (GME) = a dying biz. circling the drain. Who goes to a store to buy games? It's basically a pokemon card dealership at this point. Plus with covid, malls are dead.

So some Hedge Funds are shorting the stock, betting it would go down.

One fund in particular, Melvin Capital Managment - a multi-billion dollar hedge fund...had been accruing a big short position in gamestop. Usually you don't have to disclose your shorts - but these were 'listed put options' so some clever redditors discovered the position

Melvin had a $55M+ short against GME.. If you're not familiar with shorting - read this simple explanation using apes and snakes and bananas from the subreddit.

Teachers, take note:

except in this case - redditors saw the overloaded short position and started buying the stock, as a "short squeeze" against melvin. Now the "borrowed" shares were due, but redditors refused to sell, demanding higher and higher prices.

to be clear. This has nothing to do with gamestop as a business. They are just a piece of rope being used in a tug of war between internet nerds and wall st suits.

the rally cry on r/wallstreet bets:

"we can remain retarded for longer than they can stay solvent!"

Melvin lost $2B+ in like 2 weeks, and just had to get bailed out by 2 other funds just to cover it's losses from the shorts.

It's not quite George Soros "Breaking the Bank of England" - but it's close.

The yolo traders of reddit just broke a multi-billion dollar hedge fund

"Why can't Melvin capital just uninstall robinhood and reinstall it to restore their save game to get their money back????" - u/dopexile

short squeezes (and day trading) are stressful and super volatile.

But... I'm here for the petty fight between internet trolls and wall st.

And in that fight, i'm going with the neckbeard cat guy rather than goldman sachs suit. $50k on $GME and $BB at market open baby

Elon musk is egging on via twitter. CNBC anchors and experts are losing shit

Other potential wild cards in the story

- SEC might intervene

- the naked short (more than 100%). no idea what might happen

- the hedgefund guys are lying via the media that they are out of the game

- reddit admins might ban the sub. autists are gonna fuck the site up in that scenario

- cryptomarket might collapse as autists change their focus to stonks

- /biz/ is salty that the younger brother reddit won the medal again

GME GameStop Corp. Stock Quote

Stock screener for investors and traders, financial visualizations.

Last edited: