- Joined

- Jul 30, 2017

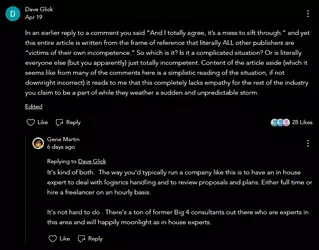

I know Dwight Cenac's post apparently went viral and stirred up a lot of people, but man, way to go TC guys to very much prove his point:They were proud of not having proper project or business management as part of the interviews and presentation at Adepticon, with comments implying they believe people who know how to run a business would just ruin things. They really believe they can just cheer their way to success.

This isn’t a business. It’s a hobby club pretending to be one.

Anyway, onto part 2 of comments. Split into a new post since I know the other one was about to hit size limits.

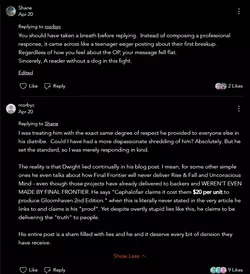

This time rcorbyc is the one with a long post we're going to text paste.

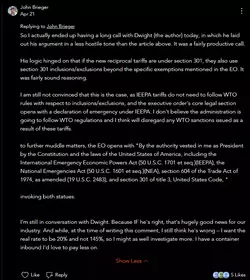

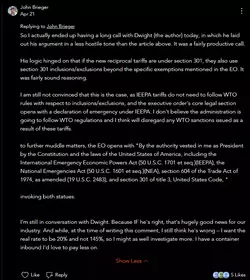

Now John Brieger... this one is another long one that gets interesting.

Which he then had a followup.

What an absolute load of utter tripe. Literally the only thing that you get right is one of the HTS codes, and that tariffs aren't 245%. The thing is, it's already been told to you that the HTS website IS NOT UP TO DATE and that Donald's moronic EO breaks WTO MFN status.

But let's take a look at some the garbage you're spewing and debunk it, shall we?

"CMON has a well-documented history of:

Then we get into your absolute lie bonanza about tariffs. But you've already been taken to task on this in other comments, so there's little point in repeating that. Let's just move on.

But, let's go to your attacks on Cephalofair. Now, I say all the following as someone who has absolute zero love for the company, and thinks Isaac and his sycophants are the some of the most self righteous jerks in the industry. But none of that gives any credibility to your "arguments" and complete lies. Cephalofair never said they were being hit with 245% tariffs, so your "real talk" you claim "Cephalofair’s $4 million panic hinges on the idea that they’re being charged a 245% tariff. They're not." is a complete fabrication. Cephalofair LITERALLY NEVER SAID they were being charged a 245% tariff. EVEN YOU STATED that earlier in your own BS article. You admit they talk about a 145% tariff but then you try to pull a fast one on readers to say their numbers are based on a 245% tariff. You can't even keep your lies internally consistent (gee, you're a bit like that orange dude you appear to worship in that regard).

You try to talk about them shipping Gloomhaven by quoting them as "4. “Our last major project shipped 140 ocean containers from China." Yeah, you know what they "LAST MAJOR PROJECT" was? FROSTHAVEN. You know, the thing that DID ship... and those 140 containers were bound for destinations ACROSS THE GLOBE, not just the US. If only you understood the meaning of the English language and understood that "last project" is not "current project" - but I guess those simple details are beyond your understanding, or don't fit your agenda of lies, so you try to hoodwink anyone unfortunate enough to read your drivel. Thus EVERYTHING else that you say on that topic is COMPLETE FABRICATION, because you simply couldn't understand that simple distinction and simple English word meaning.

Not to mention that you count backers as "1 game per backer" ignoring that RETAILERS ARE ALSO BACKERS, and order multiple copies, or that backers may order add-ons, or a copy of Gloomhaven as well as Frosthaven, etc, etc. But you'd know that if you'd ever produced more than a single game, or one that has multiple SKUs... oh wait, HIGH NOON does have expansions and other boxes? So you're not actually incompetent and clueless on this point, but actively lying about to try to make it sound like you have a valid point to make? Oh, Dwight, what you do you know - you played yourself. And came out looking like a fool to anyone who was actually engaging their brain while reading your nonsense invective.

You also immediately make the false conclusion of taking their stated production cost (which you dispute, despite having ZERO evidence to support your claim - just "trust me bro" - no, I don't because you're proven repeatedly wrong in your commentary), and assume that they get to pocket EVERY SINGLE DOLLAR of difference between the production cost and the RETAIL PRICE. Are you abjectly stupid, or are you just posing this lie for your those gullible enough in your echo chamber to believe it? There are MULTIPLE other costs in addition to the pure production cost, and MULTIPLE people take a cut of the final retail price - including, you know, THE RETAILER THAT SELLS IT. Cephalofair does NOT take that entire difference, yet you're presenting that differential as their potential profit. Now maybe if you're an insignificant player in the space who sells small quantities of boardgames direct to a small customer base, you might not understand the actual reality of a boardgame business that engages in retail distribution, but if you're going to talk about companies that DO have that market, then you better make sure that you're actually understand that, and don't just spew uninformed commentary... but that's what you went ahead and did anyway.

One on hand, we have LITERALLY EVERY SINGLE OTHER PLAYER in the industry, from the big to small players, many of whom manage all this stuff themselves, saying that it's broken. On the other, we have you, saying "nope, everyone else is wrong." You're not the "special person" that has uncovered a massive conspiracy and DONALD IS THE ONE TRUE GODKING. You're a gullible fool spouting stuff you have NO IDEA ABOUT, because you haven't actually SHIPPED ANYTHING that would be affected by these idiotic tariffs.

Simply put, your math would be pathetic for an elementary school student. Your knowledge of the tariffs is woefully ignorant. Your understanding of how businesses work that aren't small quantity production to a minuscule market of direct purchases is non-existent.

The only reputation that didn't make it out of the blog alive was your own.

But let's take a look at some the garbage you're spewing and debunk it, shall we?

"CMON has a well-documented history of:

- Failing to deliver to customers

- Surprise-gouging backers with last-minute shipping hikes

- Refusing to own up to delays and screwups

- Acting with arrogant impunity because they know people will keep paying"

Then we get into your absolute lie bonanza about tariffs. But you've already been taken to task on this in other comments, so there's little point in repeating that. Let's just move on.

But, let's go to your attacks on Cephalofair. Now, I say all the following as someone who has absolute zero love for the company, and thinks Isaac and his sycophants are the some of the most self righteous jerks in the industry. But none of that gives any credibility to your "arguments" and complete lies. Cephalofair never said they were being hit with 245% tariffs, so your "real talk" you claim "Cephalofair’s $4 million panic hinges on the idea that they’re being charged a 245% tariff. They're not." is a complete fabrication. Cephalofair LITERALLY NEVER SAID they were being charged a 245% tariff. EVEN YOU STATED that earlier in your own BS article. You admit they talk about a 145% tariff but then you try to pull a fast one on readers to say their numbers are based on a 245% tariff. You can't even keep your lies internally consistent (gee, you're a bit like that orange dude you appear to worship in that regard).

You try to talk about them shipping Gloomhaven by quoting them as "4. “Our last major project shipped 140 ocean containers from China." Yeah, you know what they "LAST MAJOR PROJECT" was? FROSTHAVEN. You know, the thing that DID ship... and those 140 containers were bound for destinations ACROSS THE GLOBE, not just the US. If only you understood the meaning of the English language and understood that "last project" is not "current project" - but I guess those simple details are beyond your understanding, or don't fit your agenda of lies, so you try to hoodwink anyone unfortunate enough to read your drivel. Thus EVERYTHING else that you say on that topic is COMPLETE FABRICATION, because you simply couldn't understand that simple distinction and simple English word meaning.

Not to mention that you count backers as "1 game per backer" ignoring that RETAILERS ARE ALSO BACKERS, and order multiple copies, or that backers may order add-ons, or a copy of Gloomhaven as well as Frosthaven, etc, etc. But you'd know that if you'd ever produced more than a single game, or one that has multiple SKUs... oh wait, HIGH NOON does have expansions and other boxes? So you're not actually incompetent and clueless on this point, but actively lying about to try to make it sound like you have a valid point to make? Oh, Dwight, what you do you know - you played yourself. And came out looking like a fool to anyone who was actually engaging their brain while reading your nonsense invective.

You also immediately make the false conclusion of taking their stated production cost (which you dispute, despite having ZERO evidence to support your claim - just "trust me bro" - no, I don't because you're proven repeatedly wrong in your commentary), and assume that they get to pocket EVERY SINGLE DOLLAR of difference between the production cost and the RETAIL PRICE. Are you abjectly stupid, or are you just posing this lie for your those gullible enough in your echo chamber to believe it? There are MULTIPLE other costs in addition to the pure production cost, and MULTIPLE people take a cut of the final retail price - including, you know, THE RETAILER THAT SELLS IT. Cephalofair does NOT take that entire difference, yet you're presenting that differential as their potential profit. Now maybe if you're an insignificant player in the space who sells small quantities of boardgames direct to a small customer base, you might not understand the actual reality of a boardgame business that engages in retail distribution, but if you're going to talk about companies that DO have that market, then you better make sure that you're actually understand that, and don't just spew uninformed commentary... but that's what you went ahead and did anyway.

One on hand, we have LITERALLY EVERY SINGLE OTHER PLAYER in the industry, from the big to small players, many of whom manage all this stuff themselves, saying that it's broken. On the other, we have you, saying "nope, everyone else is wrong." You're not the "special person" that has uncovered a massive conspiracy and DONALD IS THE ONE TRUE GODKING. You're a gullible fool spouting stuff you have NO IDEA ABOUT, because you haven't actually SHIPPED ANYTHING that would be affected by these idiotic tariffs.

Simply put, your math would be pathetic for an elementary school student. Your knowledge of the tariffs is woefully ignorant. Your understanding of how businesses work that aren't small quantity production to a minuscule market of direct purchases is non-existent.

The only reputation that didn't make it out of the blog alive was your own.

Now John Brieger... this one is another long one that gets interesting.

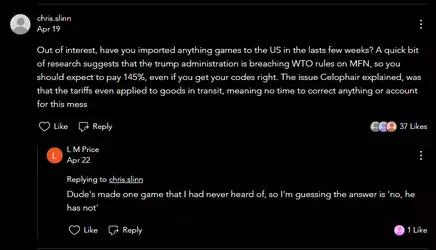

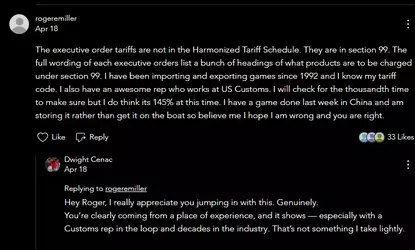

Hi, publisher here. This article has some very serious mis-information re: expected tariff rates. I highly recommend you edit the top of this article with corrections. What proof would you need to make sure this misinformation is not spread? I have 8500 units on the water (left China April 14), due to arrive May 11/12 under HTS 9504.90.6000, so I will shortly have very solid data.Nearly all board games are already being imported under HTS 9504.90.6000. I have worked on 90+ titles over the last decade and few to none fell under any other classification, with the exception of a low number of "numbers on cards" style games which fell under 9504.40.0000 (playing cards).Board games that left China on the water before 12 ET April 9th this year will be subject to 20% tariffs under current regulations. This is why you can see reports of publishers who are currently landing product and paying 20%.Boats after that date will be subject to 20% IEEPA fentanyl tariff and an additive 125% "reciprocal" tariff. If your boat left China April 10, it likely does not land at a minimum until April 23. I put "reciprocal" in air quotes because it is in fact, not reciprocal based on the product codes of tariffed goods from China. Trump is breaking WTO MFN status with this EO. You talked about retaliatory tariffs, but the current EO is beyond retaliatory. Trump's administration has used trade deficits to calculate this rate, because, under their thinking, the deficit represents "not only non-reciprocal differences in tariff rates among foreign trading partners, but also extensive use of non-tariff barriers by foreign trading partners, which reduce the competitiveness of U.S. exports while artificially enhancing the competitiveness of their own goods. These non-tariff barriers include technical barriers to trade; non-scientific sanitary and phytosanitary rules; inadequate intellectual property protections; suppressed domestic consumption (e.g., wage suppression); weak labor, environmental, and other regulatory standards and protections; and corruption."Per the executive order, it applies to ALL PRODUCT CODES, except those listed in an exemption annex, and some exemptions related to goods under different tariff structures. none of the product codes for board games or card games are in that exemption annex. You are correct that the HTS website is not displaying this rate, but it doesn't mean the EO is not applying to our codes as written. So yes, I'm never going to be able to post an EO text listing 9504.90.6000 because they are only listing exempt codes or ones covered by a rate other than the 145% rate.

I encourage you to re-read section 3, implementation of the white house EO and see how it pretty clearly applies to goods that were previously MFN. https://www.whitehouse.gov/presidential-actions/2025/04/regulating-imports-with-a-reciprocal-tariff-to-rectify-trade-practices-that-contribute-to-large-and-persistent-annual-united-states-goods-trade-deficits/

I encourage you to re-read section 3, implementation of the white house EO and see how it pretty clearly applies to goods that were previously MFN. https://www.whitehouse.gov/presidential-actions/2025/04/regulating-imports-with-a-reciprocal-tariff-to-rectify-trade-practices-that-contribute-to-large-and-persistent-annual-united-states-goods-trade-deficits/

Which he then had a followup.

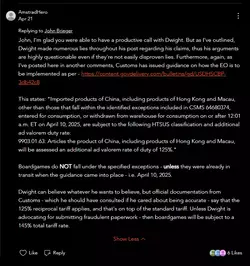

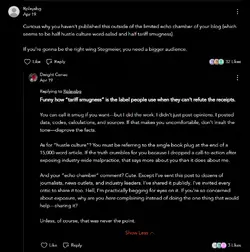

Replying to

Dwight Cenac

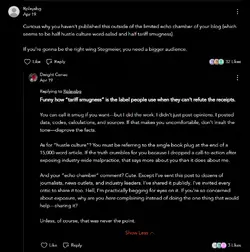

“Funny how ‘tariff smugness’ is the label people use when they can’t refute the receipts.” Who else has used the phrase “tariff smugness” (google search returns zero results)? Don’t straw man my argument like I’m falling back on some trope in disagreeing with you. I coined that particularly for your post here. You seem to think you’re the one true tariff-understander who must condescendingly tell all the popular babies to stop lying about their financial situations.

Have you replied to any conversation on BGG about tariffs? No. Have you posted this in a forum devoted to board game discussions? No. You posted it on a blog that is, again, half hustle inspo posts and half tariff diatribes.

Three of your published blog posts are about “impact” and “hustle” and “core values” (key words taken from their titles) and three are about how, again, you’re the golden one who is the one true understander of tariffs. I wasn’t talking about your broken (at time of my original reply) link to preorder your book that no one asked for (yet fits pretty perfectly into the hustle and grind playbook of passive income generation; when’s the prerecorded seminar dropping?) when I alluded to hustle culture; at time of my post your blog had six entries and those were what I was referring to with the word “blog.”

Yes, I’ve got an issue with your tone. You obviously have an ax to grind with “the industry.” Referring to your tone as smug seemed like a pretty straightforward way of my commenting on it.

It all reeks of a right-wing, Facebook boomer-y smirkiness, like literally every other publisher is some Johnny-come-lately, a fresh off the turnip truck naif ready to be taken advantage of by Big Warehouse.

I wouldn’t share any of your posts; of course that was never the point. Sarcasm is sometimes hard to grok online so I’ll be a bit more direct re: my final line in my previous post. You seem to want to be a right-wing Jamey Stegmeier, influencing board game production and business with long blog posts full of “expertise.” He’s got a much bigger audience than you. That was my point. I have noticed that right-wing influencers and creators shy away from more mainstream outlets (BGG, large subreddits) to stay snug and cozy in their echo chambers owning the libs and stroking their egos. Gene from GMT wrote a pretty detailed update about how the tariffs will affect their company, and if I had to guess he probably aligns closer to you politically than most other publishers. But where’s the fun in critiquing him, I guess. He’s not a pronouns-in-bio guy on CNN.

Dwight Cenac

“Funny how ‘tariff smugness’ is the label people use when they can’t refute the receipts.” Who else has used the phrase “tariff smugness” (google search returns zero results)? Don’t straw man my argument like I’m falling back on some trope in disagreeing with you. I coined that particularly for your post here. You seem to think you’re the one true tariff-understander who must condescendingly tell all the popular babies to stop lying about their financial situations.

Have you replied to any conversation on BGG about tariffs? No. Have you posted this in a forum devoted to board game discussions? No. You posted it on a blog that is, again, half hustle inspo posts and half tariff diatribes.

Three of your published blog posts are about “impact” and “hustle” and “core values” (key words taken from their titles) and three are about how, again, you’re the golden one who is the one true understander of tariffs. I wasn’t talking about your broken (at time of my original reply) link to preorder your book that no one asked for (yet fits pretty perfectly into the hustle and grind playbook of passive income generation; when’s the prerecorded seminar dropping?) when I alluded to hustle culture; at time of my post your blog had six entries and those were what I was referring to with the word “blog.”

Yes, I’ve got an issue with your tone. You obviously have an ax to grind with “the industry.” Referring to your tone as smug seemed like a pretty straightforward way of my commenting on it.

It all reeks of a right-wing, Facebook boomer-y smirkiness, like literally every other publisher is some Johnny-come-lately, a fresh off the turnip truck naif ready to be taken advantage of by Big Warehouse.

I wouldn’t share any of your posts; of course that was never the point. Sarcasm is sometimes hard to grok online so I’ll be a bit more direct re: my final line in my previous post. You seem to want to be a right-wing Jamey Stegmeier, influencing board game production and business with long blog posts full of “expertise.” He’s got a much bigger audience than you. That was my point. I have noticed that right-wing influencers and creators shy away from more mainstream outlets (BGG, large subreddits) to stay snug and cozy in their echo chambers owning the libs and stroking their egos. Gene from GMT wrote a pretty detailed update about how the tariffs will affect their company, and if I had to guess he probably aligns closer to you politically than most other publishers. But where’s the fun in critiquing him, I guess. He’s not a pronouns-in-bio guy on CNN.

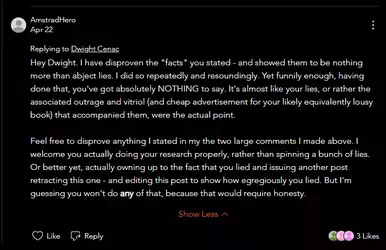

Replying to

rogeremiller

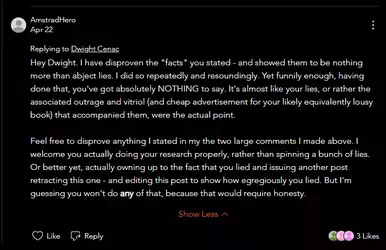

Hey Roger, I really appreciate you jumping in with this. Genuinely.

You’re clearly coming from a place of experience, and it shows — especially with a Customs rep in the loop and decades in the industry. That’s not something I take lightly.

That said, I think we might be talking about two sides of the same coin here.

You're absolutely right that the new executive order tariffs are executed through Section 99. But Section 99 doesn’t exist in a vacuum — it modifies the Harmonized Tariff Schedule, and the HTS classification at the point of entry is still what drives which section applies.

So if a product is correctly coded under 9504.90.6000, it should still fall under the 20% IEEPA duty, not the 125% reciprocal tariff or a fentanyl-linked enforcement measure.

And from everything I’ve seen (including cross-checking against the Annexes of the executive order and the latest ITC notes), 9504.90.6000 is still under MFN status, meaning it's not a reciprocal tariff target — because China never raised their tariffs on the U.S. for that code. That’s the whole point of the MFN protection.

So if someone is getting hit with a 145% or 245% stack under 9504.90.6000, that implies there’s either:

If you end up confirming something definitive from your rep that proves 9504.90.6000 is now subject to stacked reciprocal tariffs, I’d welcome the info — and I’d update my post accordingly.

Until then, I’ll keep standing by the HTS classifications we’ve cited and the clear MFN logic that’s protected that code from the 125% spike everyone’s freaking out about.

Appreciate the dialogue. Hope you’re right there with me in hoping this mess settles soon.

Best of luck getting your game over here. When it lands, let me know. I'd love to buy a copy.

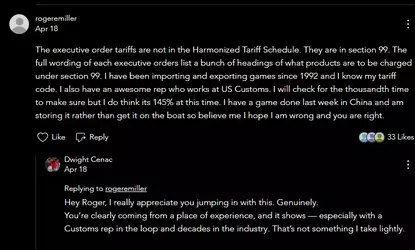

rogeremiller

Hey Roger, I really appreciate you jumping in with this. Genuinely.

You’re clearly coming from a place of experience, and it shows — especially with a Customs rep in the loop and decades in the industry. That’s not something I take lightly.

That said, I think we might be talking about two sides of the same coin here.

You're absolutely right that the new executive order tariffs are executed through Section 99. But Section 99 doesn’t exist in a vacuum — it modifies the Harmonized Tariff Schedule, and the HTS classification at the point of entry is still what drives which section applies.

So if a product is correctly coded under 9504.90.6000, it should still fall under the 20% IEEPA duty, not the 125% reciprocal tariff or a fentanyl-linked enforcement measure.

And from everything I’ve seen (including cross-checking against the Annexes of the executive order and the latest ITC notes), 9504.90.6000 is still under MFN status, meaning it's not a reciprocal tariff target — because China never raised their tariffs on the U.S. for that code. That’s the whole point of the MFN protection.

So if someone is getting hit with a 145% or 245% stack under 9504.90.6000, that implies there’s either:

- A misclassification (like being filed under 9503), or

- An internal Customs decision we haven’t seen published yet (which would be… a bombshell).

If you end up confirming something definitive from your rep that proves 9504.90.6000 is now subject to stacked reciprocal tariffs, I’d welcome the info — and I’d update my post accordingly.

Until then, I’ll keep standing by the HTS classifications we’ve cited and the clear MFN logic that’s protected that code from the 125% spike everyone’s freaking out about.

Appreciate the dialogue. Hope you’re right there with me in hoping this mess settles soon.

Best of luck getting your game over here. When it lands, let me know. I'd love to buy a copy.

Replying to

rogeremiller

Hey, really appreciate the level of detail and the good faith effort here — especially from someone who’s clearly not just reacting to headlines. And I totally agree, it’s a mess to sift through. I am mentally, physically and spiritually exhausted from all of this, so I am right there with you. But this is the kind of dialogue the industry needs right now.

You mentioned 9903.01.24 and 9903.01.63 — just to clarify for others reading: those aren’t product codes themselves. They’re tariff modifiers that apply an additional duty on top of the base HTS code, but only if that base code is listed in the related Section 301 annexes.

Now here’s the key point:

HTS Code 9504.90.6000 — the correct classification for board games — is not listed in the applicable Section 301 annexes.

It was originally included in 2018, but was explicitly removed before enforcement. And as of today, there has been:

That matters, because even if someone at Customs is flagging these modifiers for a shipment, they legally can’t apply unless the code has been officially re-included. And right now? It hasn’t been.

But let’s game it out.

Let’s say, purely hypothetically, that 9504.90.6000 was added back into Section 301. What’s the worst-case stack?

That’s a cumulative maximum of 75%, and even that assumes an aggressive scenario with both 301 codes applying — which would be unusual, if not redundant.

So where does the 145% number come from?

Honestly, I think it’s a conflation of multiple tariff programs, some of which don’t apply at all to MFN-classified goods like board games, and others that are simply not in force. Or it’s a result of misclassification — like if someone’s filing the shipment under 9503.00.0090 (miscellaneous toys), which is exposed to the 125% reciprocal tariff.

That’s why I’ve been so loud about getting your HTS codes right. If you’re importing under 9504.90.6000, and you’re not seeing it in the Section 301 annex, there is no legal pathway to 145% right now.

That said — I’d be really curious to hear what your Customs contact says. If there’s an internal update in play, a change in enforcement guidance, or anything being soft-circulated, I’d love to take a look. I’m not here to win points. I’m here to make sure we’re all playing with the same deck.

Thanks again for your diligence on this — feel free to reach out to me directly via DM or loop me in if you get anything new from your rep.

Always here to help.

rogeremiller

Hey, really appreciate the level of detail and the good faith effort here — especially from someone who’s clearly not just reacting to headlines. And I totally agree, it’s a mess to sift through. I am mentally, physically and spiritually exhausted from all of this, so I am right there with you. But this is the kind of dialogue the industry needs right now.

You mentioned 9903.01.24 and 9903.01.63 — just to clarify for others reading: those aren’t product codes themselves. They’re tariff modifiers that apply an additional duty on top of the base HTS code, but only if that base code is listed in the related Section 301 annexes.

Now here’s the key point:

HTS Code 9504.90.6000 — the correct classification for board games — is not listed in the applicable Section 301 annexes.

It was originally included in 2018, but was explicitly removed before enforcement. And as of today, there has been:

- No new Section 301 investigation targeting that code

- No public comment period

- No updated annexes adding it back in

- And no formal enforcement notice for it under either 9903.01.24 or 9903.01.63

That matters, because even if someone at Customs is flagging these modifiers for a shipment, they legally can’t apply unless the code has been officially re-included. And right now? It hasn’t been.

But let’s game it out.

Let’s say, purely hypothetically, that 9504.90.6000 was added back into Section 301. What’s the worst-case stack?

- Base IEEPA tariff: 20%

- 301 Modifier under 9903.01.24: 25%

- 301 Modifier under 9903.01.63: 30%

That’s a cumulative maximum of 75%, and even that assumes an aggressive scenario with both 301 codes applying — which would be unusual, if not redundant.

So where does the 145% number come from?

Honestly, I think it’s a conflation of multiple tariff programs, some of which don’t apply at all to MFN-classified goods like board games, and others that are simply not in force. Or it’s a result of misclassification — like if someone’s filing the shipment under 9503.00.0090 (miscellaneous toys), which is exposed to the 125% reciprocal tariff.

That’s why I’ve been so loud about getting your HTS codes right. If you’re importing under 9504.90.6000, and you’re not seeing it in the Section 301 annex, there is no legal pathway to 145% right now.

That said — I’d be really curious to hear what your Customs contact says. If there’s an internal update in play, a change in enforcement guidance, or anything being soft-circulated, I’d love to take a look. I’m not here to win points. I’m here to make sure we’re all playing with the same deck.

Thanks again for your diligence on this — feel free to reach out to me directly via DM or loop me in if you get anything new from your rep.

Always here to help.

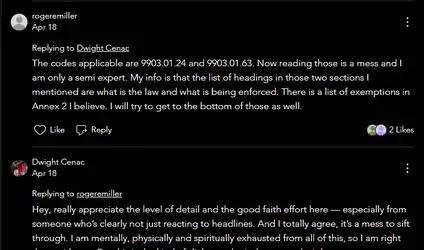

Replying to

Dwight Cenac

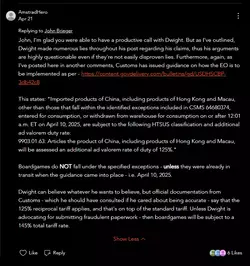

I'm unclear as to where you've gotten those numbers, but they're wrong as of your time of writing.If you take a look at the actual rates published, you can pretty easily apply those. Let me plug in the relevant numbers for you:

And of course there are de minimis exemptions, which are also a far cry from the pure exemption they have been. Currently, you're charged a minimum of $75 per postal package with contents produced in China worth under $800. With hikes up to $200 already laid out in an EO. But this is a completely different subject.If you'd be looking to avoid tariffs through using normal post though: forget about that.Either way, that is the "legal pathway to 145% right now" that you said doesn't exist.If you're not seeing it, you're simply not looking well enough.

Dwight Cenac

I'm unclear as to where you've gotten those numbers, but they're wrong as of your time of writing.If you take a look at the actual rates published, you can pretty easily apply those. Let me plug in the relevant numbers for you:

- 301 Modifier under 9903.01.24: 20% (This reads like it doesn't apply, until you read the note 2(u) it refers to, which applies a blanket 20% rate to most everything "product of China and Hong Kong.")

- 301 Modifier under 9903.01.63: 125% (This reads like it doesn't apply, until you read the note 2(v) it refers to, which applies a blanket 125% rate to most everything "product of China, Hong Kong and Macau." Specifically in note 2(v)(xiii)(10))

Exemptions

There are no exemptions to 9903.01.63, beyond a rare few, all itemized in its listing by referring back to other listings, but itemized in a more readable format in Executive Order 14257 (the EO that enacted the "reciprocal" tariffs, from section 3(b), page 11 onwards) and later "clarified" in this presidential memorandum to include some more categories not readily apparently exempted by the EO: https://www.whitehouse.gov/presidential-actions/2025/04/clarification-of-exceptions-under-executive-order-14257-of-april-2-2025-as-amended/But to be clear and save you the searching: unless you're selling oil, lumber products, raw minerals or very specific electronic (components) your products probably don't apply for any exemptions.To be clear, the numbers named in EO 14257 are no longer current and have been raised. The latest EO concerning this can be found here: https://www.whitehouse.gov/presidential-actions/2025/04/modifying-reciprocal-tariff-rates-to-reflect-trading-partner-retaliation-and-alignment/The relevant section that raised the number in subdivision (v)(xiii)(10) of U.S. note 2 to subchapter III of chapter 99 of the HTSUS to 125% can be found in section 3c of this EO.

And of course there are de minimis exemptions, which are also a far cry from the pure exemption they have been. Currently, you're charged a minimum of $75 per postal package with contents produced in China worth under $800. With hikes up to $200 already laid out in an EO. But this is a completely different subject.If you'd be looking to avoid tariffs through using normal post though: forget about that.Either way, that is the "legal pathway to 145% right now" that you said doesn't exist.If you're not seeing it, you're simply not looking well enough.

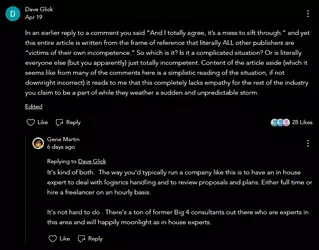

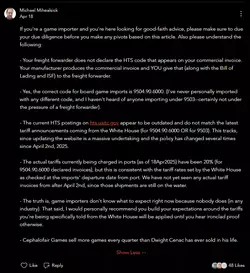

Replying to

Michael Mihealsick

Wow. That was a lot of words to deliver nothing of substance. I hope you don't write your own rulebooks.

But you know what, Mike? I'll bite.

Let’s get one thing straight: I’m not asking anyone to blindly pivot based on my blog. In fact, I’m encouraging the exact opposite. The entire article is built around one idea—do your own due diligence. Don’t take CNN’s word for it. Don’t take my word for it. Check the HTS codes yourself. Audit your paperwork. Verify your customs filings.

Now let’s address your bullet points:

Because some of us are still here doing the work without $5+ million in crowdfunded capital and a prime-time TV interview.

But hey, if you got better data, I’ll be the first to update the blog.

Until then?

Facts > fear.

Michael Mihealsick

Wow. That was a lot of words to deliver nothing of substance. I hope you don't write your own rulebooks.

But you know what, Mike? I'll bite.

Let’s get one thing straight: I’m not asking anyone to blindly pivot based on my blog. In fact, I’m encouraging the exact opposite. The entire article is built around one idea—do your own due diligence. Don’t take CNN’s word for it. Don’t take my word for it. Check the HTS codes yourself. Audit your paperwork. Verify your customs filings.

Now let’s address your bullet points:

- You’re absolutely right. The manufacturer puts the HTS code on the commercial invoice, and it’s up to the publisher to validate it. That’s exactly the point. If someone gets hit with a 245% tariff, that didn’t come from a random number generator. It came from somewhere in the supply chain. The question is: Who failed to catch it?Also...

“Your freight forwarder does not declare the HTS code…”

That’s not entirely true.

In practice, freight forwarders absolutely play a role in HTS classification. You have zero excuse not to know this. Many publishers—myself included—have worked directly with freight forwarders to select or revise codes prior to customs filing. Freight forwarders often review the invoices, suggest codes based on product descriptions, or flat-out change them to “expedite clearance.”

Some of them do this because they think it’ll help. Others do it because they’re lazy and just want the shipment through.

I’ve personally been offered alternative codes by my forwarder without ever changing the product. So to suggest they’re just passive conduits of whatever the factory prints? That’s not just inaccurate—it’s dangerously naïve.

This entire panic is proof that something is breaking down in the logistics chain. If manufacturers, publishers, and forwarders are all saying “it wasn’t me,” then guess what?

Somebody’s not telling the truth.

- Yes, 9504.90.6000 is the correct code. That’s also in the blog. What I’ve pointed out is that other codes—like 9503.00.0090—have been used, and when they are, they trigger stacked reciprocal tariffs. The industry’s own panic is proof enough that mistakes are being made somewhere.

- HTS.usitc.gov is the official government site. If it’s outdated, we should all be concerned that no one seems to have access to updated official data. So what are importers and publishers referencing to justify claims of 145–245%? If we’re all flying blind, then anyone declaring hard numbers should show hard receipts.

If there’s an official U.S. government publication listing HTS code 9504.90.6000 with a tariff higher than 20% under the IEEPA or reciprocal frameworks, I’d love to see it. As of now, the only binding source remains the Harmonized Tariff Schedule at hts.usitc.gov, and it doesn’t reflect the figures you're apparently clinging to like a lifeline that's trying to strangle your business. If someone has internal memos or predictions, those aren’t a substitute for published law.

- "...but this is consistent with the tariff rates set by the White House as checked at the imports' departure date from port." Dude… what are you even talking about?

The White House hasn’t said a single word about 9504.90.6000. Not now, not ever. Because they don’t need to. That’s an MFN code—it sits in a completely different lane from the retaliatory tariff discussion. I literally broke this down line-by-line in the blog post. The 20% you’re seeing? That’s the IEEPA slap. It’s universal. It’s been there. It’s staying there. And the only reason you’re not seeing anything higher is because it was never supposed to be higher in the first place.

Let’s walk through this real slow—using your panic math:

Where does the “245%” panic come from?

Answer:

- Traditional Tariff (let’s call it baseline)

- Plus IEEPA (Section 301 universal slap)

- Plus the Reciprocal Tariff (100%+) = Total Armageddon

9504.90.6000 is an MFN code.

That means it is not part of the reciprocal tariff hike.

It never was. It never will be.

Unless China somehow decides to violate the WTO and take itself off the MFN list, there is no mechanism for the reciprocal tariff to apply.

So no, you’re not going to see some magical tariff explosion "when the next shipments arrive." Because the hike you’re warning people about isn’t coming. It’s never coming—on this code.

Unless Trump or whoever completely rewrites the trade structure and replaces IEEPA with the reciprocal tariff and decides to call that the baseline—which they won’t, because that would be the same thing as making the IEEPA the new reciprocal tariff. And at that point, it’s not even the same conversation.

So again—what exactly are you trying to say here?

Because all this hand-waving about “departure dates” and “White House updates” sounds less like a fact check and more like a weak attempt to sound credible while stirring up confusion.

And that? That’s not helping anybody. - Nobody knows what to expect? That’s fair. But uncertainty isn’t an excuse for fearmongering. It’s a reason to slow down, verify your codes, read the Federal Register, and respond with facts, not vibes, which is precisely what I wrote in my blog.

And again... the White House is never going to tell you anything different about this code because it’s not part of the Reciprocal Tariff program—and never will be. Waiting for a change here is like waiting for the sun to turn blue. If your business plan hinges on that, you’ve already lost.

Thank you for claiming to disagree with me while literally proving my point.

- Cephalofair sells more than I do?

You’re right, Flotilla. Cephalofair has sold more games than I have.

And with all that money, reach, and industry influence,

they still got flattened by a basic logistics mistake I caught in my spare time.

Bravo.

If that’s your gold standard for leadership, then congratulations.

You’re next.

Because some of us are still here doing the work without $5+ million in crowdfunded capital and a prime-time TV interview.

But hey, if you got better data, I’ll be the first to update the blog.

Until then?

Facts > fear.