China Shares ‘Common Goal’ With Russia to Undermine US, Can’t Be Trusted to Mediate End to Ukraine Crisis: Lawmakers

The Chinese Communist Party is an ally of

Russia and can’t be trusted to help resolve the

Ukraine crisis, U.S. lawmakers told The Epoch Times.

The warning comes amid growing calls from Ukraine and elsewhere pressing the regime in Beijing to use its influence with Moscow to mediate an end to the conflict.

China’s stance on the war has been under intense international scrutiny since Russia first opened fire against Ukraine. Despite the

repeated urging of U.S. Secretary of State Antony Blinken for Beijing to “make its voice heard,” and Kyiv

calling for the regime to leverage its diplomatic relations with Moscow to press for a ceasefire, Beijing has carefully sidestepped the topic,

refusing to denounce Russia’s aggression

or join Western sanctions on Moscow.

It’s now the only major country in the world that

refuses to call the Russian action an “invasion.”

“China has been deliberately, consistently, and deeply unhelpful throughout this crisis,” a spokesperson for Sen. Ted Cruz (R-Texas) told The Epoch Times.

“The Chinese Communist Party uses ‘sovereignty’ as an excuse for its aggression across Asia, but has refused to condemn Russia’s further invasion of Ukraine,” the person said, referring to the regime’s claim that it holds sovereignty over the self-ruled democratic island of Taiwan, which it seeks to absorb by force if necessary.

Beijing’s stance shouldn’t be surprising in view of the mutual interests of the two countries’ leaders, the spokesperson said. China’s leader Xi Jinping views Russian President Vladimir

Putin “as an ally in their mutual goal of undermining the United States and our allies.”

‘Hypocrisy’

On day 12 of Russia’s attack, China’s Foreign Minister Wang Yi described the country’s friendship with Moscow as “

rock solid,” an affirmation stated after Xi and Putin announced a “

no limits” partnership between the two countries in early February.

Wang also for the first time signaled China’s willingness to provide “necessary mediation” in the conflict, but rejected the possibility that a diplomatic fallout would hinder China’s relationship with Russia.

“No matter how precarious and challenging the international situation may be,” he told reporters, China and Russia will “steadily advance our comprehensive strategic partnership of coordination for a new era.”

Wang’s remarks showed plainly enough that the world can’t put its hopes on China to end the bloody conflict, said Rep. Young Kim (R-Calif.).

“While the world works to rally support for Ukraine, China’s Foreign Minister Wang Yi called Russia his country’s ‘most important strategic partner,’” she told The Epoch Times.

“As authoritarian regimes seek to undermine freedom and democracy around the world, we know Xi Jinping’s regime cannot be a trusted mediator.”

There’s also a touch of irony in China’s tacit support for Russia.

“Ukraine is exposing the hypocrisy of the Chinese Communist Party. They preach non-interference in internal affairs of other countries but refuse to condemn an invasion of a sovereign state,” Sen. Marco Rubio (R-Fla.) told The Epoch Times.

“And they condemn Taiwan’s desire to separate from the mainland but support Putin recognizing breakaway republics in eastern Ukraine.

“They hypocritically support Russia’s criminal invasion because they share a common goal with Putin, to impose a new global order with them at the top and America relegated to becoming a second-rate power.”

The island of Taiwan faces a similar predicament to Ukraine due to the growing threats from its larger neighbor. Chinese warplanes have continued to harass Taiwan on a regular basis since the Ukraine war started, and the regime has

held multiple military drills in the South China Sea, heightening anxieties for the island.

The Chinese regime has come to Moscow’s aid as the latter sustains punishment from the West.

After Mastercard, Visa, and American Express cut off their services in Russia, the country’s banks

turned to China for alternatives.

Bilateral trade

has surged. In the first two months of 2022, China’s exports from Russia rose 41.5 percent from the year-earlier period, a growth rate exceeding all other countries, according to Chinese customs authorities.

China lifted all import restrictions on Russian wheat on the first day of Russia’s invasion. By 2024, the two countries are aiming to boost total trade to a record $250 billion.

Meanwhile, there’s growing evidence that the Chinese regime knew of Putin’s plans months ago.

Concerned that Putin would mount a “reckless invasion,” White House officials had engaged China in advance entreating its officials to help avert a war, but China declined, a top U.S. policy adviser recently said in a

panel event.

Instead, senior Chinese officials

reportedly asked Russia to postpone making a military move until the end of the Beijing Winter Olympics.

Such reports have prompted analysts to argue that the Chinese regime had privately supported Putin’s plans as part of a mutual bid to counter the West.

Gold, Palladium Retreat From Highs

Gold and palladium on Wednesday hit the brakes on a blistering rally as riskier assets attempted a comeback, with analysts predicting another run higher for precious

metals in case of a further escalation in the

Ukraine crisis.

Spot

gold fell 1.9 percent to $2,013.79 per ounce, as of 1047 GMT, snapping a four-session rally that took it to within reach of the August 2020 all-time high. U.S. gold futures fell 1.1 percent to $2,021.20.

“What we may be seeing now is just a small correction after such a large move over a prolonged period of time (in gold and palladium),” said Craig Erlam, senior market analyst at OANDA.

Key equity indices rebounded as investors picked up beaten-down stocks following a recent rout sparked by fears about growing Western sanctions on Russia for its invasion of Ukraine.

Crude oil prices, strength in which has driven fears of inflation and burnished gold’s appeal as a hedge against rising costs, also retreated.

Strong resistance in gold prices can be expected at near these high levels and a pullback to near $1,930 is likely, with some consolidation between $1,930 and $2,075, said Michael McCarthy, chief strategy officer at Tiger Brokers, Australia.

“But if the current instability in geopolitical terms continues, it’s very likely we will seek fresh all time highs for precious metals,” McCarthy added.

Palladium, used by automakers in catalytic converters to curb emissions, fell 3.7 percent to $3,063.19 per ounce after hitting a record high of $3,440.76 on Monday, driven by fears of disruptions to supply of the metal from top producer Russia.

Recent volatility in precious metals can be seen as normal as commodities aren’t following fundamentals or industrial demand anymore, said Natixis analyst Bernard Dahdah.

Spot silver dropped 1 percent to $26.13 per ounce, after touching a near nine-month high on Tuesday. Platinum dipped 3.5 percent to $1,113.43.

UK Sanctions on Russian Oil Will Push up Living Costs, Britons Warned

Britain’s new

sanctions on

Russian oil and gas imports could have an impact on the cost of living in the UK, politicians and experts have warned.

Business secretary Kwasi Kwarteng announced on Tuesday that Britain will join the United States in halting the import of Russian oil and related products, to ramp up the economic pressure on Russia following the invasion of

Ukraine.

Russian oil and related products will be phased out of UK imports by the end of 2022, Kwarteng said.

In a statement posted on Twitter, he said, “This transition will give the market, businesses and supply chains more than enough time to replace Russian imports—which make up 8 percent of UK demand.”

He said that he was also considering ending the Russian supply of natural gas to the UK, which makes up 4 percent.

Ukrainian President Volodymyr Zelensky praised the new sanctions, saying that they sent a “powerful signal.”

But Prime Minister Boris Johnson suggested that Britons would be experiencing more pain at the petrol pumps, where prices have already soared since the Russian invasion of Ukraine began last month.

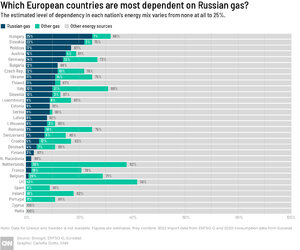

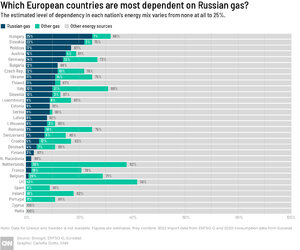

Johnson told broadcasters on Tuesday that the UK was “less exposed” than some European nations but that dropping Russia from supplies couldn’t be done overnight.

Conservative MP and former Housing, Communities, and Local Government Secretary Robert Jenrick told the BBC’s “Newsnight” it could be “the most difficult economic year we’ve seen in my lifetime.”

No UK petrol demand comes from Russia, nor heating or fuel oil, but 18 percent of the total demand for diesel comes from Russia, according to the Department for Business, Energy, and Industrial Strategy.

Robert Buckley, an energy analyst at Cornwall Insight, told the BBC that although the UK ban was “largely symbolic” because only 8 percent of its energy comes from Russia, it would likely combine with other factors and push up prices.

According to UK automotive services company RAC, drivers and businesses were hit on Tuesday by the second-largest daily hike in diesel prices for more than 20 years.

The average cost of a litre of diesel at UK forecourts reached a record 165.2 pence on Tuesday, up from 162.3 pence on Monday.

The RAC said the jump of more than 3 pence was the second largest since 2000.

The average price of a litre of petrol also increased, from 156.4 pence on Monday to 158.2 pence on Tuesday.

RAC fuel spokesman Simon Williams said on Wednesday, “Wholesale fuel prices have already risen dramatically this week, so more pump price increases in the coming days are inevitable.”

Oil Falls Towards $125 as Investors Weigh US Import Ban

Oil slipped towards $125 a barrel in volatile trading on Wednesday as

investors assessed the U.S. ban of Russian oil imports and Russia announced a new ceasefire in Ukraine on Wednesday to let civilians flee.

A view that the U.S. ban of Russian oil imports may not worsen shortages kept a lid on prices, traders said, as did talk that Ukraine was no longer seeking NATO membership after some news reports this week on the issue.

“Maybe this is playing its part,” said Tamas Varga of oil broker PVM said of the Ukraine NATO membership issue.

“The realization that the U.S. import ban might not materially make the current supply shock worse than it has been might have also triggered this bout of profit-taking,” he added.

Brent crude fell $2.27, or 1.8 percent, to $125.71 a barrel at 1105 GMT, after earlier rising above $131. U.S. West Texas Intermediate (WTI) fell $3.19, or 2.6 percent, to $120.51.

Oil also fell as the head of the International Energy Agency described the agency’s decision last week to release 60 million barrels of oil reserves to compensate for supply disruptions following Russia’s invasion as “an initial response” and that more could be released if needed.

Oil has surged since Russia, the world’s second-largest crude exporter, launched what it called a “special operation” in Ukraine. Brent hit $139 on Monday, its highest since 2008.

On Wednesday, Russia announced a new ceasefire in Ukraine to let civilians flee besieged cities.

In addition to the U.S. decision, Britain also said on Tuesday it would phase Russian imports out and Shell said it would stop buying Russian crude. JP Morgan estimated around 70 percent of Russian seaborne oil was struggling to find buyers.

One potential source of extra oil supply is Iran, which has been in talks with Western powers for months on restoring a deal which lifted sanctions on Iran in return for curbs on its nuclear program.

Iran’s chief negotiator in the Vienna talks returned to the Austrian capital on Wednesday.

Amid concern over supply shortages, there are some signs the market is not short of crude yet.

Asia Stocks Mixed After Wall Street Falls, US Bans Russian Oil

European

stocks and Wall Street futures rebounded Wednesday as investors watched diplomatic efforts to end Russia’s attack on

Ukraine, while Asian markets sank after Chinese inflation accelerated.

Already high oil prices added more than $1 per barrel following President Joe Biden’s ban on imports of

Russian crude.

London and Frankfurt opened higher. Shanghai, Tokyo, and Hong Kong declined amid enduring unease about the war’s

global impact.

Futures for Wall Street’s S&P 500 index and Dow Jones Industrial Average were up 1 percent after the market slid Tuesday.

“Financial markets seem calmer” as Ukrainian and Russian diplomats prepare to meet in Turkey, Chris Turner, and Francesco Pesole of ING said in a report. “Yet energy prices look set to stay high as the West weans itself off Russian exports.”

In early trading, the FTSE 100 in London jumped 2.1 percent to 7,107.28. Frankfurt’s DAX surged 3.7 percent to 13,302.51 and CAC 40 in Paris jumped 3.5 percent to 6,174.29.

On Wall Street, the S&P 500 sank 0.7 percent on Tuesday for its fourth straight daily decline. It is now 13.1 percent below its latest record high.

The Dow lost 0.6 percent and the Nasdaq composite retreated 0.3 percent. On Monday, it closed 20 percent below its record high.

In

Asia, the Shanghai Composite Index tumbled 1.1 percent to 3,256.39 after Chinese regime reported consumer prices rose 0.6 percent in February over the previous month, picking up from January’s 0.4 percent gain.

The Nikkei 225 in Tokyo slid 0.3 percent to 24,717.53. The Hang Seng in Hong Kong lost 0.7 percent to 20,627.71 after being down 2.2 percent at one point.

“Inflation will pick up” as prices of oil and other commodities rise due to the Ukraine war, Julian Evans-Pritchard of Capital Economics said in a report. That “will have a much more pronounced impact on the March figures.”

Sydney’s S&P-ASX 200 climbed 1 percent to 7,053.00 and India’s Sensex advanced 2.3 percent to 54.684.42.

New Zealand and Southeast Asian markets rose. South Korean markets were closed for a presidential election.

Benchmark U.S. crude rose $1.86 to $125.56 per barrel in electronic trading on the New York Mercantile Exchange. The contract jumped $4.30 on Tuesday to $123.70.

Brent crude, the basis for international oil prices, gained $2.42 to $130.40 per barrel in London. It advanced $4.77 the previous session to $127.98.

Commodities markets have been roiled because Russia is the No. 2 oil exporter and the No. 3 supplier of nickel, which is used in electric car batteries, stainless steel, and other products. Russia and Ukraine also are among the biggest global sellers of wheat.

Nickel prices doubled Tuesday to more than $100,000 per metric ton, prompting the London Metal Exchange to suspend trading. The exchange said it did not expect to resume trading before Friday and was considering imposing limits on price fluctuations when it does.

On Tuesday, Biden announced the United States would block imports of Russian crude to punish Putin for attacking Ukraine. Biden said he acted in consultation with European allies but acknowledged they are more dependent on Russian oil and gas and might not be able to make similar moves immediately.

Biden said he hopes to limit the pain for Americans but acknowledged the ban will push up gasoline prices.

“Defending freedom is going to cost us as well,” he said.

Before the invasion of Ukraine, financial markets already were uneasy about the global outlook as the Federal Reserve and other central banks prepare to try to cool inflation by withdrawing ultra-low interest rates and other stimulus.

In currency markets, the dollar advanced to 115.79 yen from Tuesday’s 115.74 yen. The euro gained to $1.0951 from $1.0908.

South Australia to Grow Nation’s Weapons Manufacturing Arsenal

South Australia is set to house a new $75 million (US$55 million) state-of-the-art weapons manufacturing facility as the Australian government continues to bolster its sovereign

defence capabilities.

It comes shortly after Australia earmarked $10 billion (US$7.3 billion) towards a new

nuclear submarine base amid an “

arc of autocracy” and the rise of authoritarian regimes around the world.

The Sovereign Combat System Collaboration Centre will be headed by Saab, a Swedish weapons and defence company, with a focus on integrating world-leading technology into Australia’s combat systems.

The federal government has diverted $22.6 million (US$16.4 million) of its own $1.3 billion (US$950 million) Modern Manufacturing Initiative for the project, a fund designated to boost domestic production across industries.

Defence Industry Minister Melissa Price said the investment represented Australia’s economic growth and commitment to strengthening its defence capabilities.

“We are determined to build our sovereign capability to ensure that we can deliver at home what we need to defend ourselves when we need it, and this investment will help us achieve that,” Price

said.

South Australia’s capital, Adelaide, is already home to Australia’s premier naval shipbuilding facility and is a central hub for numerous precincts devoted to military research, development, and construction.

The project will also see the creation of more than 950 highly-skilled jobs by 2027, along with giving Australia’s small and medium manufacturers access to lucrative national and global defence supply chains.

Minister for Industry Angus Taylor highlighted the important role the opportunity played in developing Australia’s manufacturing businesses.

“We want more Australian businesses to contribute to local and international defence supply chains, and more Australian innovation and intellectual property to be contributed to products supplied to the ADF and other markets,” Taylor said.

“This investment with Saab will enable us to leverage our highly-skilled workforce, and world-leading innovation and manufacturing might to strengthen our combat system capabilities on home soil and unlock new opportunities in some of the world’s most advanced supply chains.”

Taylor pointed out that Australia planned to continue strengthening its place as a key player in its military manufacturing and defence capabilities.

“Keeping Australians safe is one of the Morrison Government’s highest priorities,” Taylor said. “Today’s funding from the Modern Manufacturing Initiative comes on top of the billions of dollars the Government is investing to build our sovereign manufacturing capability in defence.”

Even prior to the Russia-Ukraine conflict, Australia had been accelerating the expansion of its defensive arsenal amid concerns over the last two years that Beijing would attempt to exert its power forward in the Indo-pacific.

This includes a landmark pact with the United States and the United Kingdom to grant Australia access to advanced nuclear submarine technology.

In addition to maritime capabilities, Australia has spent

$3.5 billion on over 100 U.S. tanks and armoured vehicles, with a further

$1 billion weapons contract inked with South Korea for 45 armoured artillery and supply vehicles.

The Morrison government has also

shorted the approval times for future defence equipment and technology contracts following the reduction in red tape that had in some cases extended contract negotiations by several years.

EU Rolls out Plan to Cut Russia Gas Dependency This Year, End It Within the Decade

The European Commission published plans on Tuesday to cut the

EU’s dependency on Russian gas by two-thirds this year and end its reliance on Russian supplies of the fuel “well before 2030.”

The European Union executive said it will do so by switching to alternative supplies and expanding clean energy more quickly under the plans, which will largely be the responsibility of national governments for implementing.

Jet Fuel Price Surge Deals Heavy Blow to Fragile Air Travel Recovery

Global jet

fuel prices have surged to near 14-year highs in line with crude oil’s surge on supply shortfall worries, slamming air carriers and travellers with steep cost increases just as air travel was starting to recover from COVID-19 restrictions.

Oil prices have soared to their highest since 2008 as supplies lag recovering global demand and as the U.S. weighs banning Russian oil imports following Moscow’s invasion of

Ukraine.

Global crude oil benchmark Brent has jumped 26 percent to more than $120 a barrel since Russian forces invaded Ukraine on Feb. 24, triggering a global scramble by importers to secure alternatives to Russian crudes that are at risk of sanctions.

The race for crude has jacked up prices for refined products that will be affected if crude supplies tighten, with Singapore jet fuel prices outperforming Brent since Feb. 24 to gain nearly 35 percent and hit $150 a barrel for the first time since July 2008.

Jet fuel prices in Europe and the United States have posted similar gains, leaving global carriers who have already been hammered by COVID-19 over the last two years having to pass on higher costs via fuel surcharges and increased fares.

In turn, fare hikes risk undermining an air travel recovery that has gained momentum as international border curbs ease.

“Travelling (by air) is not going to be cheap from now onwards. With the inflation across countries, most people have shallower pockets, less disposable income,” a Singapore-based jet fuel trader said.

She said more travellers would limit their plans to “necessary” travel and said restrictions related to the pandemic—with many places still requiring negative COVID tests—added to uncertainties for those travelling.

Global airline capacity dipped 0.1 percent this week to 82 million seats, and remains 23 percent below the corresponding week in pre-pandemic 2019, according to aviation data firm OAG.

Total scheduled airline capacity in North East Asia in the week to Monday dropped 4.5 percent from the previous week, more than any other region, while international capacity to and from the region remains 88 percent below the corresponding week in 2019.

Domestic flight schedules in the United States had been on track to surpass 2019’s levels this spring, but the higher fuel and ticket costs now risk slowing that momentum.

“Airlines will be pushed again on credit limits and again see suppliers less willing to give unsecured terms. We may see some further casualties post-COVID now, just when recovery looked more positive,” a senior London-based trade source said.

Buoyed by expectations for tighter near term supplies, Asian refining margins for jet fuel on Monday jumped to $26.17 a barrel over Dubai crude, their strongest level on record according to Refinitiv Eikon data that goes back to 2009.

China pledges more than $790,000 in aid to Ukraine

China's Red Cross will provide 5 million yuan (or around $791,000 USD) in humanitarian aid to Ukraine, China's Foreign Ministry said in a briefing, adding that the first batch of the aid left Beijing on Wednesday,

The aid, which includes food and daily necessities, comes at the request of Ukraine and will be delivered to the Ukrainian Red Cross "as soon as possible," Foreign Ministry spokesperson Zhao Lijian said Wednesday.

Remember: China has repeatedly called for parties to exercise "maximum restraint" to prevent a massive humanitarian crisis. Beijing has also consistently refused to call the war in Ukraine a Russian invasion.

Ukrainians say evacuation convoy blocked

The city council of Bucha, just north of Kyiv, has accused Russian forces of blocking the evacuation of people through an agreed evacuation corridor.

"The occupants are disrupting the evacuation. Currently, 50 buses are blocked by Russian military in the parking lot: do not give passage to the column," the city council said in a brief Facebook post. "Negotiations are ongoing to unlock traffic."

"We remind you that the "green corridor" was an agreement at the highest level," it added.

While there has been no progress in getting an evacuation convoy moving from the beleaguered Kyiv suburb of Bucha, the evacuations agreed for two other nearby towns appear to have got underway.

Oleksandr Markushyn, mayor of Irpin, said on Facebook: "The evacuation from the city continues. There are buses in the center of Irpin. We are evacuating as many people as possible."

Kyrylo Tymoshenko, an adviser in the president's office, says that all the children stranded in an orphanage in nearby Vorzel have been rescued and evacuated, as has the local maternity hospital.

Dutch prime minister: Impossible for EU to completely cut off Russian gas and oil warns

It is "not possible" for the European Union to cut off its supply of Russian oil and gas completely, warned Dutch Prime Minister Mark Rutte.

"We have to discuss our vulnerabilities in terms of our dependency on Russian oil and Russian gas. I will not plead to cut off our supply of oil and gas today from Russia," Rutte said in a joint news conference with his French counterpart in Paris on Wednesday.

The bloc needs the Russian supply, Rutte stressed, calling it "the uncomfortable truth."

On Tuesday, the EU announced its plans to cut Russian gas imports by two-thirds this year and eliminate its overall need for Russian oil and gas “well before 2030."

Rutte added that the bloc's sanctions against Russia are "pointed" at the Russian leadership, not the people.

Mariupol authorities accuse Russians of bombing maternity hospital

The city council of the southern Ukrainian city of Mariupol has posted video of a devastated maternity hospital in the city and accused Russian forces of dropping several bombs on it from the air.

"The destruction is enormous. The building of the medical facility where the children were treated recently is completely destroyed. Information on casualties is being clarified," the council said.

"A maternity hospital in the city center, a children’s ward and department of internal medicine ... all these were destroyed during the Russian air strike on Mariupol. Just now," said Pavlo Kyrylenko, head of the Donetsk regional administration.

The UK is sending Ukraine more anti-tank weapons to defend against Russian troops, defense minister says

Britain is increasing its supply of weapons systems to Ukraine in “response to further acts of aggression by Russia,” UK Defence Minister Ben Wallace said Wednesday.

Britain has now supplied 3,615 anti-tank weapons to Ukraine, and will also shortly be supplying a small consignment of Javelin anti-tank missiles, he told lawmakers in parliament.

Wallace said the “initial supply was to be 2,000 New Light anti-tank weapons, small arms and ammunition,” but that has been increased and the UK will continue to deliver more.

“We will shortly be starting the delivery of small consignment of anti-tank Javelin missiles,” he said adding that all weapons are considered to be “defensive systems,” and are “calibrated not to escalate to a strategic level.”

The UK is also considering supplying Ukraine with Starstreak high velocity anti-air missiles “in response to their request. The ministry of defence believes that this system “will remain within the definition of defensive weapons, but will allow the accredit force to better defend their skies.”

Russia has only been successful in one of its original objectives in Ukraine, according to UK intelligence and failed to take out Ukrainian air defenses, Wallace said.

“The Ukrainian armed forces have put up a strong defense while mobilizing the whole population. President Putin's arrogant assumption that he would be welcomed as the Liberator has deservedly crumbled as far as his troops morale.”

IAEA says "no critical impact" to Chernobyl safety after Ukrainian officials warn of nuclear leak

The International Energy Agency said there has been "no critical impact" to the safety of Chernobyl, following warnings by Ukraine’s Foreign Minister Dmytro Kuleba and the country's security and intelligence service of a possible radiation leak, after the plant was disconnected from the state's power grid.

The warnings came in response to reports from Ukraine’s energy operator Ukrenergo and state-run nuclear company Energoatom that Chernobyl’s power had been “fully disconnected,” threatening cooling systems that are integral for preventing a “nuclear discharge.”

In a tweet Wednesday, the IAEA said it had been informed by Ukraine that Chernobyl had lost power, but that it saw “no critical impact” on the plant’s safety.

“IAEA says heat load of spent fuel storage pool and volume of cooling water at #Chernobyl Nuclear Power Plant sufficient for effective heat removal without need for electrical supply,” it added.

Ukraine’s foreign minister repeated Energoatom’s warnings, saying that Chernobyl had “lost all electric supply” and calling on the international community to demand Russia “cease fire” to “allow repair units to restore power.”

“Reserve diesel generators have a 48-hour capacity to power the Chornobyl NPP. After that, cooling systems of the storage facility for spent nuclear fuel will stop, making radiation leaks imminent,” Kuleba said

in a tweet Wednesday.

Ukraine’s technical security and intelligence service echoed Kuleba’s concerns, warning that “all nuclear facilities” in the Chernobyl exclusion zone were without power, and that if the pumps could not be cooled, a “nuclear discharge” could occur.

Neither Kuleba nor the intelligence service commented on whether the diesel generators could be sustained beyond the 48-hour period.

On Tuesday, the IAEA said it had lost contact with remote data transmission from safeguards monitoring systems installed at Chernobyl.

In a statement Tuesday, IAEA Director General Rafael Mariano Grossi expressed his willingness to travel to Chernobyl and expressed his concern for the staff operating the nuclear plant.