By Jon Hilsenrath, Anthony DeBarros and Kara Dapena

Nov. 3, 2022

Building bonds

Thirty years ago, the globe's great powers became enmeshed in what George H.W. Bush called “a new world order.” The Soviet empire collapsed, China embraced markets and the U.S. became a global cop in a more connected world.

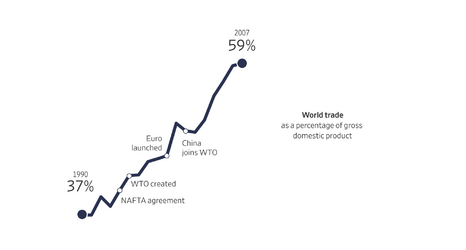

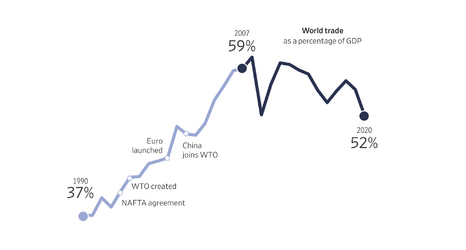

Trade was at the center of it all. Agreements during the 1990s and early 2000s paved the way to economic integration and hopes for political cooperation.

Data source: World Bank

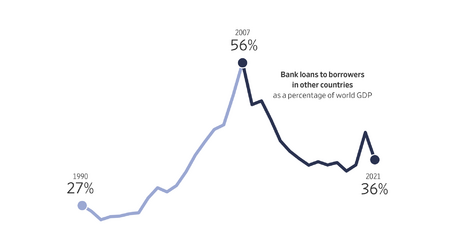

An explosion of international bank lending sewed countries together by pocketbooks.

Data sources: Bank for International Settlements (loans); World Bank (GDP)

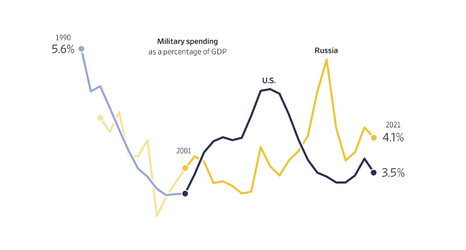

A new era of peace that lasted until the early 2000s sent military spending down.

Then the system began to crack...

Data source: Stockholm International Peace Research Institute

In 2001, Al Qaeda terrorists attacked and U.S. forces invaded Afghanistan and Iraq. Vladimir Putin began a quest to restore Russia as a world power.

Data source: Stockholm International Peace Research Institute

Financial volatility rose with a world awash in cash, culminating in the 2008 global financial crisis, when international lending reversed.

Data sources: Bank for International Settlements (loans); World Bank (GDP)

Trade peaked as an engine of global growth at the time of the financial crisis. After they had become so connected, the great powers were set on course to clash.

Data source: World Bank

Supply chains

Large multinational firms had broken production into pieces connected through vast global supply chains. Russia was a primary producer of raw materials, China a manufacturing powerhouse, and the U.S. a leader in logistics, finance and consumption.

Furniture is one window into how the supply chains worked. Starting in the early 2000s, Russia became the chief supplier of wood and wood products exported to China.

Data source: UN Comtrade

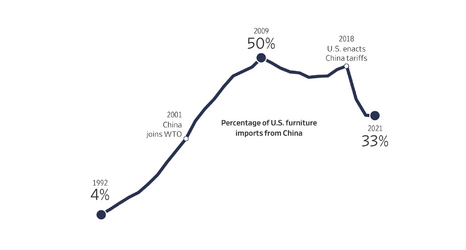

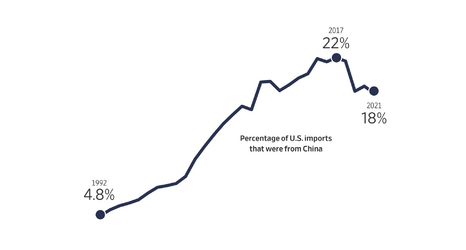

In turn, China became the world’s factory floor. U.S. furniture imports from China by dollar value peaked in the financial crisis, then dropped sharply after former President Donald Trump imposed tariffs on Chinese goods.

Data note: Excludes medical furniture, mattress supports; Data source: Census Bureau

The imports pushed down costs for American consumers but also drove down jobs for U.S. workers in the industry, one source of global tension.

Data source: Labor Department

Disorder

Global integration had benefits, but as stresses mounted, the tools of integration became a means of confrontation.

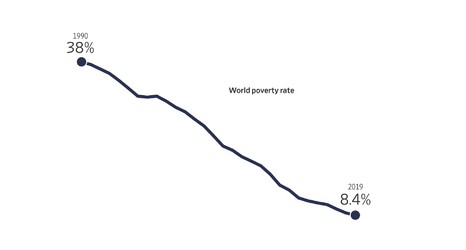

The new order helped to reduce global poverty by bringing work to low-wage countries, especially China.

Data note: Percentage of people who live on less than $2.15 a day, 2017 prices; Data source: World Bank

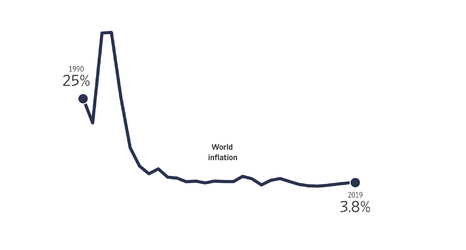

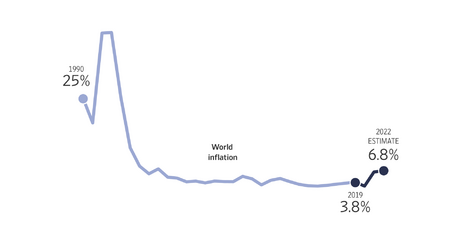

Low-cost labor and global integration drove down inflation after a jump in the early 1990s, when the Soviet empire collapsed.

Data source: International Monetary Fund

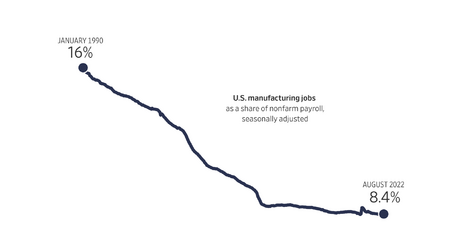

But as China became a manufacturing juggernaut, U.S. jobs felt the impact, in furniture and beyond.

Data source: Labor Department

The U.S. used tariffs to punish China and other trade partners for what it called unfair trade, then they retaliated.

Data source: United States International Trade Commission

Financial integration also became a weapon of war through the use of sanctions, which have surged after Russia’s invasion of Ukraine.

Data source: Hochschule Konstanz University of Applied Sciences, Drexel University School of Economics, Austrian Institute for Economic Research

Global supply chains became stressed, and U.S. firms began shifting activity from China to Vietnam, India, Thailand and other Asian nations.

Data note: Goods only; Data source: Census Bureau

Among other problems, the tension is helping to fuel inflation. Covid disrupted supply chains. Tariffs and sanctions have multinational firms rethinking plans. The Ukraine war cut into energy supplies. And consumers everywhere feel the new disorder.

Data source: International Monetary Fund

Photo illustrations: WSJ; Cover photos: Getty Images (4); 'Building bonds' photos: Getty Images (4); 'Supply chains' photos: Getty Images (3), Bloomberg News (1); 'Disorder' photos: Reuters (1), Getty Images (2), ZUMA Press (1)

Source (Archive)

Last edited: