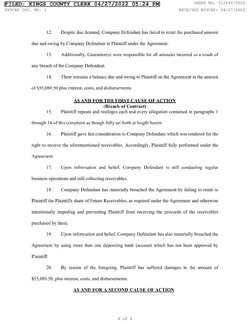

A Breach of Contract lawsuit was filled against Vickers back in 2022.

I pulled the lawsuit for this myself from the New York courts website. (I don't know why it says Kings County Superior Courts, it's Kings County Supreme Court)

You can find it yourself here:

https://iapps.courts.state.ny.us/nyscef/CaseSearch

Search for "Matthew Vickers".

There are two documents, a complaint plus one attached exhibit (the "revenue purchase agreement") and then a notice that the plaintiff was discontinuing the suit.

The exhibit is the key document.

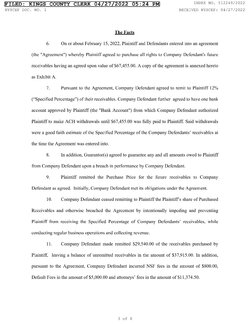

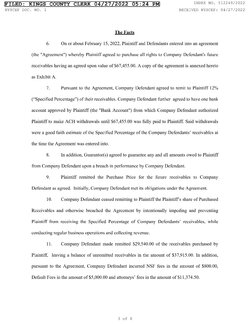

From reading the agreement, Matthew Vickers received an initial payment of $45,000 from Thor.

In return, he had to pay back $67,455. This is the initial payment plus 49.9%.

Vickers agreed to pay 12% of future receipts (so not net income or profit) into the business on a daily basis until such time that the $67,455 was paid in full, excepting US banking holidays, which was estimated to be $844. This would appear to place estimated receipts (not profit) for Rocklin Coin Shop at around $7,000 daily. At this payment amount it would take 80 days (not including any holidays) to pay the full amount.

The contract specifies that the agreement Vickers entered into "

is not intended to be, nor shall it be construed as a loan." Vickers was "

selling a portion of future revenue stream to FUNDER at a discount, and is not borriwng money from FUNDER, therefore there is no interest rate or payment schedule and no time period during which the Purchased Amount must be collected...", and Vickers could renegotiate the payment amount if 12% of receipts turned out to be lower than $844 daily. From what I understand from the contract, the way he would have to do this would be to email these people asking for a reduction in payments. They would then do research, potentially going as far as to log in to his business' bank account, and determine what 12% of receipts over the previous 2 weeks was and set that as the payment amount for the following two weeks. If he wanted the payment amount adjusted for longer than that he would have to go through this process every two weeks.

Vickers agreed to give access to the company bank account:the funding company was to be provided "

with all of the information, authorizations and passwords necessary for verifying Merchant’s receivables, receipts, deposits and withdrawals into and from the Account"

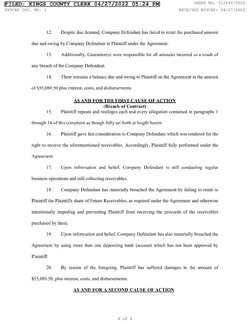

According to the complaint, the agreement was entered into in February 2022 and as of April 2022 Vickers paid $29,540. He owed a further $37,915 and Thor wanted him to pay an additional $17,174.50 for fucking around.

According to the complaint, Vickers "

also materially breached the Agreement by using more than one depositing bank (account [sic] which has not been approved by Plaintiff."

The lawsuit was discontinued by the plaintiff after a couple days, so presumably they came to an agreement.

Document 1 is the complaint.

Document 2 is the exhibit - the agreement:

Document 3 is a notice from a couple days later from the plaintiff dropping the lawsuit without prejudice.

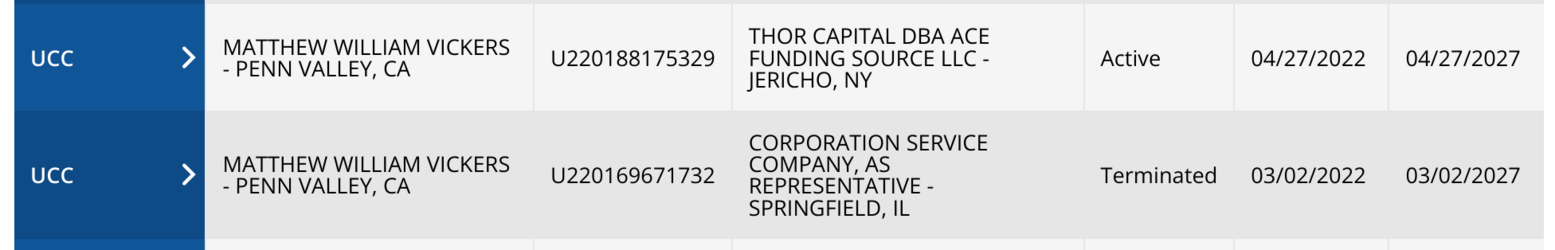

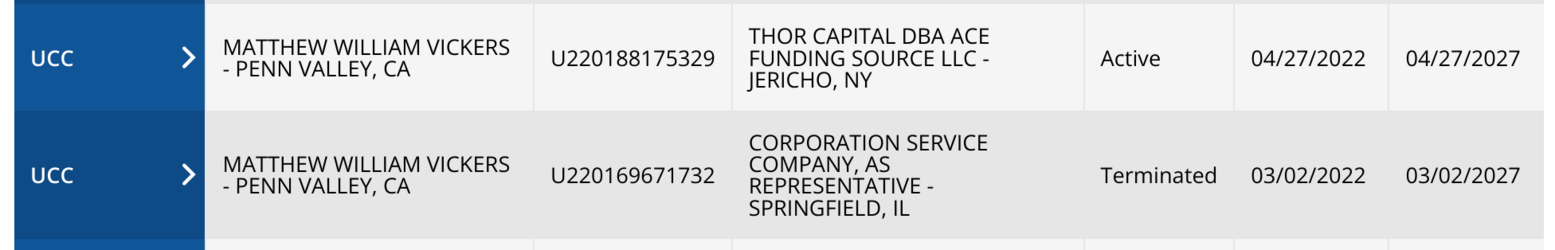

In terms of the liens:

The first one below must be related to the lawsuit by Thor and was filed on the same day as the lawsuit complaint.

The lien below that one may or may not be related, I can't tell because it only has the name of a third party company acting as a representative. The optional filer reference numbers are completely different though.

The first lien is still listed as active. The second was terminated on November 26, 2022.

If these two liens weren't related I think there is a problem because they sure sound to have been secured by substantially the same underlying assets.