Alrighty gang. It cost me 10 bucks and 2 hours of sleep, but I skimmed through the Case 18-24489 in the California Eastern Bankruptcy Court. I think I know what is going on.

Vickers initially tried filing for Chapter 13, debt restructuring, in 2018. In the initial petition (attached below), Vickers claims around 200k in unsecured debts, and seeks to reconsolidate.

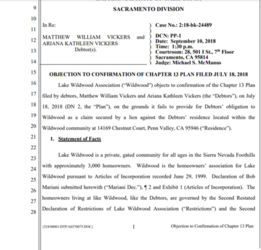

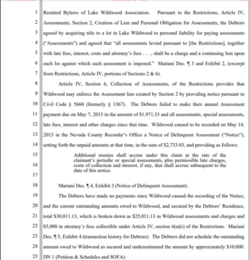

IMMEDIATELY all his creditors dogpile, in particular his homeowners association, Wildwood Association, who argue that Vickers has a contract with them that requires payment that is intrinsically tied to his property. Dumb ass literally signed his soul to the HoA. Fucking hell man.

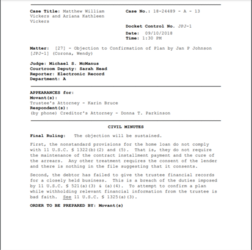

The court sustained the objection. Vickers like an absolute retard signed a mortgage that precluded bankruptcy protection on his property if he fell into arrears with the dues required of his participation in the Home Owners Association. The court also found Vickers acted in bad faith by hiding this and other material facts from the trustee

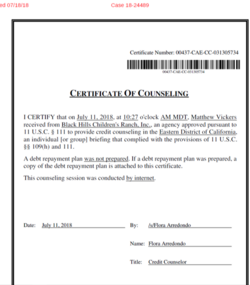

As an aside, he DID attend the mandatory credit counseling.

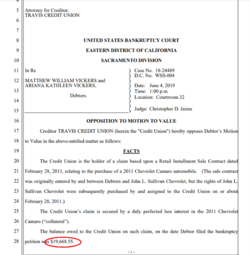

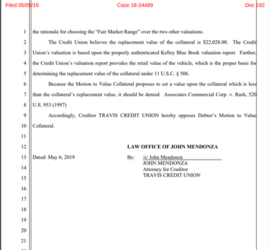

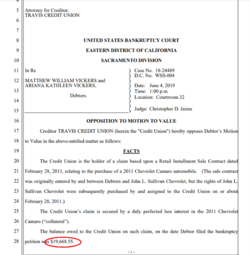

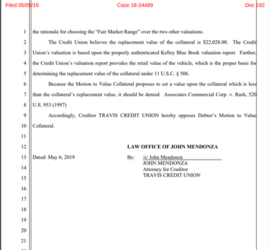

After this, it was a fucking dogpile. All his creditors entered the chat. Did anyone know this guy owned a fucking Camaro? He owed 20k on it , his lender wanted it back lol.

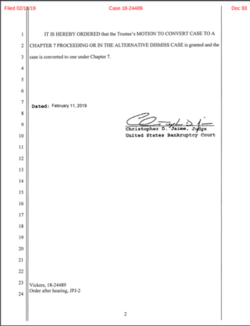

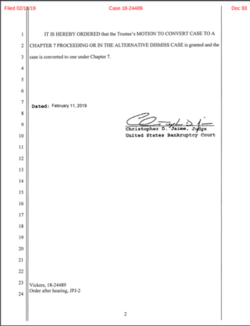

Whoopsie doodle! Vickers decided he wasn't filing for Chapter 13. No, it was Chapter 7 this time! Full liquidation!

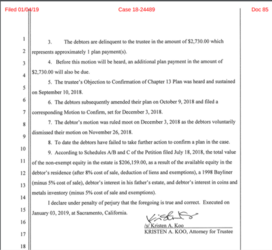

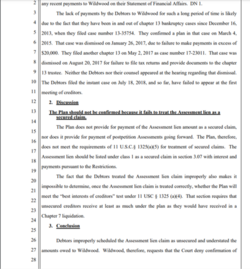

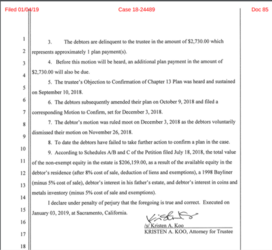

Shit went downhill from here. You see, part of bankruptcy ironically, is that you also have to pay the people managing it. Like your trustee. Which Vickers did NOT do. Since he initially filed under Chapter 13, the Trustee was established contractually as someone who worked FOR his estate, as opposed to a vulture coming in to pick up the pieces. Even though he had moved to change the Chapter 13 filing to a Chapter 7, he was still on the hook to pay the trustee for the time spent on the pre liquidation analysis. He didn't pay.

This was a legal death sentence.

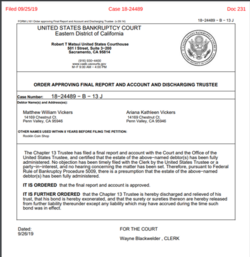

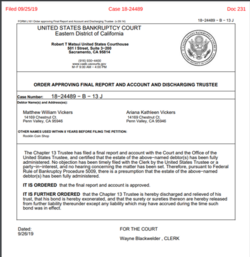

The Court found that Vickers had no met the standards for Chapter 7 bankruptcy as required by statute. Worse, he had essentially defaulted by failing to address prior motions in the file by the trustee and secured creditors for response or payment. The Court dismissed his case with prejudice.

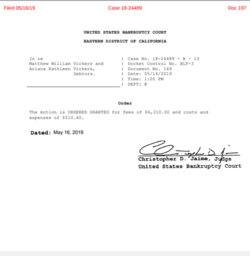

They also ordered Vickers to Pay Fees and Costs as a final FUCK YOU

So tl;dr, what we are seeing here is not a NEW bankruptcy. Its the conclusion of the third and FINAL bankruptcy Vickers filed in 2018. One he (or his lawyer) absolutely bungled worse then Ty Beard with a Notary Seal. In very broad strokes.

This cost 10 bucks and 2 hours of sleep. Give me my stickers. I am going to bed.