An aerial view of Liuzhou, China. VIDEO: Jimmyan/Getty

By Brian Spegele and Rebecca Feng

July 14, 2024 12:00 pm ET

LIUZHOU, China—Officials were bullish about the future of their factory town in early 2019. The economy was prospering, a new industrial district was on the way and an elevated light-rail system was taking shape.

“The achievements of the past year have not come easily,” Mayor Wu Wei said in a city report at the time. He credited the grit of local party leaders but didn’t mention an ace in the hole.

For years, Liuzhou and scores of other Chinese cities together amassed trillions of dollars in off-the-books debt for economic development projects. The opaque financing was the yeast that helped China rise to the envy of the world.

Today, overgrown construction sites, sparsely used highways and abandoned tourist attractions make much of that debt-fueled growth look illusory and suggests China’s future is far from assured.

Liuzhou, a city in the southern region of Guangxi, raised billions of dollars to build the infrastructure for a new industrial district, where a state-owned financing group acquired land and opened hotels and an amusement park. Other tracts of acquired land sit vacant, and many area streets look practically deserted. Birds flit through the rows of abandoned buildings at an unfinished apartment complex.

“The government is broke,” said one local resident who watched the project falter from her shop across the street.

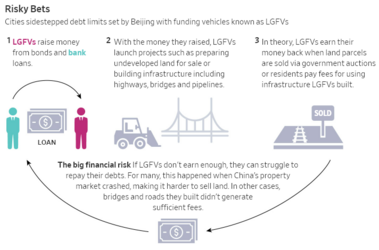

At the heart of the mess are the complex state-owned funding vehicles that borrowed money on behalf of local governments, in many cases pursuing development projects that generated few economic returns. The deterioration of China’s real-estate market in the past three years meant local governments could no longer rely on land sales to real-estate developers, a significant source of revenue.

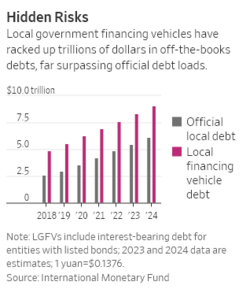

Economists estimate the size of such off-the-books debt is somewhere between $7 trillion and $11 trillion, about twice the size of China’s central government debt. The total amount isn’t known—likely not even to Beijing, say bankers and economists—because of the opaqueness surrounding the financial arrangements that allowed the debt to balloon.

As much as $800 billion of that debt is at a high risk of default, economists say. If the financing vehicles can’t meet their obligations, Beijing could either pay for bailouts, which might create a bigger problem by encouraging unsound borrowing. Or it could allow insolvent funding vehicles to go belly up, exposing Chinese banks to serious losses and potentially spurring a credit crunch that would further erode economic growth.

An entrance to the abandoned light-rail project in Liuzhou, China. PHOTO: BRIAN SPEGELE/WSJ

An elevated stretch of the unfinished light-rail project. PHOTO: BRIAN SPEGELE/WSJ

Top Chinese leaders are expected to raise the looming threat at a long-awaited summit starting Monday that will chart a course for China’s economy.

What is clear is that all of this built-up debt is part of what is preventing China from doing more to stimulate its economy. Annual growth slowed to 5.2% last year from 7.8% a decade earlier.

China’s Ministry of Finance didn’t reply to a request for comment.

For now, local officials are taking the blame. Wu, the leader of Liuzhou, was fired in November and has been charged with abuse of power and other crimes. Communist Party investigators allege he had pursued wasteful “political vanity projects.”

Wu couldn’t be reached for comment.

A cash crunch and stepped-up scrutiny by central government officials has also stalled the city’s light-rail system, leaving behind a trail of half-built tracks. A Liuzhou official said the city wasn’t able to answer questions about its debts.

Other cities also are scrapping infrastructure projects, which have long driven much of China’s growth. Moody’s Investors Service and Fitch Ratings lowered their outlook on China’s credit rating to negative from stable, largely because of doubts that local governments can properly service their debt.

“The reckoning has arrived,” said Victor Shih, a professor at the University of California, San Diego, who researches China’s politics and financial system.

Financial sinkhole

The municipal debt dilemma grew out of a fundamental weakness in how Chinese cities fund themselves.Beijing controls the purse strings and puts limits on local-government bonds. At the same time, China expects cities to kick-start economic growth and provide services with limited budgets.

Deficit spending provided one solution. Chinese cities discovered decades ago that they could take on debt through state-owned entities known as local government financing vehicles, or LGFVs, to fund sewers, streets and the like.

Because the debts don’t appear on government ledgers—only on the LGFV books—cities were able to sidestep borrowing limits. The bonds were attractive to Chinese banks and other institutional investors that assumed cities were on the hook to pay them back. Investors figured that allowing bond defaults by LGFVs is too risky for China’s financial system and too costly for its economy.

Many of the projects funded by LGFVs turned out to be ill-timed, ill-conceived or both.

Liupanshui, a city in the region of Guizhou, set up six LGFVs for 23 tourism projects, including construction of a ski resort on a mountain that typically gets enough snow for less than two months a year, though it also is open for offseason recreation. State media reported that 16 of the 23 city ventures are idle “low-efficiency” projects.

Another LGFV, in neighboring Yunnan province, ran up $8.4 billion in debt to build projects, including “artistic living space.” After the housing was done, not enough people wanted to live there. The project was sold in 2021, literally, for a few cents, to another LGFV in the same province.

Rhodium Group, a research firm, found that only a fifth of nearly 2,900 LGFVs it reviewed last year had enough cash to cover their short term debt obligations and interest payments.

With little cash coming in from its investments, the LGFVs have stayed afloat with money from local governments—and by continuing to borrow. Research by the International Monetary Fund in 2022 found that 80% to 90% of LGFV annual spending came from new financing.

With little cash coming in from its investments, the LGFVs have stayed afloat with money from local governments—and by continuing to borrow. Research by the International Monetary Fund in 2022 found that 80% to 90% of LGFV annual spending came from new financing.The LGFVs sometimes guaranteed each other’s debts, which made their swelling liabilities look safer to investors. In Liuzhou, one LGFV received guarantees from 13 other state-owned entities in 2022, making all of them liable if it defaults. Some had shared addresses or similar names. A financing vehicle called Liuzhou Urban Investment Construction Development provided $99 million of debt guarantees to Liuzhou Urban Construction Investment Development.

LGFV borrowing became more aggressive as their liabilities grew. Some LGFVs, working together, shifted assets from their balance sheets to another’s when issuing bonds, allowing them to borrow more at lower costs, according to bankers and investors.

Some city officials who initiated LGFVs seemed clueless about how they worked. An investment banker recalled meeting local officials in northern China in 2022 about a potential LGFV bond issue.

The officials had a question: Would they actually have to pay it back?

Yes, they would, the banker recalled telling them.

The Meihuashan resort in Liupanshui, China, which typically has a ski season of less two months. PHOTO: TAO LIANG/XINHUA/ZUMA PRESS

The amusement park in Liuzhou. PHOTO: BRIAN SPEGELE/WSJ

Good view

From the fabled reputation of its coffin artisans, Liuzhou was long regarded as a good place to die. Yet its isolation—250 miles from China’s prime manufacturing hubs in the Pearl River Delta—made it a tough place to attract businesses.Like other Chinese cities, Liuzhou, with 4.2 million residents, sought to modernize its manufacturing sector, aligning itself with a push by Beijing to make China a powerhouse for semiconductors, electric vehicles and other industries.

City officials envisioned a sprawling district of factories and apartment buildings to replace the ramshackle villages east of Liuzhou’s downtown. They assigned an LGFV called Guangxi Liuzhou Dongcheng Investment Development Group to obtain loans from state banks and sell bonds to help pay for the project.

Dongcheng leveled the plots and installed pipelines, electricity connections and other improvements to attract developers. It told prospective investors that the city wasn’t liable for the debts even though the entity was effectively raising the money on the local government’s behalf.

Dongcheng’s total liabilities hit about $9 billion in 2018. It brought the city’s ambitions to life, opening a convention center, amusement park and a Ramada Plaza hotel, which one foreign visitor praised on Tripadvisor for the view from his bathroom.

Dongcheng’s total liabilities hit about $9 billion in 2018. It brought the city’s ambitions to life, opening a convention center, amusement park and a Ramada Plaza hotel, which one foreign visitor praised on Tripadvisor for the view from his bathroom.Dongcheng expanded into financial services, using borrowed money to make loans to other businesses. It also pursued endeavors in private equity and venture capital, bond documents show. Revenue reached about $1 billion in 2018, most of it from its land-development business with the government. In 2019, its net profit was nearly $100 million.

Two other LGFVs controlled Liuzhou’s bus system, which had been losing tens of millions of dollars a year. Passenger volume was falling, and government-regulated ticket prices average just a few cents each. With LGFV money to prop it up, city officials found little urgency to overhaul bus operations.

Liuzhou officials instead decided the city needed a light-rail network to link its aging downtown with the new industrial district Dongcheng was building. Guangxi Liuzhou Rail Transit Investment Development Group, another LGFV, took charge and by late 2020, it was conducting limited test runs.

Weak factory demand and a lack of new sources of growth finally caught up with the city beginning in 2020.

Weak factory demand and a lack of new sources of growth finally caught up with the city beginning in 2020.Work on the light-rail project was suspended. In 2022, local officials disclosed that Beijing, which is supposed to approve major public transit systems, never gave its permission. The amusement park and Ramada turned out to be money losers, according to Dongcheng’s bond documents.

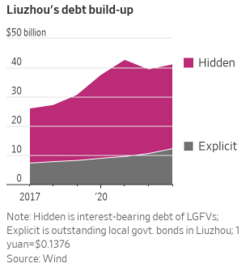

All nine of Liuzhou’s financing vehicles that have published financials are cash-strapped, with cash-on-hand making up less than 5% of their total assets. At the end of 2023, they together recorded nearly $29 billion of interest-bearing debt, according to financial-data provider Wind. The city’s official debt load was around $12 billion.

After China’s real-estate bubble burst in 2021, home sales collapsed and prices sank. Private developers showed little interest in buying land from the local government, so Dongcheng stepped in. It used borrowed cash to purchase large tracts and help refill government coffers. Since 2022, subsidiaries of Dongcheng have purchased 67% of all land parcels sold in the new district, records show.

Despite spending billions of dollars on new development, the city’s economic output last year was slightly smaller than it was in 2019. General revenue fell by about 30% over the same period.

Despite spending billions of dollars on new development, the city’s economic output last year was slightly smaller than it was in 2019. General revenue fell by about 30% over the same period.Late last year, China’s Ministry of Finance publicly criticized Liuzhou for its debts, calling out eight city leaders and LGFV executives. In addition to the arrest of the former mayor, Dongcheng’s former chairman was charged with taking bribes. That scrutiny hasn’t stopped the city’s LGFVs this year from ordering the issue of nine bonds totaling $647 million.

The IMF estimates that LGFV debt across China will grow 60% by 2028 compared with 2022 levels.

A taxi driver ferrying passengers earlier this year beneath the abandoned tracks of the failed light-rail project in Liuzhou expressed frustration about the pork-barrel spending.

With city buses underused, he asked, why did the city need to build a rail system?

On a Communist Party-run messaging board, a resident complained about the construction fences still bordering the abandoned light-rail project. The fences block the sidewalk, the resident wrote, forcing pedestrians to walk in the road.

Guangxi Liuzhou Rail Transit, the LGFV responsible for the project, responded candidly to the online post.

“Due to the tremendous financial pressure on our company recently, we’re not able to tear down this part of the fencing,” it said. “Thank you for your concern.”

The Ramada Plaza hotel in Liuzhou. PHOTO: BRIAN SPEGELE/WSJ

Grace Zhu contributed to this article.

Source (Archive)